Enlarge image

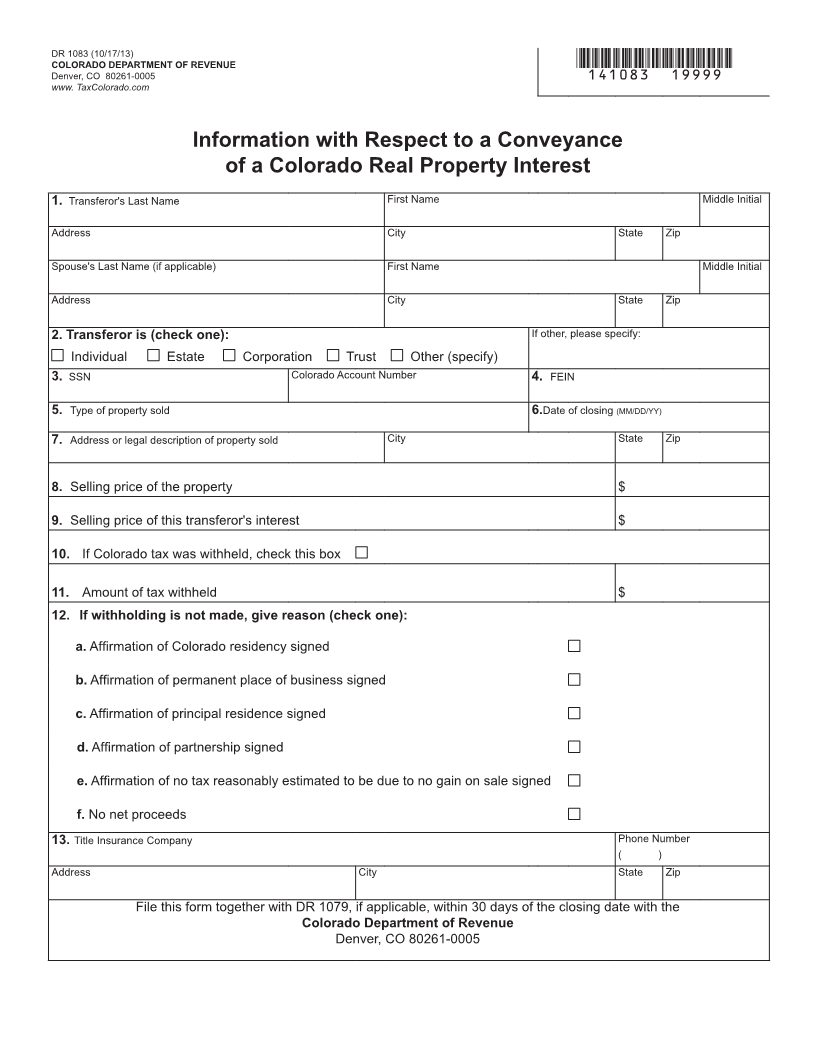

DR 1083 (10/17/13)

COLORADO DEPARTMENT OF REVENUE *141083==19999*

Denver, CO 80261-0005

www. TaxColorado.com

Information with Respect to a Conveyance

of a Colorado Real Property Interest

1. Transferor's Last Name First Name Middle Initial

Address City State Zip

Spouse's Last Name (if applicable) First Name Middle Initial

Address City State Zip

2. Transferor is (check one): If other, please specify:

Individual Estate Corporation Trust Other (specify)

3. SSN Colorado Account Number 4. FEIN

5. Type of property sold 6.Date of closing (MM/DD/YY)

7. Address or legal description of property sold City State Zip

8. Selling price of the property $

9. Selling price of this transferor's interest $

10. If Colorado tax was withheld, check this box

11. Amount of tax withheld $

12. If withholding is not made, give reason (check one):

a. Affirmation of Colorado residency signed

b. Affirmation of permanent place of business signed

c. Affirmation of principal residence signed

d. Affirmation of partnership signed

e. Affirmation of no tax reasonably estimated to be due to no gain on sale signed

f. No net proceeds

13. Title Insurance Company Phone Number

( )

Address City State Zip

File this form together with DR 1079, if applicable, within 30 days of the closing date with the

Colorado Department of Revenue

Denver, CO 80261-0005