Enlarge image

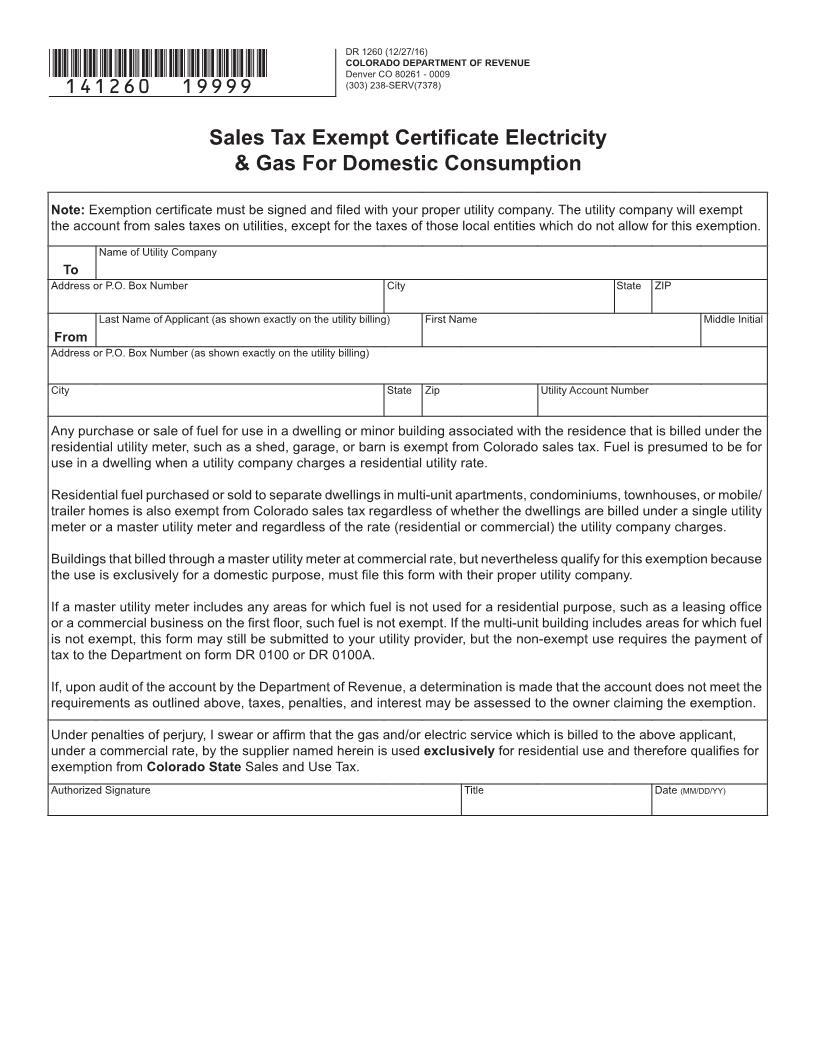

DR 1260 (12/27/16)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261 - 0009

*141260==19999* (303) 238-SERV(7378)

Sales Tax Exempt Certificate Electricity

& Gas For Domestic Consumption

Note: Exemption certificate must be signed and filed with your proper utility company. The utility company will exempt

the account from sales taxes on utilities, except for the taxes of those local entities which do not allow for this exemption.

Name of Utility Company

To

Address or P.O. Box Number City State ZIP

Last Name of Applicant (as shown exactly on the utility billing) First Name Middle Initial

From

Address or P.O. Box Number (as shown exactly on the utility billing)

City State Zip Utility Account Number

Any purchase or sale of fuel for use in a dwelling or minor building associated with the residence that is billed under the

residential utility meter, such as a shed, garage, or barn is exempt from Colorado sales tax. Fuel is presumed to be for

use in a dwelling when a utility company charges a residential utility rate.

Residential fuel purchased or sold to separate dwellings in multi-unit apartments, condominiums, townhouses, or mobile/

trailer homes is also exempt from Colorado sales tax regardless of whether the dwellings are billed under a single utility

meter or a master utility meter and regardless of the rate (residential or commercial) the utility company charges.

Buildings that billed through a master utility meter at commercial rate, but nevertheless qualify for this exemption because

the use is exclusively for a domestic purpose, must file this form with their proper utility company.

If a master utility meter includes any areas for which fuel is not used for a residential purpose, such as a leasing office

or a commercial business on the first floor, such fuel is not exempt. If the multi-unit building includes areas for which fuel

is not exempt, this form may still be submitted to your utility provider, but the non-exempt use requires the payment of

tax to the Department on form DR 0100 or DR 0100A.

If, upon audit of the account by the Department of Revenue, a determination is made that the account does not meet the

requirements as outlined above, taxes, penalties, and interest may be assessed to the owner claiming the exemption.

Under penalties of perjury, I swear or affirm that the gas and/or electric service which is billed to the above applicant,

under a commercial rate, by the supplier named herein is used exclusively for residential use and therefore qualifies for

exemption from Colorado State Sales and Use Tax.

Authorized Signature Title Date (MM/DD/YY)