Enlarge image

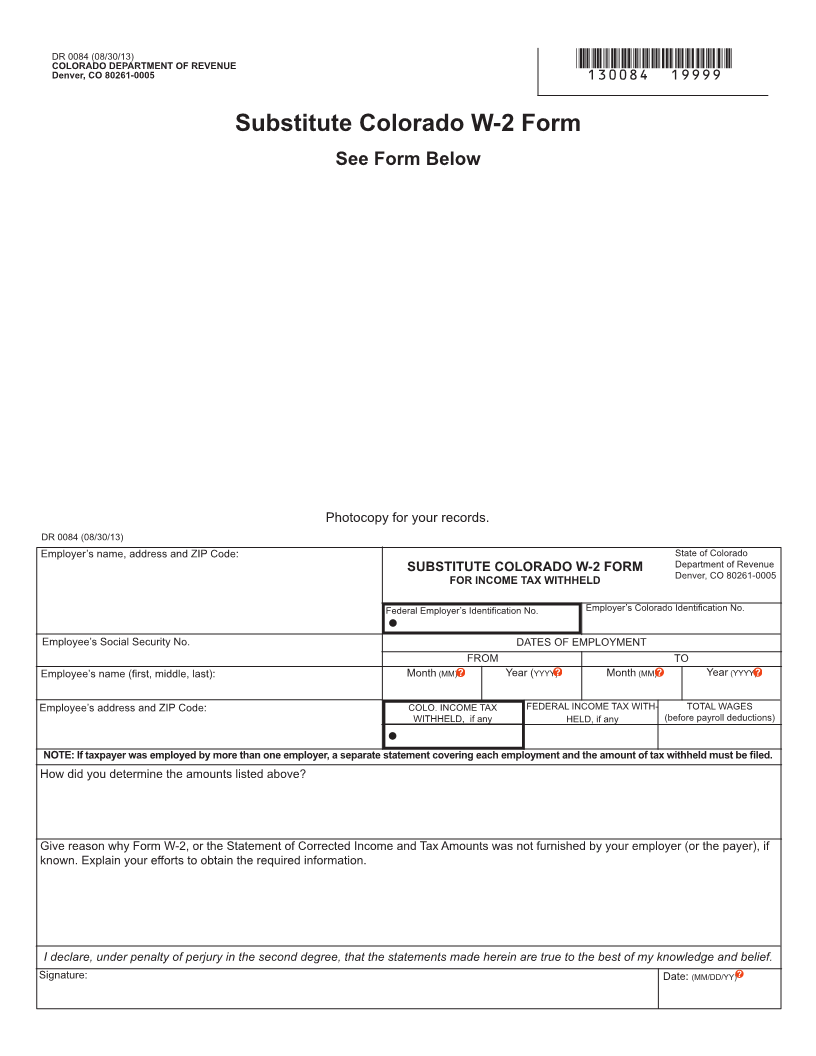

DR 0084 (08/30/13)

COLORADO DEPARTMENT OF REVENUE *130084==19999*

Denver, CO 80261-0005

Substitute Colorado W-2 Form

See Form Below

Photocopy for your records.

DR 0084 (08/30/13)

Employer’s name, address and ZIP Code: State of Colorado

SUBSTITUTE COLORADO W-2 FORM Department of Revenue

FOR INCOME TAX WITHHELD Denver, CO 80261-0005

Federal Employer’s Identification No. Employer’s Colorado Identification No.

●

Employee’s Social Security No. DATES OF EMPLOYMENT

FROM TO

Employee’s name (first, middle, last): Month (MM) Year (YYYY) Month (MM) Year (YYYY)

Employee’s address and ZIP Code: COLO. INCOME TAX FEDERAL INCOME TAX WITH- TOTAL WAGES

WITHHELD, if any HELD, if any (before payroll deductions)

●

NOTE: If taxpayer was employed by more than one employer, a separate statement covering each employment and the amount of tax withheld must be filed.

How did you determine the amounts listed above?

Give reason why Form W-2, or the Statement of Corrected Income and Tax Amounts was not furnished by your employer (or the payer), if

known. Explain your efforts to obtain the required information.

I declare, under penalty of perjury in the second degree, that the statements made herein are true to the best of my knowledge and belief.

Signature: Date: (MM/DD/YY)