Enlarge image

DR 1091 (08/12/20)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

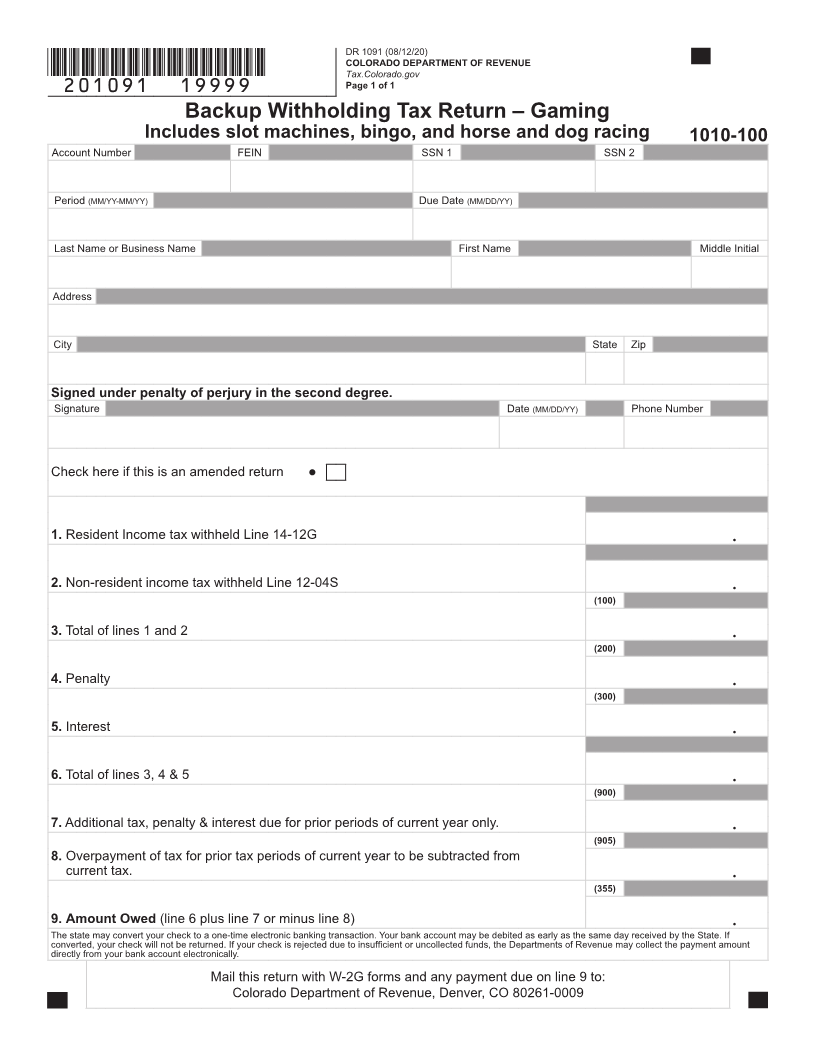

Backup Withholding Tax Return - Gaming

Instructions

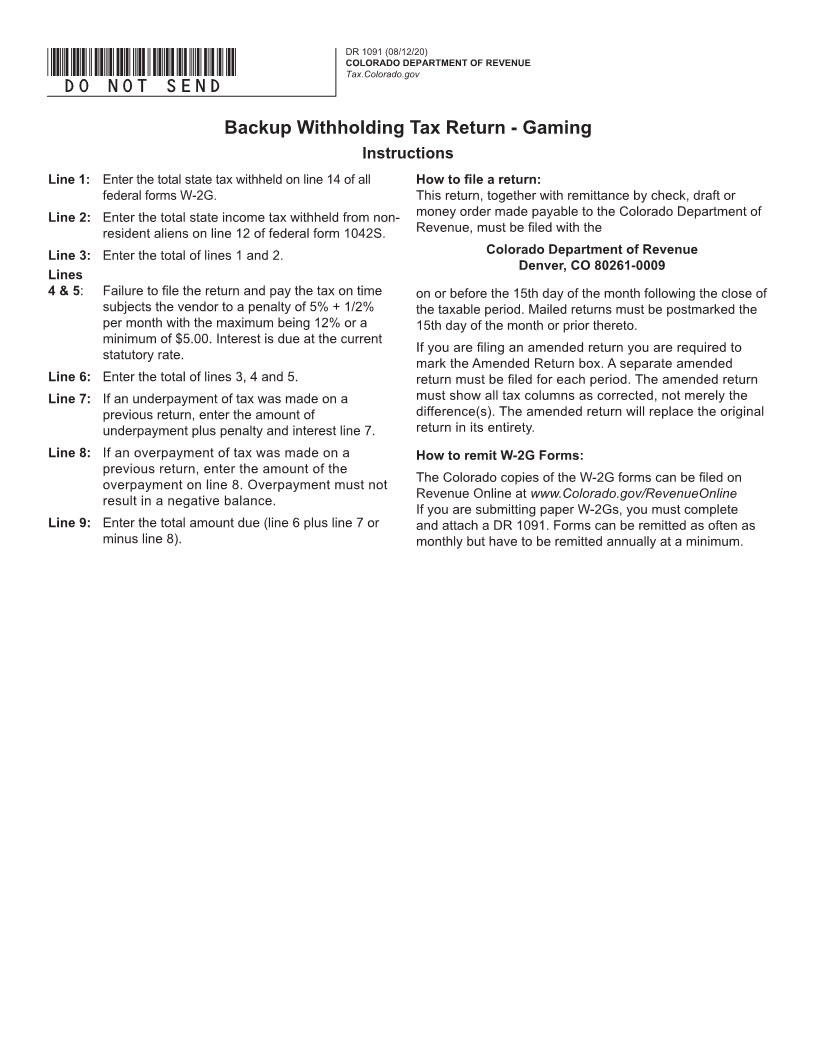

Line 1: Enter the total state tax withheld on line 14 of all How to file a return:

federal forms W-2G. This return, together with remittance by check, draft or

Line 2: Enter the total state income tax withheld from non- money order made payable to the Colorado Department of

resident aliens on line 12 of federal form 1042S. Revenue, must be filed with the

Line 3: Enter the total of lines 1 and 2. Colorado Department of Revenue

Denver, CO 80261-0009

Lines

4 & 5: Failure to file the return and pay the tax on time on or before the 15th day of the month following the close of

subjects the vendor to a penalty of 5% + 1/2% the taxable period. Mailed returns must be postmarked the

per month with the maximum being 12% or a 15th day of the month or prior thereto.

minimum of $5.00. Interest is due at the current

If you are filing an amended return you are required to

statutory rate.

mark the Amended Return box. A separate amended

Line 6: Enter the total of lines 3, 4 and 5. return must be filed for each period. The amended return

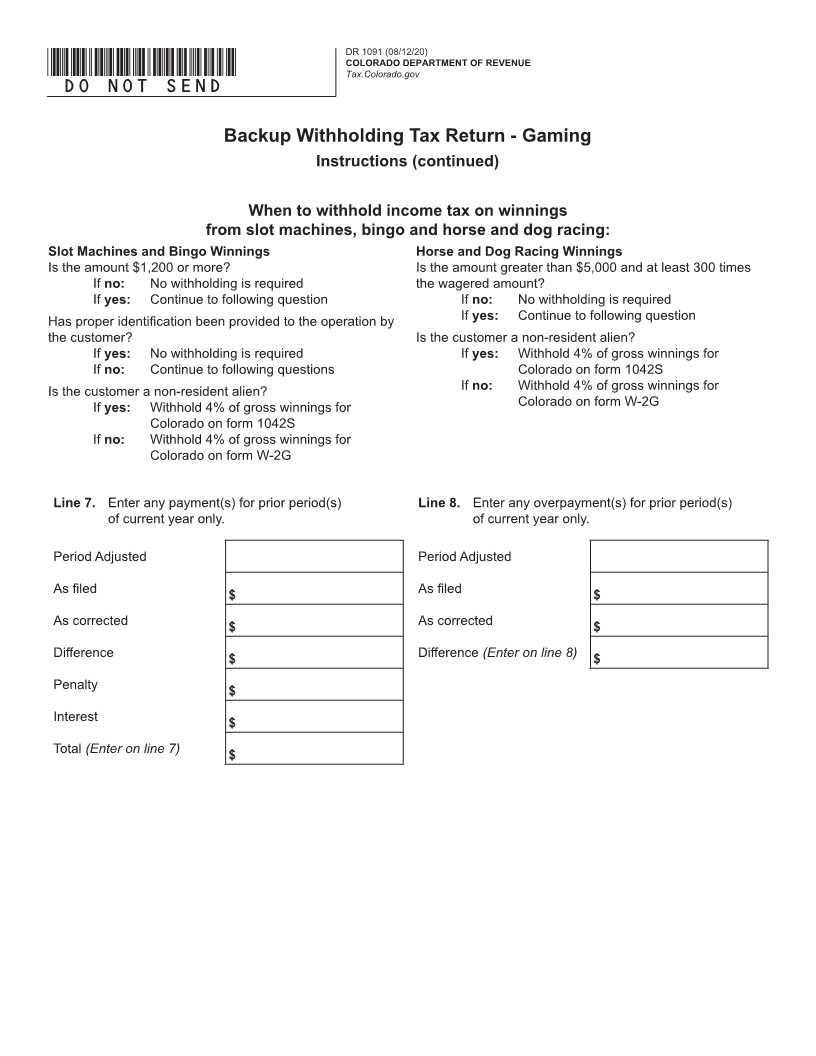

Line 7: If an underpayment of tax was made on a must show all tax columns as corrected, not merely the

previous return, enter the amount of difference(s). The amended return will replace the original

underpayment plus penalty and interest line 7. return in its entirety.

Line 8: If an overpayment of tax was made on a How to remit W-2G Forms:

previous return, enter the amount of the

The Colorado copies of the W-2G forms can be filed on

overpayment on line 8. Overpayment must not

Revenue Online at www.Colorado.gov/RevenueOnline

result in a negative balance.

If you are submitting paper W-2Gs, you must complete

Line 9: Enter the total amount due (line 6 plus line 7 or and attach a DR 1091. Forms can be remitted as often as

minus line 8). monthly but have to be remitted annually at a minimum.