Enlarge image

DR 1191 (10/26/17)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0009

*DO=NOT=SEND* Colorado.gov/Tax

DR 1191 Instructions

General Information

Purchases of machinery or machine tools and parts Local Taxes

thereof are exempt from state sales and use tax Cities, counties and special districts may or may not

when the machinery will be used in manufacturing. exempt manufacturing equipment from local sales taxes.

39-26-709(1)(g), C.R.S. Refer to publication DR 1002 for a list of localities that

To qualify the machinery must be: exempt this equipment from local tax.

Used in Colorado,

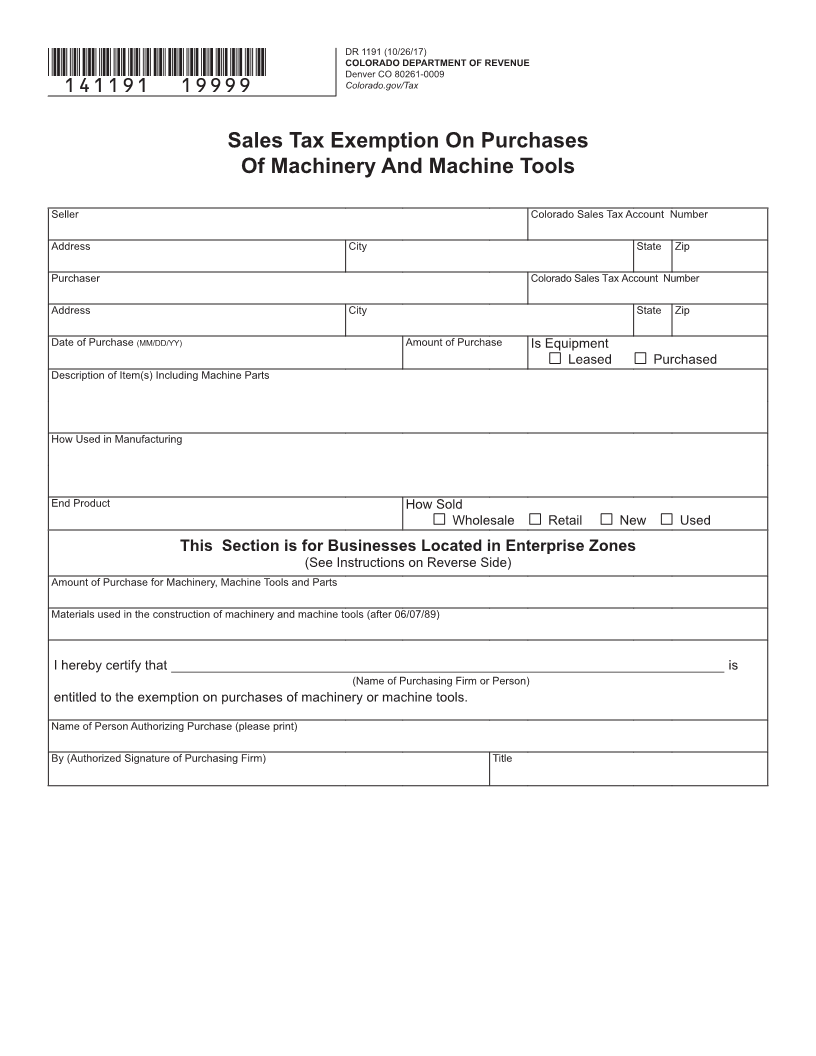

Claiming The Exemption

Used directly and predominantly to manufacture

tangible personal property for sale or profit. Complete the DR 1191, Sales Tax Exemption on Purchases of

Machinery and Machine Tools. Give one copy of the completed

Of a nature that would have qualified for the federal form to the seller of the machinery and a second copy to the

investment tax credit under the definition of section Department of Revenue. The purchaser must also keep a copy.

38 property found in the Internal Revenue Code of An exemption cannot be claimed for sales tax paid in another

1954, as amended. This includes tangible personal state which is credited against Colorado sales or use tax.

property with a useful life of one year or more and limits

qualifying purchases of used equipment to a maximum For further information regarding the manufacturing

of $150,000 annually, exemption, see FYI Sales 10 available on our

Included on a purchase order or invoice totaling more Taxation Web site at Colorado.gov/Tax , or call

than $500, (303) 238-SERV (7378).

Capitalized.

Enterprise Zones

The manufacturing exemption is expanded to exempt additional

purchases from sales and use tax when machinery is used

solely and exclusively in an enterprise zone. Equipment that is

used both within and outside an enterprise zone only qualifies

for the regular statewide exemption, as is equipment used at a

location prior to that location’s designation as an enterprise zone.

[C.R.S. 39-30-106(1)]

Machinery used solely and exclusively in a designated

enterprise zone may be capitalized or expensed to

qualify for the exemption.

Materials for construction or repair of machinery or

machine tools are exempt from the state sales and

use tax if the machinery is used exclusively in an

enterprise zone.

Mining operations are included in the definition of

manufacturing when performed in an enterprise zone.

For further information, see FYI Sales 69, “Enterprise

Zone Exemption for Machinery and Machine Tools Used

in Mining.”