Enlarge image

DR 1059 (09/26/19)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

*131059==19999*

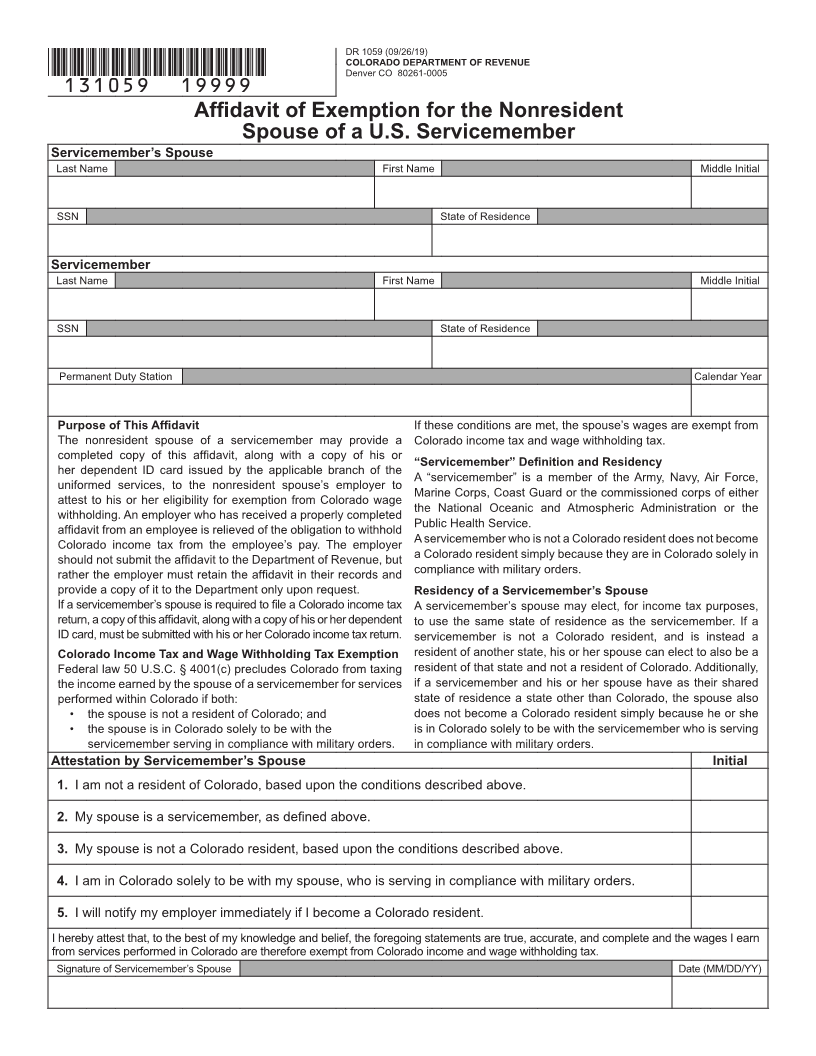

Affidavit of Exemption for the Nonresident

Spouse of a U.S. Servicemember

Servicemember’s Spouse

Last Name First Name Middle Initial

SSN State of Residence

Servicemember

Last Name First Name Middle Initial

SSN State of Residence

Permanent Duty Station Calendar Year

Purpose of This Affidavit If these conditions are met, the spouse’s wages are exempt from

The nonresident spouse of a servicemember may provide a Colorado income tax and wage withholding tax.

completed copy of this affidavit, along with a copy of his or

“Servicemember” Definition and Residency

her dependent ID card issued by the applicable branch of the

A “servicemember” is a member of the Army, Navy, Air Force,

uniformed services, to the nonresident spouse’s employer to

Marine Corps, Coast Guard or the commissioned corps of either

attest to his or her eligibility for exemption from Colorado wage

the National Oceanic and Atmospheric Administration or the

withholding. An employer who has received a properly completed

affidavit from an employee is relieved of the obligation to withhold Public Health Service.

Colorado income tax from the employee’s pay. The employer A servicemember who is not a Colorado resident does not become

should not submit the affidavit to the Department of Revenue, but a Colorado resident simply because they are in Colorado solely in

rather the employer must retain the affidavit in their records and compliance with military orders.

provide a copy of it to the Department only upon request. Residency of a Servicemember’s Spouse

If a servicemember’s spouse is required to file a Colorado income tax A servicemember’s spouse may elect, for income tax purposes,

return, a copy of this affidavit, along with a copy of his or her dependent to use the same state of residence as the servicemember. If a

ID card, must be submitted with his or her Colorado income tax return. servicemember is not a Colorado resident, and is instead a

Colorado Income Tax and Wage Withholding Tax Exemption resident of another state, his or her spouse can elect to also be a

Federal law 50 U.S.C. § 4001(c) precludes Colorado from taxing resident of that state and not a resident of Colorado. Additionally,

the income earned by the spouse of a servicemember for services if a servicemember and his or her spouse have as their shared

performed within Colorado if both: state of residence a state other than Colorado, the spouse also

• the spouse is not a resident of Colorado; and does not become a Colorado resident simply because he or she

• the spouse is in Colorado solely to be with the is in Colorado solely to be with the servicemember who is serving

servicemember serving in compliance with military orders. in compliance with military orders.

Attestation by Servicemember’s Spouse Initial

1. I am not a resident of Colorado, based upon the conditions described above.

2. My spouse is a servicemember, as defined above.

3. My spouse is not a Colorado resident, based upon the conditions described above.

4. I am in Colorado solely to be with my spouse, who is serving in compliance with military orders.

5. I will notify my employer immediately if I become a Colorado resident.

I hereby attest that, to the best of my knowledge and belief, the foregoing statements are true, accurate, and complete and the wages I earn

from services performed in Colorado are therefore exempt from Colorado income and wage withholding tax.

Signature of Servicemember’s Spouse Date (MM/DD/YY)