Enlarge image

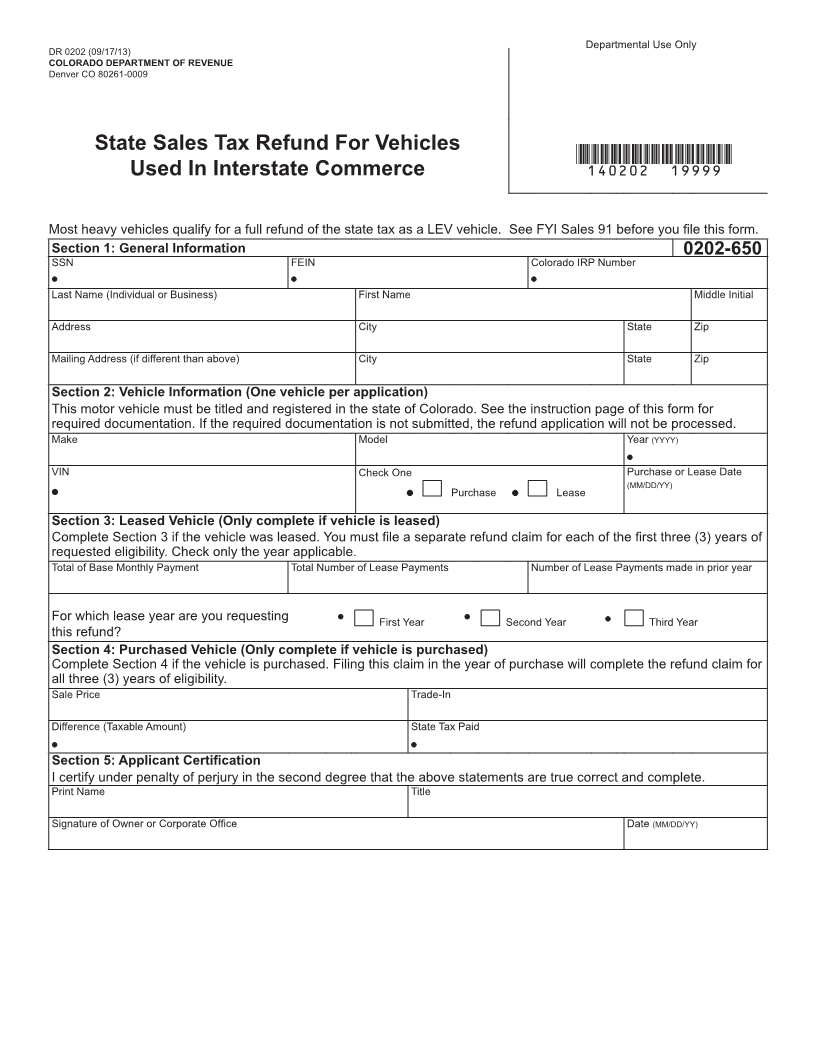

DR 0202 (09/17/13) Departmental Use Only

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0009

State Sales Tax Refund For Vehicles

*140202==19999*

Used In Interstate Commerce

Most heavy vehicles qualify for a full refund of the state tax as a LEV vehicle. See FYI Sales 91 before you file this form.

Section 1: General Information 0202-650

SSN FEIN Colorado IRP Number

Last Name (Individual or Business) First Name Middle Initial

Address City State Zip

Mailing Address (if different than above) City State Zip

Section 2: Vehicle Information (One vehicle per application)

This motor vehicle must be titled and registered in the state of Colorado. See the instruction page of this form for

required documentation. If the required documentation is not submitted, the refund application will not be processed.

Make Model Year (YYYY)

VIN Check One Purchase or Lease Date

(MM/DD/YY)

Purchase Lease

Section 3: Leased Vehicle (Only complete if vehicle is leased)

Complete Section 3 if the vehicle was leased. You must file a separate refund claim for each of the first three (3) years of

requested eligibility. Check only the year applicable.

Total of Base Monthly Payment Total Number of Lease Payments Number of Lease Payments made in prior year

For which lease year are you requesting First Year Second Year Third Year

this refund?

Section 4: Purchased Vehicle (Only complete if vehicle is purchased)

Complete Section 4 if the vehicle is purchased. Filing this claim in the year of purchase will complete the refund claim for

all three (3) years of eligibility.

Sale Price Trade-In

Difference (Taxable Amount) State Tax Paid

Section 5: Applicant Certification

I certify under penalty of perjury in the second degree that the above statements are true correct and complete.

Print Name Title

Signature of Owner or Corporate Office Date (MM/DD/YY)