Enlarge image

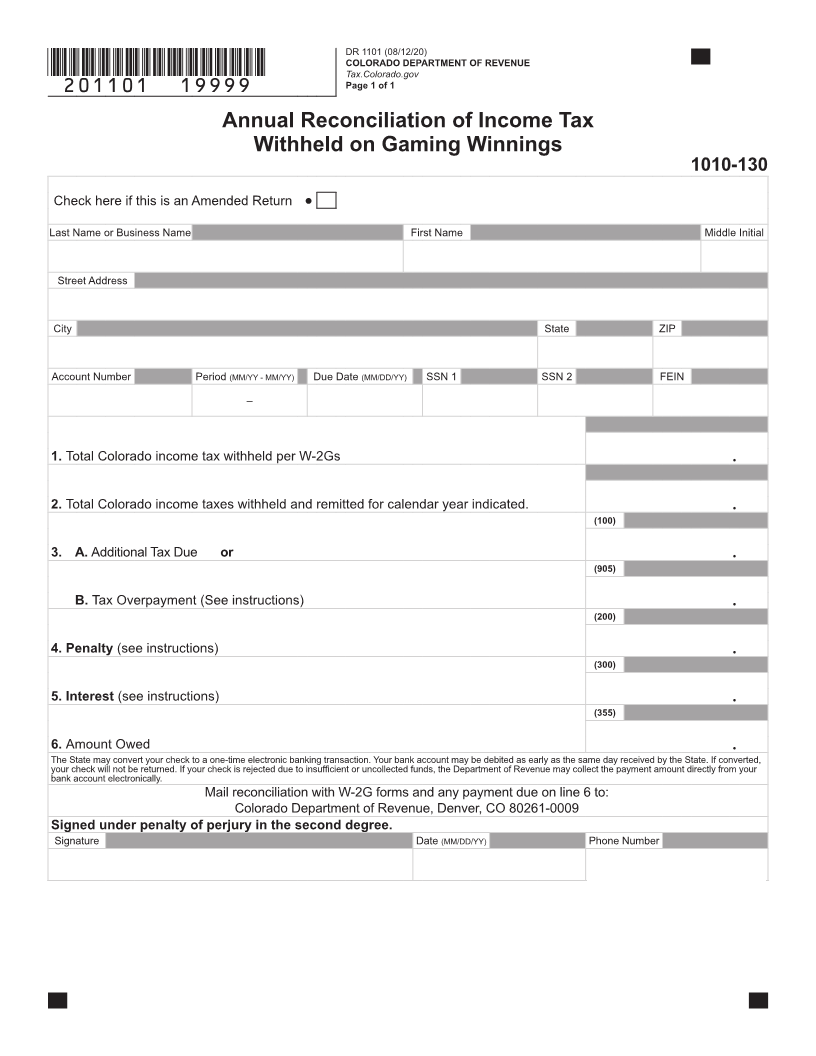

DR 1101 (08/12/20)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

Annual Reconciliation of Income Tax Withheld on Gaming Winnings

Instructions

If you are filing an amended return, check the amended Compute the interest due at the statutory rate printed in FYI

return box. A separate amended return must be filed for each General 11 at Tax.Colorado.gov

period. The amended return must show all tax columns as If there is an overpayment, put the amount of line 3B.

corrected, not the difference(s). The amended return will You must apply for a refund of the overpayment of tax

replace the original return in its entirety. by filing DR 0137. This form may be obtained online at

Use this form to reconcile the amount of backup withholding Tax.Colorado.gov

remitted with the total reported on Forms W-2G. Send the W-2G form(s) along with this form for the

If additional tax is due, put the amount on line 3A. Compute applicable period.

penalty at the larger of 5% (.05) of the balance due for the

Mail them to:

first month you are late and 1/2% (.005) additional penalty for

each additional month you are late. The maximum penalty Colorado Department of Revenue

is 12% (.12), and the minimum penalty is $5.00. Denver CO 80261-0009