Enlarge image

DR 1098 (11/14/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Colorado Withholding Worksheet for Employers

This worksheet prescribes the method for employers to 4. If an employee does not submit form W-4 or form

calculate the required Colorado wage withholding. This DR 0004, complete Step 2a as if they submitted form

calculation is based on an employee’s withholding certificate, W-4 with an expected filing status of “single,” and

which is either IRS form W-4 or Colorado form DR 0004. A enter zero on Step 2e.

new employee must submit the current version of form W-4, A withholding certificate remains in effect until the

which is available at IRS.gov. Starting in 2022, an employee employee submits a new certificate or the Department

also has the option to submit the new form DR 0004. adjusts their withholding. An employee may submit a new

Employers must use the calculation in this worksheet certificate at any time during their employment, and a

according to the following rules. new certificate revokes and replaces any prior certificate.

1. If an employee submits form DR 0004, use the Therefore, if an employee submits a new form W-4 without

amounts entered on that form, including an amount of a new form DR 0004, that form W-4 revokes any prior

zero, as instructed in Step 2. form DR 0004 (or any requests for additional withholding

made prior to 2022).

2. If an employee submits only form W-4 without form

DR 0004, complete Step 2a based on the expected Go to Tax.Colorado.gov/Withholding-Tax for additional

filing status indicated on that form W-4, unless they resources regarding Colorado withholding, including:

claim to be exempt. 1. an electronic version of this worksheet, the

3. If an employee submits only form W-4 and claims DR 1098 Withholding Calculator;

to be exempt, see Part 1 of the Colorado Wage 2. the new form DR 0004, Colorado Employee

Withholding Tax Guide for instructions. Unless the Withholding Certificate; and

Department adjusts the exemption claim, do not the Colorado Wage Withholding Tax Guide,

3.

complete this calculation, and use a withholding which provides more information about wage

amount of zero. withholding requirements.

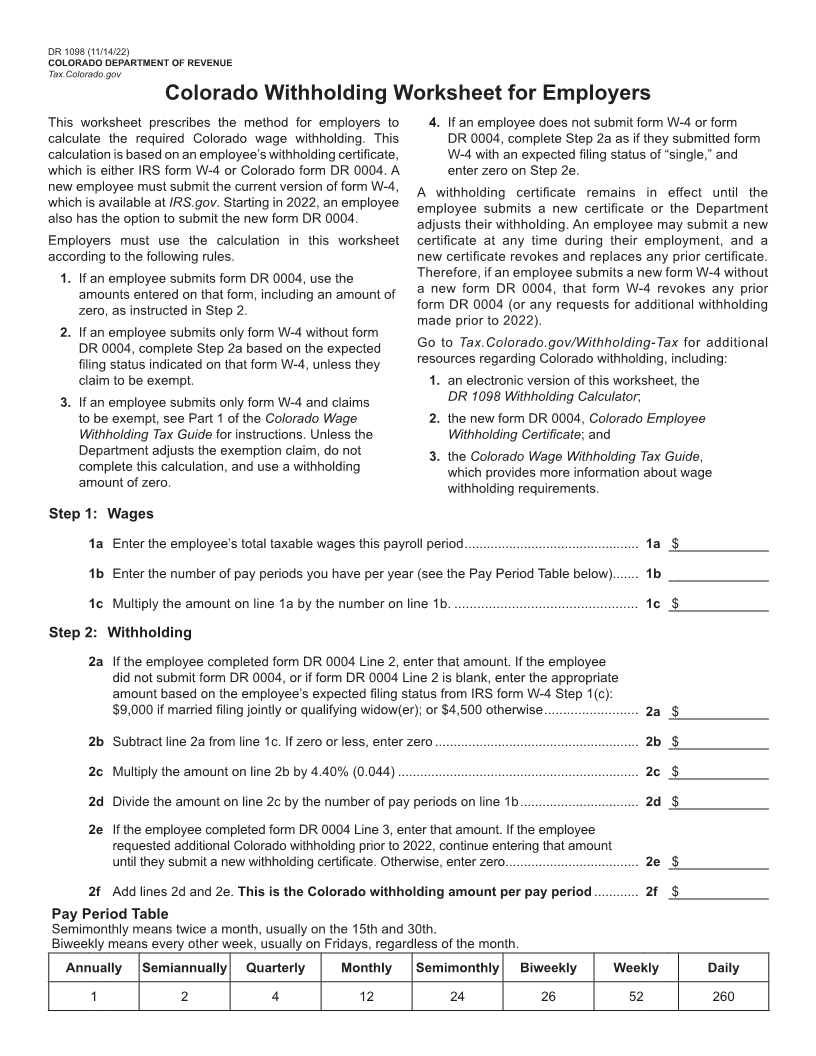

Step 1: Wages

1a Enter the employee’s total taxable wages this payroll period ............................................... 1a $

1b Enter the number of pay periods you have per year (see the Pay Period Table below) ....... 1b

1c Multiply the amount on line 1a by the number on line 1b. ................................................ 1c $

Step 2: Withholding

2a If the employee completed form DR 0004 Line 2, enter that amount. If the employee

did not submit form DR 0004, or if form DR 0004 Line 2 is blank, enter the appropriate

amount based on the employee’s expected filing status from IRS form W-4 Step 1(c):

$9,000 if married filing jointly or qualifying widow(er); or $4,500 otherwise ......................... 2a $

2b Subtract line 2a from line 1c. If zero or less, enter zero ....................................................... 2b $

2c Multiply the amount on line 2b by 4.40% (0.044) ................................................................. 2c $

2d Divide the amount on line 2c by the number of pay periods on line 1b ................................ 2d $

2e If the employee completed form DR 0004 Line 3, enter that amount. If the employee

requested additional Colorado withholding prior to 2022, continue entering that amount

until they submit a new withholding certificate. Otherwise, enter zero .................................... 2e $

2f Add lines 2d and 2e. This is the Colorado withholding amount per pay period ............ 2f $

Pay Period Table

Semimonthly means twice a month, usually on the 15th and 30th.

Biweekly means every other week, usually on Fridays, regardless of the month.

Annually Semiannually Quarterly Monthly Semimonthly Biweekly Weekly Daily

1 2 4 12 24 26 52 260