Enlarge image

DR 1107 (08/13/20)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

*DO=NOT=SEND*

Instructions for Completing 1099 Income Withholding Tax Return

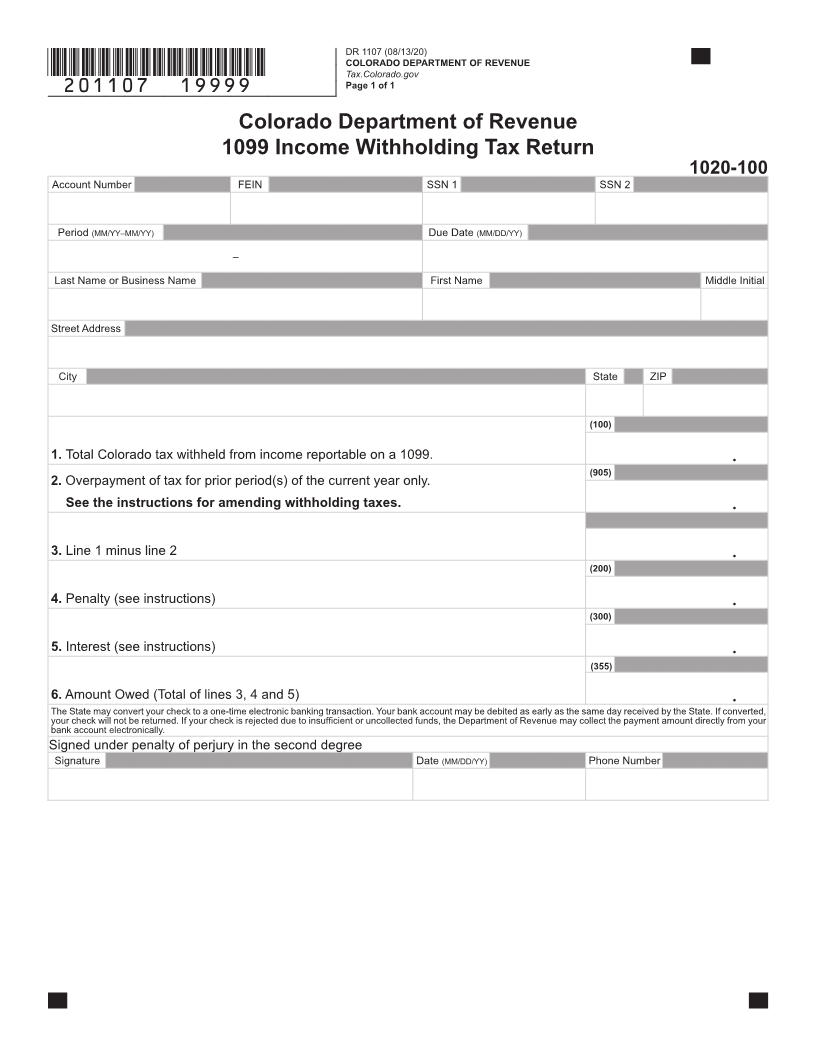

The DR 1107 Income Withholding Tax Return should Filing Period: List here the filing period for this return. Be

be filed for current year 1099 withholding only. Review sure you are using the correct period end date for your defined

publication FYI Withholding 7, Colorado 1099/W-2G Income filing frequency.

Withholding Tax Requirements for detailed information Enter the amount of Colorado income tax withheld

Line 1

about filing requirements and frequencies. for the period.

You may sign up for Electronic Funds Transfer (EFT). The If a previous period in the current tax year was

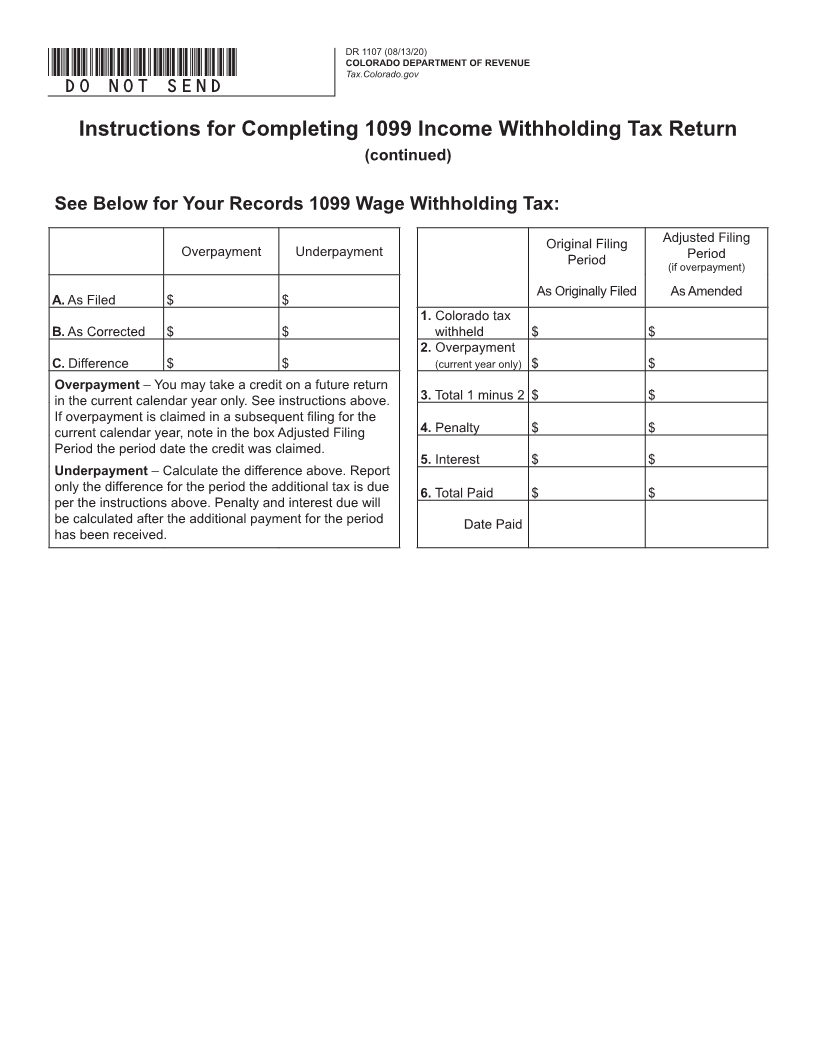

Line 2

EFT transaction is the filing of the return. overstated and paid, complete the worksheet

Visit www.Colorado.gov/revenue/eft for information on below and calculate the overpayment for the

how to register and pay through EFT. Do not file a paper tax period. See the instructions for amending

DR 1107 if you remitted the withholding taxes via EFT. withholding taxes.

To prevent being billed by the department when no taxes Calculate the net amount due by subtracting line 2

Line 3

were withheld during the filing period, file a completed paper from line 1.

form 1099 Income Withholding Tax return (DR 1107).

Line 4 Complete only if the return is being filed after the

Instructions for Amending Withholding Taxes due date. Penalty is calculated by determining how

If you overpaid for a period, you may take a credit on a far past the due date the return is being filed. If the

return in the current calendar year. The credit may be return is filed within the first month after the due

taken by reducing the amount remitted on your subsequent date, calculate the penalty at 5% (.05) of the tax

EFT payment or a subsequent paper form 1099 Income due, or $5, whichever is greater. For each additional

Withholding Tax Return (DR 1107). To claim the credit on a month thereafter the return is delinquent, add one-

subsequent DR 1107 for the current calendar year, deduct half of 1% (.005), up to a maximum of 12%.

the overpayment from line 1 of your return. You may only

deduct an amount bringing your return to zero (0.00) for the Line 5 Complete only if return is being filed after the due

period you are reporting. If you are unable to claim the credit date. Refer to publication FYI General 11, Colorado

on a subsequent DR 1107 within the calendar year, you Civil Tax Penalties and Interest to calculate late

should claim a refund on your Annual Transmittal of State payment interest. Enter the calculated interest

1099 Forms (DR 1106) for the appropriate year. amount on line 5.

If additional tax is owed, file another 1099 Income Line 6 Add together the amounts listed on lines 3, 4 and

Withholding Tax Return (DR 1107) reporting only the 5. This is the amount that is due. Make check or

additional amount owed. money order payable to the Colorado Department of

Revenue. Use the memo to clearly list “ 1099 WTH,”

Refunds will be issued after filing an DR 1106 filed at the end your account number, and tax period.

of February following the end of the calendar year.

Mail to and make checks payable to:

Account Number: List the Colorado business account number

from your withholding certificate or sales tax license. This Colorado Department of Revenue

number is 8 digits. Do not list your FEIN or EFT number here. Denver CO 80261-0009