Enlarge image

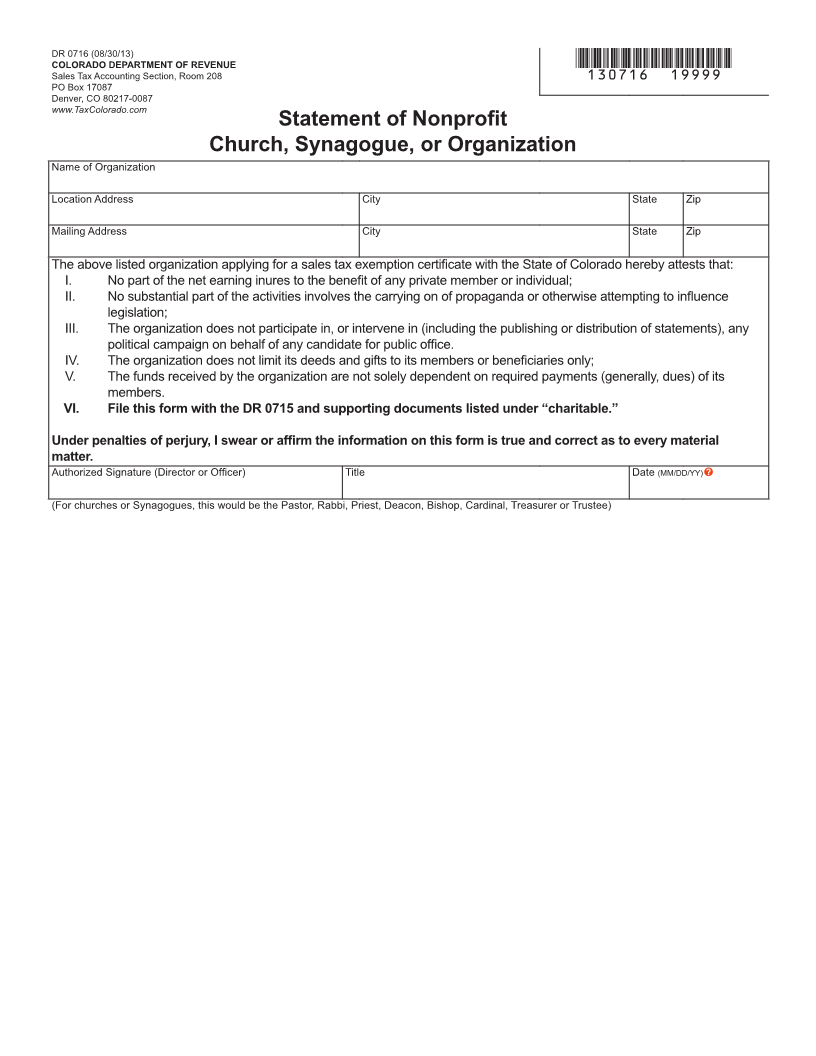

DR 0716 (08/30/13)

COLORADO DEPARTMENT OF REVENUE *130716==19999*

Sales Tax Accounting Section, Room 208

PO Box 17087

Denver, CO 80217-0087

www.TaxColorado.com

Statement of Nonprofit

Church, Synagogue, or Organization

Name of Organization

Location Address City State Zip

Mailing Address City State Zip

The above listed organization applying for a sales tax exemption certificate with the State of Colorado hereby attests that:

I. No part of the net earning inures to the benefit of any private member or individual;

II. No substantial part of the activities involves the carrying on of propaganda or otherwise attempting to influence

legislation;

III. The organization does not participate in, or intervene in (including the publishing or distribution of statements), any

political campaign on behalf of any candidate for public office.

IV. The organization does not limit its deeds and gifts to its members or beneficiaries only;

V. The funds received by the organization are not solely dependent on required payments (generally, dues) of its

members.

VI. File this form with the DR 0715 and supporting documents listed under “charitable.”

Under penalties of perjury, I swear or affirm the information on this form is true and correct as to every material

matter.

Authorized Signature (Director or Officer) Title Date (MM/DD/YY)

(For churches or Synagogues, this would be the Pastor, Rabbi, Priest, Deacon, Bishop, Cardinal, Treasurer or Trustee)