Enlarge image

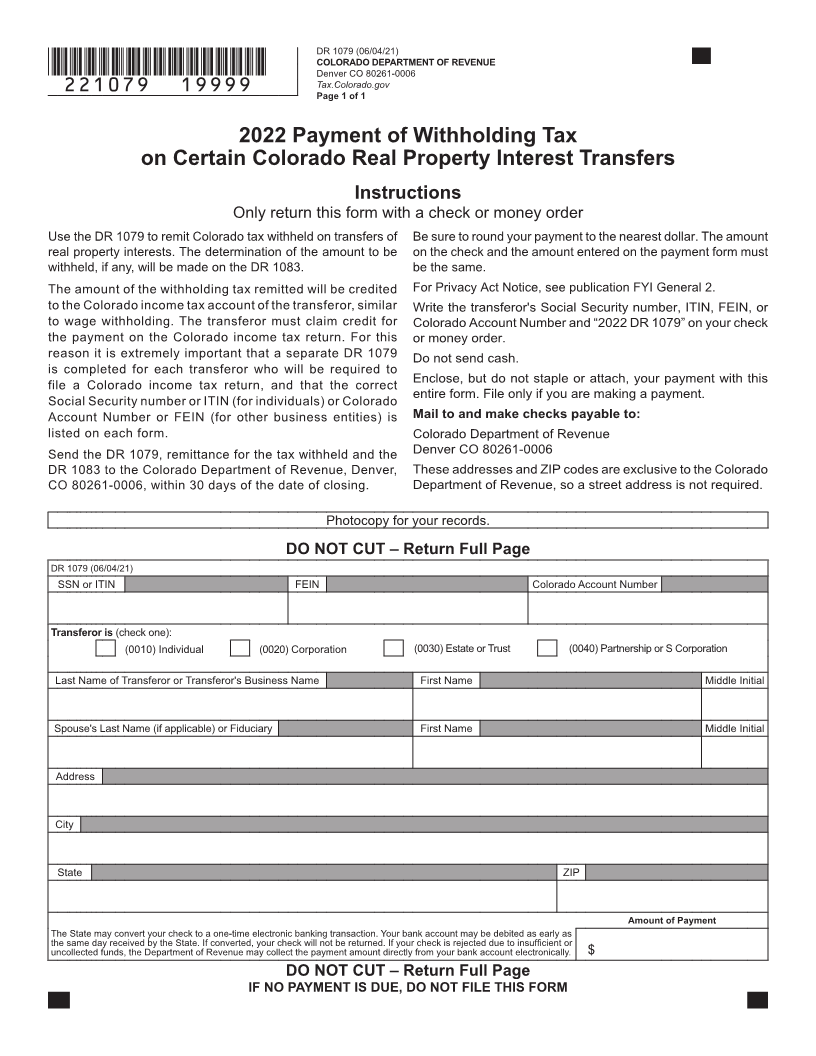

DR 1079 (06/04/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0006

*221079==19999* Tax.Colorado.gov

Page 1 of 1

2022 Payment of Withholding Tax

on Certain Colorado Real Property Interest Transfers

Instructions

Only return this form with a check or money order

Use the DR 1079 to remit Colorado tax withheld on transfers of Be sure to round your payment to the nearest dollar. The amount

real property interests. The determination of the amount to be on the check and the amount entered on the payment form must

withheld, if any, will be made on the DR 1083. be the same.

The amount of the withholding tax remitted will be credited For Privacy Act Notice, see publication FYI General 2.

to the Colorado income tax account of the transferor, similar Write the transferor's Social Security number, ITIN, FEIN, or

to wage withholding. The transferor must claim credit for Colorado Account Number and “2022 DR 1079” on your check

the payment on the Colorado income tax return. For this or money order.

reason it is extremely important that a separate DR 1079 Do not send cash.

is completed for each transferor who will be required to

Enclose, but do not staple or attach, your payment with this

file a Colorado income tax return, and that the correct

entire form. File only if you are making a payment.

Social Security number or ITIN (for individuals) or Colorado

Account Number or FEIN (for other business entities) is Mail to and make checks payable to:

listed on each form. Colorado Department of Revenue

Send the DR 1079, remittance for the tax withheld and the Denver CO 80261-0006

DR 1083 to the Colorado Department of Revenue, Denver, These addresses and ZIP codes are exclusive to the Colorado

CO 80261-0006, within 30 days of the date of closing. Department of Revenue, so a street address is not required.

Photocopy for your records.

DO NOT CUT – Return Full Page

DR 1079 (06/04/21)

SSN or ITIN FEIN Colorado Account Number

Transferor is (check one):

(0010) Individual (0020) Corporation (0030) Estate or Trust (0040) Partnership or S Corporation

Last Name of Transferor or Transferor's Business Name First Name Middle Initial

Spouse's Last Name (if applicable) or Fiduciary First Name Middle Initial

Address

City

State ZIP

Amount of Payment

The State may convert your check to a one-time electronic banking transaction. Your bank account may be debited as early as

the same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or

uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically. $

DO NOT CUT – Return Full Page

IF NO PAYMENT IS DUE, DO NOT FILE THIS FORM