Enlarge image

DR 0252 (02/15/22)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

=DO=NOT=SEND= (303) 238-SERV (7378)

Tax.Colorado.gov

Consumer Use Tax Return Instructions

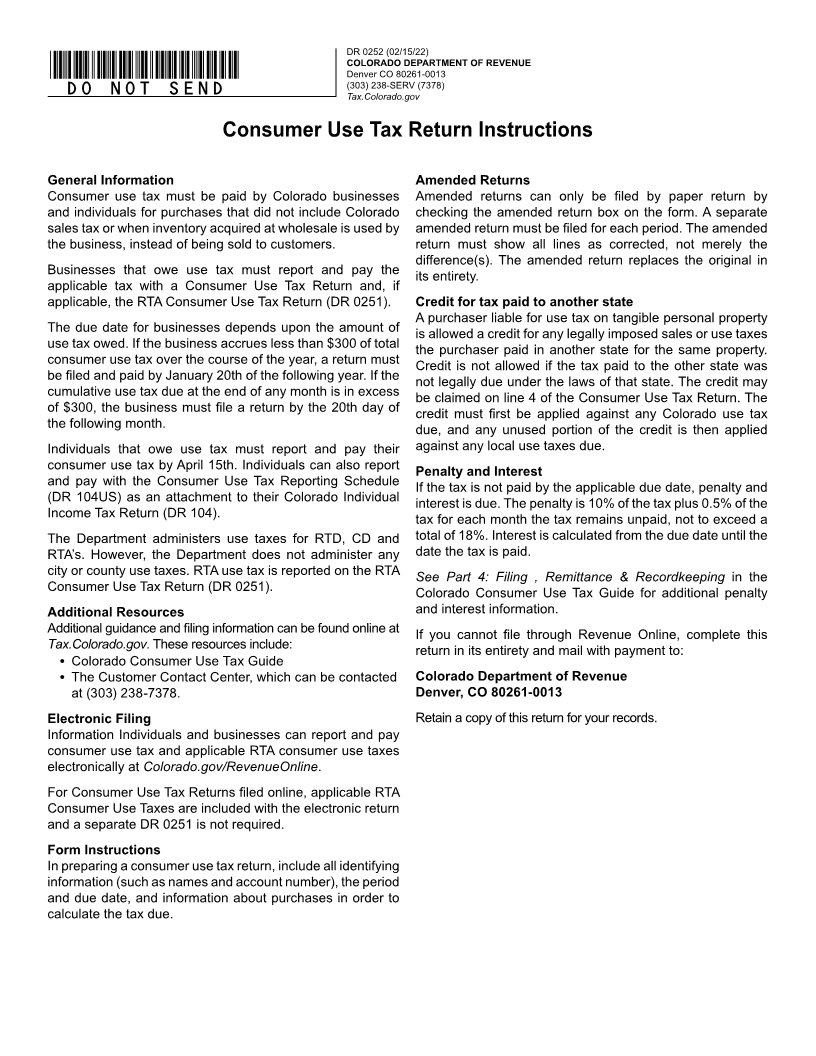

General Information Amended Returns

Consumer use tax must be paid by Colorado businesses Amended returns can only be filed by paper return by

and individuals for purchases that did not include Colorado checking the amended return box on the form. A separate

sales tax or when inventory acquired at wholesale is used by amended return must be filed for each period. The amended

the business, instead of being sold to customers. return must show all lines as corrected, not merely the

difference(s). The amended return replaces the original in

Businesses that owe use tax must report and pay the its entirety.

applicable tax with a Consumer Use Tax Return and, if

applicable, the RTA Consumer Use Tax Return (DR 0251). Credit for tax paid to another state

A purchaser liable for use tax on tangible personal property

The due date for businesses depends upon the amount of is allowed a credit for any legally imposed sales or use taxes

use tax owed. If the business accrues less than $300 of total the purchaser paid in another state for the same property.

consumer use tax over the course of the year, a return must Credit is not allowed if the tax paid to the other state was

be filed and paid by January 20th of the following year. If the not legally due under the laws of that state. The credit may

cumulative use tax due at the end of any month is in excess be claimed on line 4 of the Consumer Use Tax Return. The

of $300, the business must file a return by the 20th day of credit must first be applied against any Colorado use tax

the following month. due, and any unused portion of the credit is then applied

Individuals that owe use tax must report and pay their against any local use taxes due.

consumer use tax by April 15th. Individuals can also report

Penalty and Interest

and pay with the Consumer Use Tax Reporting Schedule If the tax is not paid by the applicable due date, penalty and

(DR 104US) as an attachment to their Colorado Individual interest is due. The penalty is 10% of the tax plus 0.5% of the

Income Tax Return (DR 104). tax for each month the tax remains unpaid, not to exceed a

The Department administers use taxes for RTD, CD and total of 18%. Interest is calculated from the due date until the

RTA’s. However, the Department does not administer any date the tax is paid.

city or county use taxes. RTA use tax is reported on the RTA See Part 4: Filing , Remittance & Recordkeeping in the

Consumer Use Tax Return (DR 0251). Colorado Consumer Use Tax Guide for additional penalty

Additional Resources and interest information.

Additional guidance and filing information can be found online at If you cannot file through Revenue Online, complete this

Tax.Colorado.gov. These resources include: return in its entirety and mail with payment to:

● Colorado Consumer Use Tax Guide

● The Customer Contact Center, which can be contacted Colorado Department of Revenue

at (303) 238-7378. Denver, CO 80261-0013

Electronic Filing Retain a copy of this return for your records.

Information Individuals and businesses can report and pay

consumer use tax and applicable RTA consumer use taxes

electronically at Colorado.gov/RevenueOnline.

For Consumer Use Tax Returns filed online, applicable RTA

Consumer Use Taxes are included with the electronic return

and a separate DR 0251 is not required.

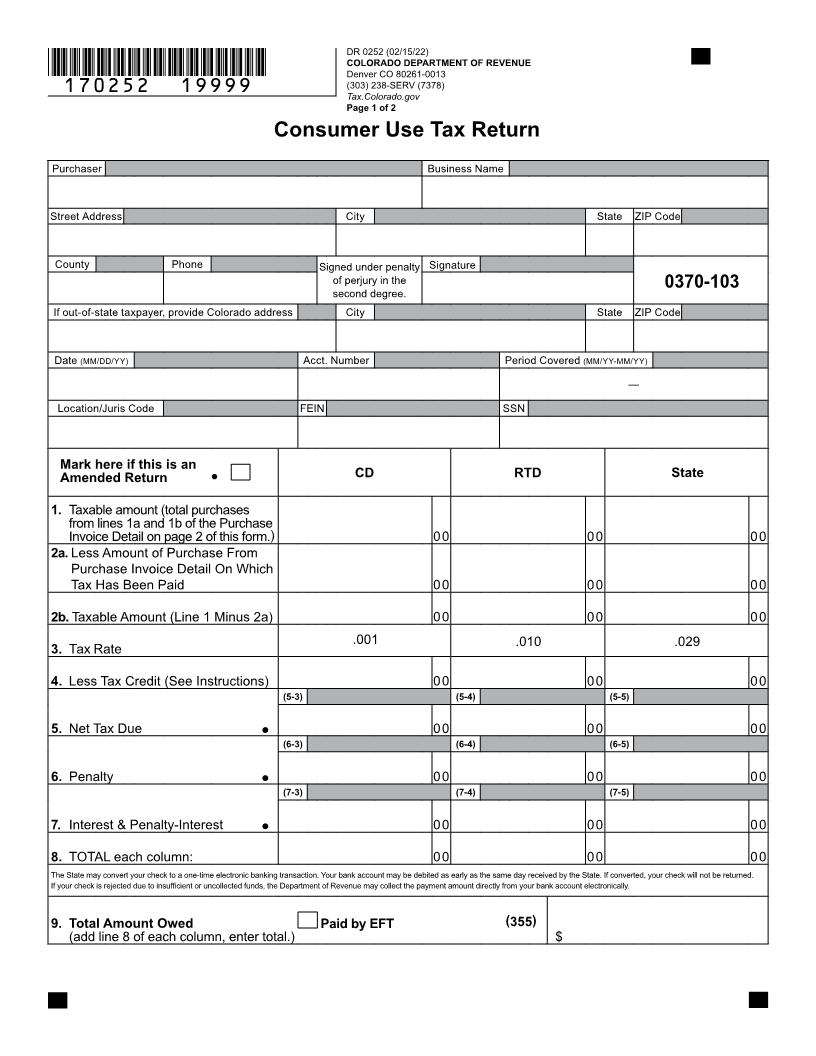

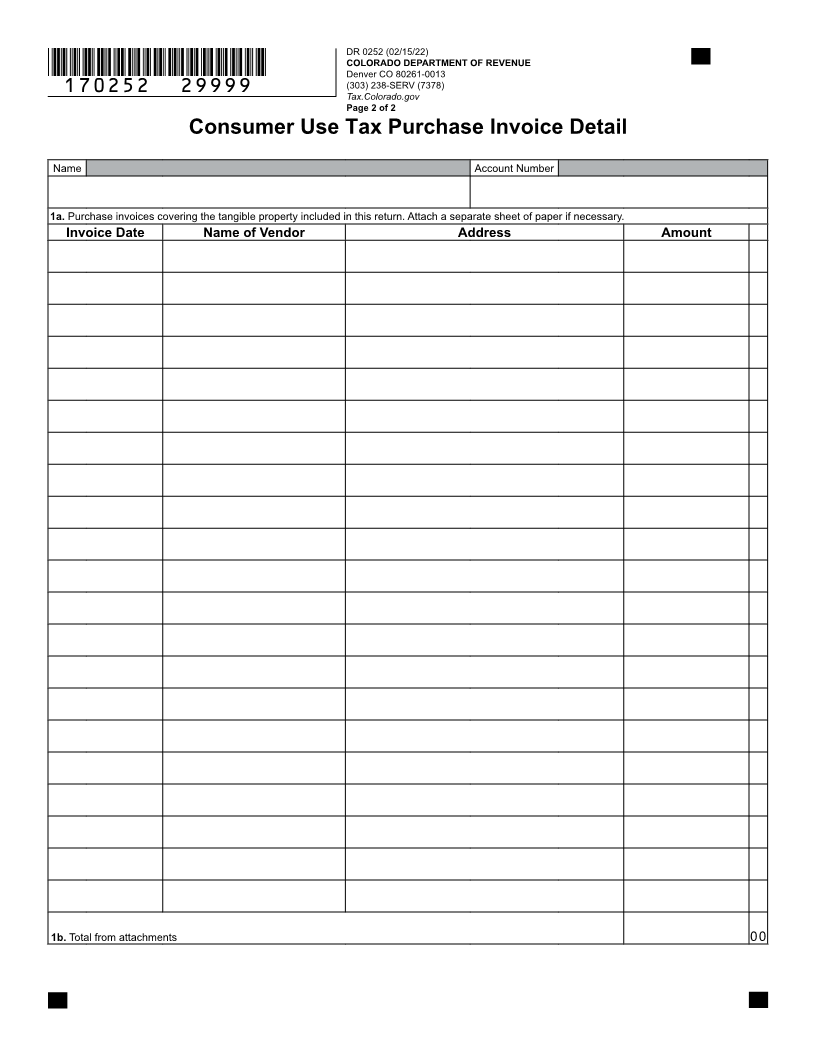

Form Instructions

In preparing a consumer use tax return, include all identifying

information (such as names and account number), the period

and due date, and information about purchases in order to

calculate the tax due.