Enlarge image

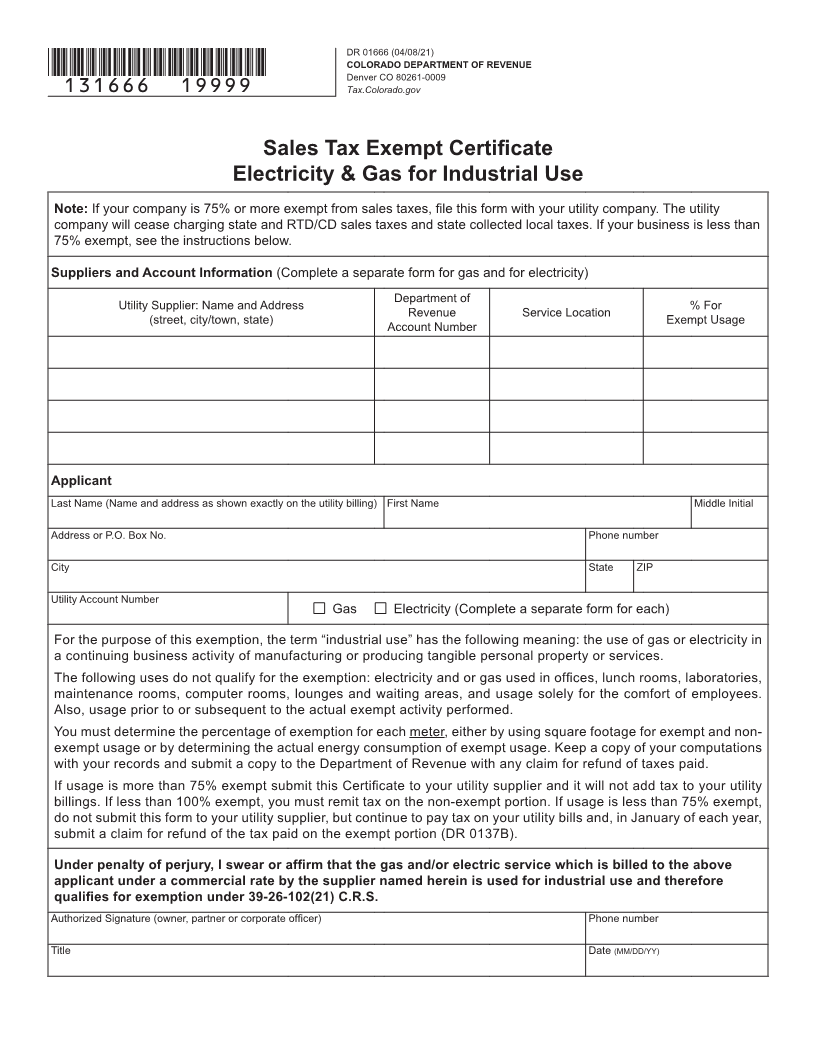

DR 01666 (04/08/21)

COLORADO DEPARTMENT OF REVENUE

*131666==19999* Denver CO 80261-0009

Tax.Colorado.gov

Sales Tax Exempt Certificate

Electricity & Gas for Industrial Use

Note: If your company is 75% or more exempt from sales taxes, file this form with your utility company. The utility

company will cease charging state and RTD/CD sales taxes and state collected local taxes. If your business is less than

75% exempt, see the instructions below.

Suppliers and Account Information (Complete a separate form for gas and for electricity)

Department of

Utility Supplier: Name and Address % For

Revenue Service Location

(street, city/town, state) Exempt Usage

Account Number

Applicant

Last Name (Name and address as shown exactly on the utility billing) First Name Middle Initial

Address or P.O. Box No. Phone number

City State ZIP

Utility Account Number

Gas Electricity (Complete a separate form for each)

For the purpose of this exemption, the term “industrial use” has the following meaning: the use of gas or electricity in

a continuing business activity of manufacturing or producing tangible personal property or services.

The following uses do not qualify for the exemption: electricity and or gas used in offices, lunch rooms, laboratories,

maintenance rooms, computer rooms, lounges and waiting areas, and usage solely for the comfort of employees.

Also, usage prior to or subsequent to the actual exempt activity performed.

You must determine the percentage of exemption for each meter, either by using square footage for exempt and non-

exempt usage or by determining the actual energy consumption of exempt usage. Keep a copy of your computations

with your records and submit a copy to the Department of Revenue with any claim for refund of taxes paid.

If usage is more than 75% exempt submit this Certificate to your utility supplier and it will not add tax to your utility

billings. If less than 100% exempt, you must remit tax on the non-exempt portion. If usage is less than 75% exempt,

do not submit this form to your utility supplier, but continue to pay tax on your utility bills and, in January of each year,

submit a claim for refund of the tax paid on the exempt portion (DR 0137B).

Under penalty of perjury, I swear or affirm that the gas and/or electric service which is billed to the above

applicant under a commercial rate by the supplier named herein is used for industrial use and therefore

qualifies for exemption under 39-26-102(21) C.R.S.

Authorized Signature (owner, partner or corporate officer) Phone number

Title Date (MM/DD/YY)