Enlarge image

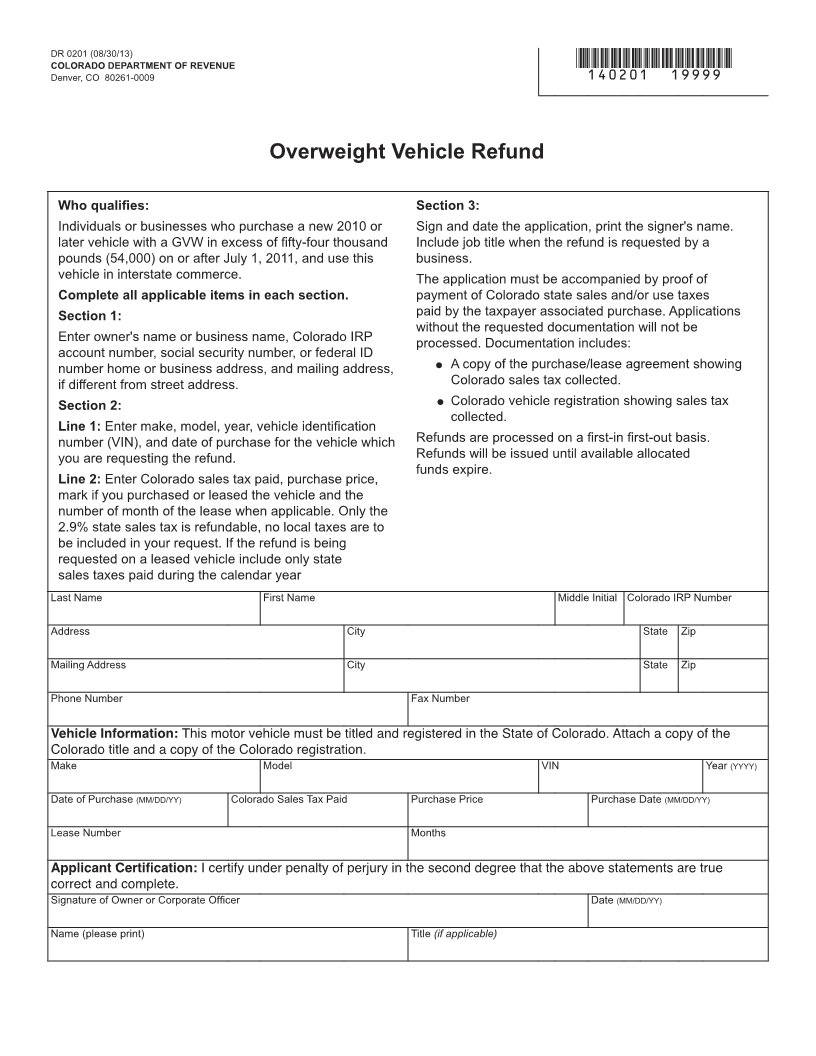

DR 0201 (08/30/13)

COLORADO DEPARTMENT OF REVENUE *140201==19999*

Denver, CO 80261-0009

Overweight Vehicle Refund

Who qualifies: Section 3:

Individuals or businesses who purchase a new 2010 or Sign and date the application, print the signer's name.

later vehicle with a GVW in excess of fifty-four thousand Include job title when the refund is requested by a

pounds (54,000) on or after July 1, 2011, and use this business.

vehicle in interstate commerce. The application must be accompanied by proof of

Complete all applicable items in each section. payment of Colorado state sales and/or use taxes

Section 1: paid by the taxpayer associated purchase. Applications

without the requested documentation will not be

Enter owner's name or business name, Colorado IRP processed. Documentation includes:

account number, social security number, or federal ID

number home or business address, and mailing address, A copy of the purchase/lease agreement showing

if different from street address. Colorado sales tax collected.

Section 2: Colorado vehicle registration showing sales tax

collected.

Line 1: Enter make, model, year, vehicle identification

number (VIN), and date of purchase for the vehicle which Refunds are processed on a first-in first-out basis.

you are requesting the refund. Refunds will be issued until available allocated

funds expire.

Line 2: Enter Colorado sales tax paid, purchase price,

mark if you purchased or leased the vehicle and the

number of month of the lease when applicable. Only the

2.9% state sales tax is refundable, no local taxes are to

be included in your request. If the refund is being

requested on a leased vehicle include only state

sales taxes paid during the calendar year

Last Name First Name Middle Initial Colorado IRP Number

Address City State Zip

Mailing Address City State Zip

Phone Number Fax Number

( ) ( )

Vehicle Information: This motor vehicle must be titled and registered in the State of Colorado. Attach a copy of the

Colorado title and a copy of the Colorado registration.

Make Model VIN Year (YYYY)

Date of Purchase (MM/DD/YY) Colorado Sales Tax Paid Purchase Price Purchase Date (MM/DD/YY)

Lease Number Months

Applicant Certification: I certify under penalty of perjury in the second degree that the above statements are true

correct and complete.

Signature of Owner or Corporate Officer Date (MM/DD/YY)

Name (please print) Title (if applicable)