Enlarge image

*220104US19999**DO=NOT=SEND*

DR 0104US (10/19/22)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 1 of 1

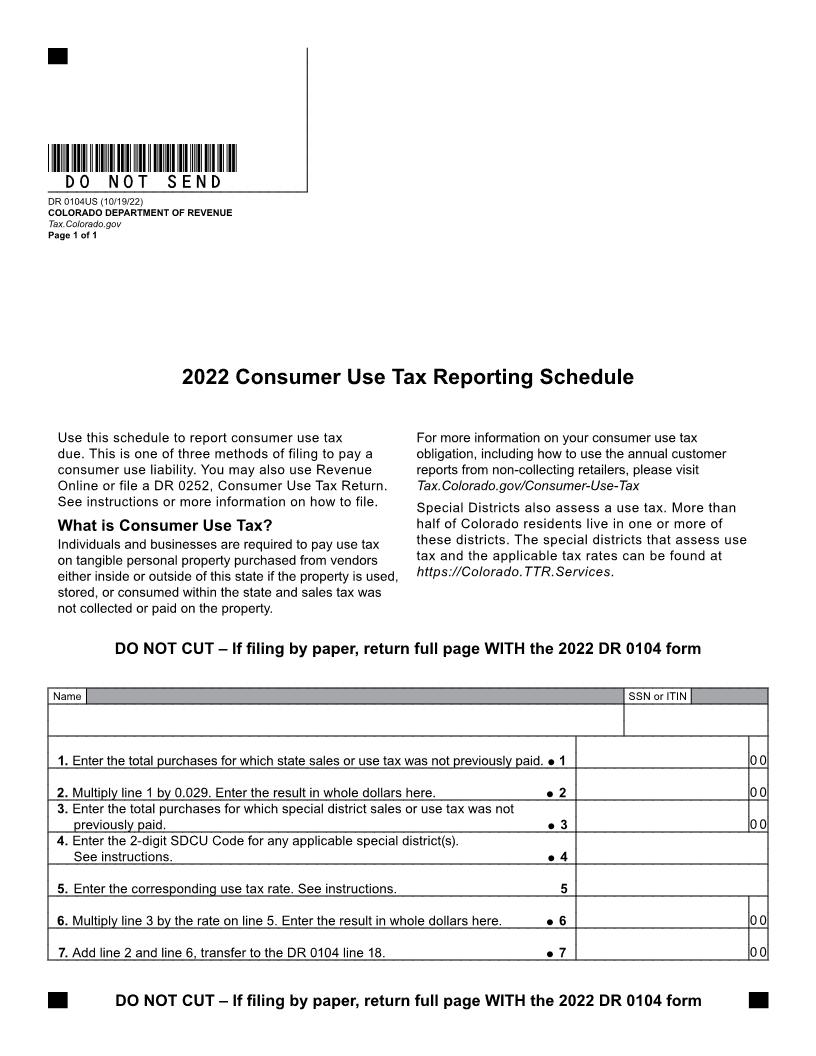

2022 Consumer Use Tax Reporting Schedule

Use this schedule to report consumer use tax For more information on your consumer use tax

due. This is one of three methods of filing to pay a obligation, including how to use the annual customer

consumer use liability. You may also use Revenue reports from non-collecting retailers, please visit

Online or file a DR 0252, Consumer Use Tax Return. Tax.Colorado.gov/Consumer-Use-Tax

See instructions or more information on how to file. Special Districts also assess a use tax. More than

What is Consumer Use Tax? half of Colorado residents live in one or more of

Individuals and businesses are required to pay use tax these districts. The special districts that assess use

on tangible personal property purchased from vendors tax and the applicable tax rates can be found at

either inside or outside of this state if the property is used, https://Colorado.TTR.Services.

stored, or consumed within the state and sales tax was

not collected or paid on the property.

DO NOT CUT – If filing by paper, return full page WITH the 2022 DR 0104 formDO NOT

Name SSN or ITIN

1. Enter the total purchases for which state sales or use tax was not previously paid. 1 0 0

SEND

2. Multiply line 1 by 0.029. Enter the result in whole dollars here. 2 0 0

3. Enter the total purchases for which special district sales or use tax was not

previously paid. 3 0 0

4. Enter the 2-digit SDCU Code for any applicable special district(s).

See instructions. 4

5. Enter the corresponding use tax rate. See instructions. 5

6. Multiply line 3 by the rate on line 5. Enter the result in whole dollars here. 6 0 0

7. Add line 2 and line 6, transfer to the DR 0104 line 18. 7 0 0

DO NOT CUT – If filing by paper, return full page WITH the 2022 DR 0104 form