Enlarge image

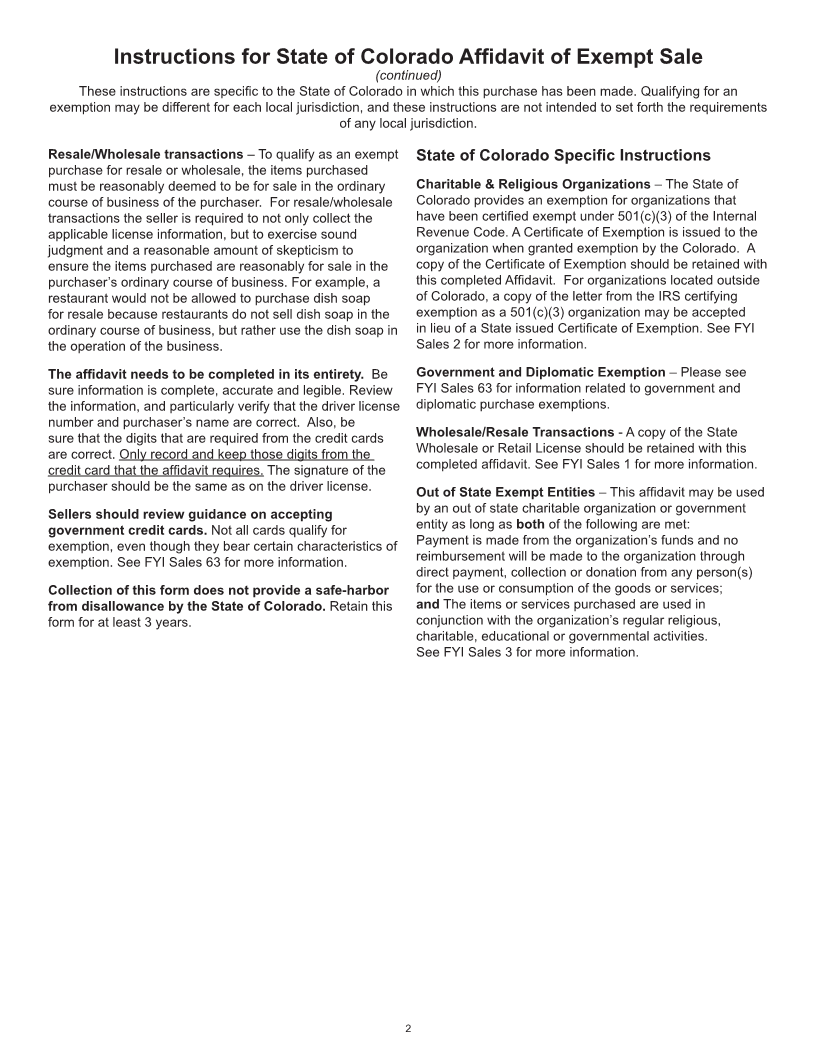

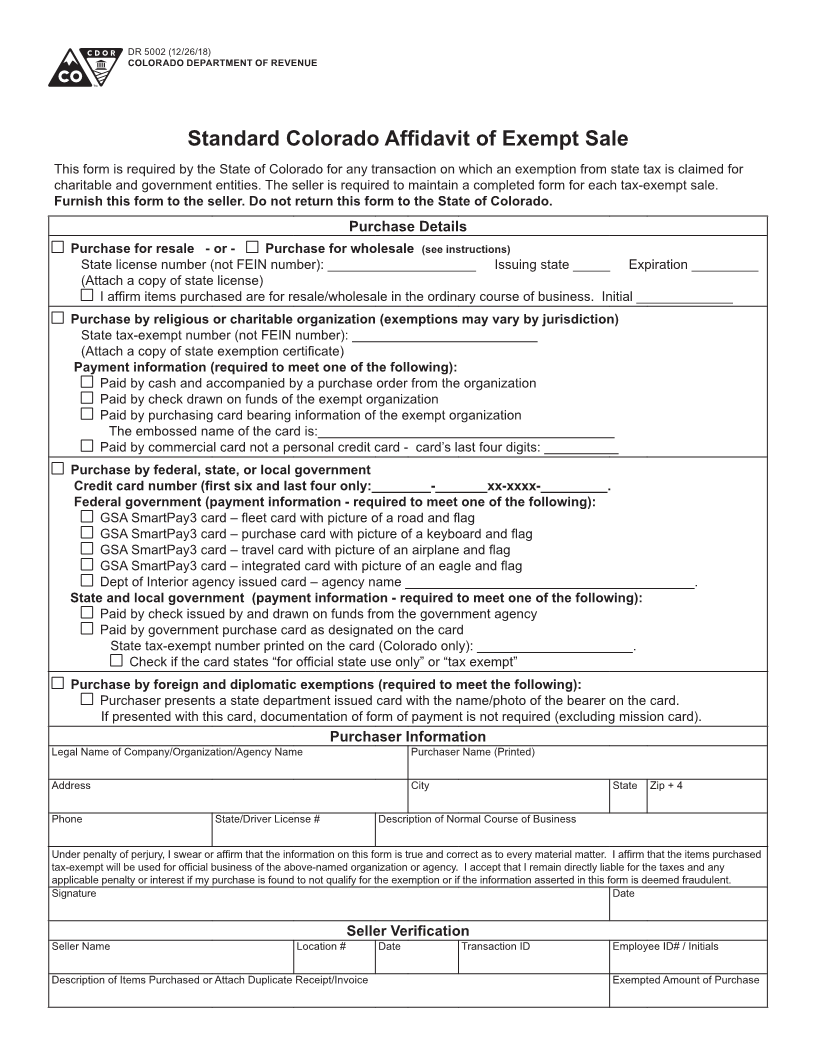

DR 5002 (12/26/18)

COLORADO DEPARTMENT OF REVENUE

Instructions for State of Colorado Affidavit of Exempt Sale

These instructions are specific to the State of Colorado in which this purchase has been made. Qualifying for an

exemption may be different for each local jurisdiction, and these instructions are not intended to set forth the requirements

of any local jurisdiction.

General Instructions

Purchaser Instructions

Purpose of Form

This form is used to certify to sellers that a purchase Purchase details. Identify the accurate qualified exemption

qualifies for exemption under Title 39, Article 26 of the reason and complete the required information for that

Colorado Revised Statutes. exemption.

For Sellers, accepting and keeping this document helps Purchaser information. Print the legal name of the

you get correct information about the purchaser, which organization or agency. Governmental agencies should

helps you prove this is an exempt sale during a tax audit. include both the name of the government and the

department or agency, for example, US Department of

For Purchasers, completing this document and giving it to

Transportation, Colorado Department of Education, or

a seller helps to speed up your purchase process.

Adams County Human Services. Abbreviations such as

_______________________________________________

“Dept.” are acceptable but do not use acronyms. List the

Reminders organization’s or agency’s mailing address, municipality,

Furnish to seller. This form should be furnished to the state, and zip code.

seller charging the tax. Do not send this form to the State

of Colorado. This form is not for organizations to request Declaration of affiant. The individual making the purchase

certification of their tax exempt status. on behalf of the exempt organization or agency (the affiant)

must complete the declaration.

Direct payment required. Purchases must be billed to and

paid directly by the funds of the organization or agency in

order to qualify for exemption. Payment in cash (without Separate form required. A separate affidavit is required

for each transaction. For ease of use, Purchase Details and

a purchase order) or by personal check or personal credit

Purchaser Information may be completed in advance and

card disqualifies a purchase from exemption even if the

the partially completed form kept on file by the purchaser

purchaser is subsequently reimbursed. Purchases made

for completion at time of each transaction.

on credit cards issued by the organization, but where the

cardholder receives and pays the bill and is subsequently

reimbursed, also do not qualify for exemption. Signature. You are swearing, under penalty of perjury,

to the accuracy of the statements made in this affidavit.

Reimbursement disqualifies exemption. If the

Carefully read and ensure that you understand each item

organization or agency will be reimbursed, in whole or

before signing this affidavit. After reviewing the form for

in part, the purchase is disqualified from exemption. For

accuracy, sign and date the form. Furnish this form to the

example, the purchase of food for a banquet for which the

seller. Do not send a copy to the State of Colorado.

organization sells tickets as a fundraiser would not qualify

for exemption.

Seller Instructions

Disputed tax must be collected. If there is a dispute

between the purchaser and the seller as to whether Sellers have the burden of proving that a transaction

tax applies, the seller that collects the tax must give was properly exempted. If an exemption is subsequently

the purchaser a receipt showing the tax collected. The disallowed by the State of Colorado, you (the seller) could

purchaser may apply to the applicable municipality directly be liable for the tax plus penalties and interest. This form

for a refund by filing a Claim for Refund form along with the is provided to help you determine if a sale qualifies for

appropriate documentation. exemption. The sale is not exempt from taxes simply

because this affidavit is completed. The responsibility

Signature required. The individual making the purchase for proper collection of taxes remains with the seller. You

must sign and date the form at the bottom. A separate are encouraged to obtain this form for each transaction

affidavit is required for each transaction. General purchaser and complete all of the information in the lower Seller

or store information may be completed in advance and kept Verification section.

on file by the seller or purchaser for ease of use.

(continued on next page)

1