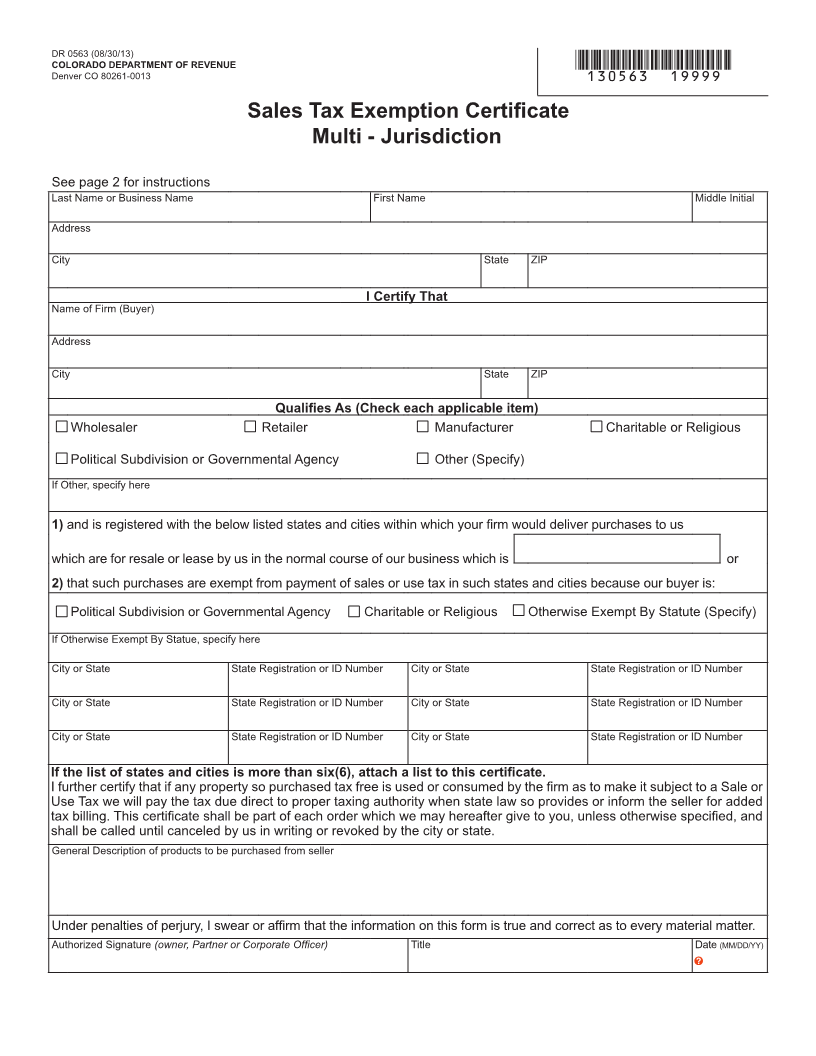

Enlarge image

DR 0563 (08/30/13)

COLORADO DEPARTMENT OF REVENUE *130563==19999*

Denver CO 80261-0013

Sales Tax Exemption Certificate

Multi - Jurisdiction

See page 2 for instructions

Last Name or Business Name First Name Middle Initial

Address

City State ZIP

I Certify That

Name of Firm (Buyer)

Address

City State ZIP

Qualifies As (Check each applicable item)

Wholesaler Retailer Manufacturer Charitable or Religious

and is registered with the below listed states and cities within which your firm would deliver purchases to us 1)

Political Subdivision or Governmental Agency Other (Specify)

Which areIf Other,for resalespecify hereor lease by us in the normal course of our business which is _________________________or

that such purchases are exempt from payment of sales or use tax in such states and cities because our buyer is:2)

1) and is registered with the below listed states and cities within which your firm would deliver purchases to us

which are for resale or lease by us in the normal course of our business which is or

2) that such purchases are exempt from payment of sales or use tax in such states and cities because our buyer is:

Political Subdivision or Governmental Agency Charitable or Religious Otherwise Exempt By Statute (Specify)

If Otherwise Exempt By Statue, specify here

City or State State Registration or ID Number City or State State Registration or ID Number

City or State State Registration or ID Number City or State State Registration or ID Number

City or State State Registration or ID Number City or State State Registration or ID Number

If the list of states and cities is more than six(6), attach a list to this certificate.

I further certify that if any property so purchased tax free is used or consumed by the firm as to make it subject to a Sale or

Use Tax we will pay the tax due direct to proper taxing authority when state law so provides or inform the seller for added

tax billing. This certificate shall be part of each order which we may hereafter give to you, unless otherwise specified, and

shall be called until canceled by us in writing or revoked by the city or state.

General Description of products to be purchased from seller

Under penalties of perjury, I swear or affirm that the information on this form is true and correct as to every material matter.

Authorized Signature (owner, Partner or Corporate Officer) Title Date (MM/DD/YY)