Enlarge image

DR 0440 (09/20/19)

COLORADO DEPARTMENT OF REVENUE

PO Box 17087

*140440==19999* Denver CO 80217-0087

Attn: Local Government Support, Rm 208

Lessor Registration for Sales Tax Collection

Any lessor that will be collecting state and state- Leases of 36 months or less

administered sales tax in Colorado must apply for and Any lessor who leases tangible personal property for terms

maintain an active sales tax license and file a completed of 36 months or less must pay sales and/or use taxes,

Lessor Registration for Sales Tax Collection (DR 0440). as applicable, on the full purchase price the lessor paid

The lessor must submit with their completed DR 0440 for the acquisition of the property, unless the lessor has

an attachment listing the location/jurisdiction codes for received permission from the Department to collect all

each jurisdiction for which the lessor will be collecting applicable state and state-administered local sales taxes

sales tax. See Location/Jurisdiction Codes for Sales Tax on all payments made by the lessee pursuant to the lease.

Filing (DR 0800), available online at Colorado.gov/tax, Any lessor filing this form must check the applicable boxes

for a complete list of location/jurisdiction codes. below to indicate whether the lessor will enter into lease

By filing this form the lessor affirms and acknowledges the agreements for terms of 36 months or less and, if so,

lessor's liability to collect state and state-administered sales whether the lessor is requesting permission to collect all

taxes, to file periodic returns to report the correct amount state and state-administered sales taxes on such leases.

of tax, and to remit all taxes with the filing of such returns. The permission to collect sales tax on lease payments, if

This form must be signed by an officer or representative granted by the Department, obligates the lessor to collect

duly authorized to act on the lessor's behalf. sales tax on all leases made by the lessor for terms of 36

months or less.

Additional resources

For additional information, see Colorado.gov/Tax and

Department publications Sales & Use Tax Topics: Leases

and Sales & Use Tax Topics: Motor Vehicles.

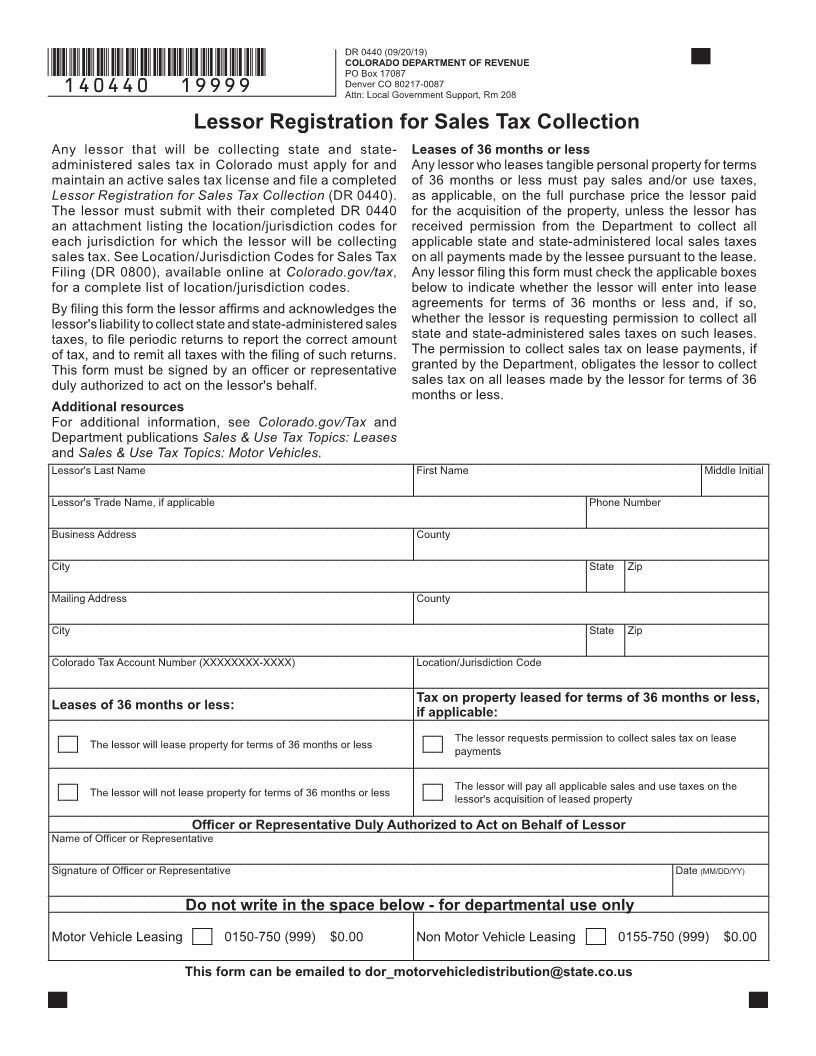

Lessor's Last Name First Name Middle Initial

Lessor's Trade Name, if applicable Phone Number

Business Address County

City State Zip

Mailing Address County

City State Zip

Colorado Tax Account Number (XXXXXXXX-XXXX) Location/Jurisdiction Code

Tax on property leased for terms of 36 months or less,

Leases of 36 months or less:

if applicable:

The lessor requests permission to collect sales tax on lease

The lessor will lease property for terms of 36 months or less

payments

The lessor will not lease property for terms of 36 months or less The lessor will pay all applicable sales and use taxes on the

lessor's acquisition of leased property

Officer or Representative Duly Authorized to Act on Behalf of Lessor

Name of Officer or Representative

Signature of Officer or Representative Date (MM/DD/YY)

Do not write in the space below - for departmental use only

Motor Vehicle Leasing 0150-750 (999) $0.00 Non Motor Vehicle Leasing 0155-750 (999) $0.00

This form can be emailed to dor_motorvehicledistribution@state.co.us