Enlarge image

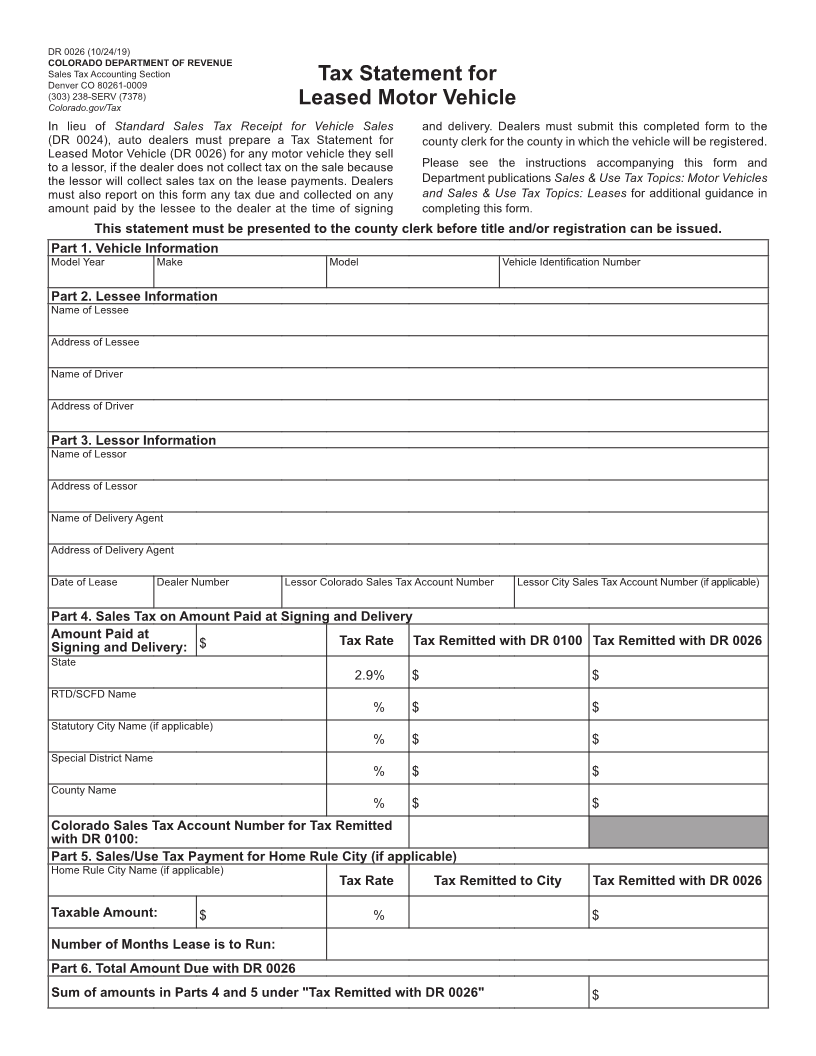

DR 0026 (10/24/19)

COLORADO DEPARTMENT OF REVENUE

Sales Tax Accounting Section

Denver CO 80261-0009 Tax Statement for

(303) 238-SERV (7378)

Colorado.gov/Tax Leased Motor Vehicle

In lieu of Standard Sales Tax Receipt for Vehicle Sales and delivery. Dealers must submit this completed form to the

(DR 0024), auto dealers must prepare a Tax Statement for county clerk for the county in which the vehicle will be registered.

Leased Motor Vehicle (DR 0026) for any motor vehicle they sell

to a lessor, if the dealer does not collect tax on the sale because Please see the instructions accompanying this form and

the lessor will collect sales tax on the lease payments. Dealers Department publications Sales & Use Tax Topics: Motor Vehicles

must also report on this form any tax due and collected on any and Sales & Use Tax Topics: Leases for additional guidance in

amount paid by the lessee to the dealer at the time of signing completing this form.

This statement must be presented to the county clerk before title and/or registration can be issued.

Part 1. Vehicle Information

Model Year Make Model Vehicle Identification Number

Part 2. Lessee Information

Name of Lessee

Address of Lessee

Name of Driver

Address of Driver

Part 3. Lessor Information

Name of Lessor

Address of Lessor

Name of Delivery Agent

Address of Delivery Agent

Date of Lease Dealer Number Lessor Colorado Sales Tax Account Number Lessor City Sales Tax Account Number (if applicable)

Part 4. Sales Tax on Amount Paid at Signing and Delivery

Amount Paid at

Signing and Delivery: $ Tax Rate Tax Remitted with DR 0100 Tax Remitted with DR 0026

State

2.9% $ $

RTD/SCFD Name

% $ $

Statutory City Name (if applicable)

% $ $

Special District Name

% $ $

County Name

% $ $

Colorado Sales Tax Account Number for Tax Remitted

with DR 0100:

Part 5. Sales/Use Tax Payment for Home Rule City (if applicable)

Home Rule City Name (if applicable)

Tax Rate Tax Remitted to City Tax Remitted with DR 0026

Taxable Amount: $ % $

Number of Months Lease is to Run:

Part 6. Total Amount Due with DR 0026

Sum of amounts in Parts 4 and 5 under "Tax Remitted with DR 0026" $