Enlarge image

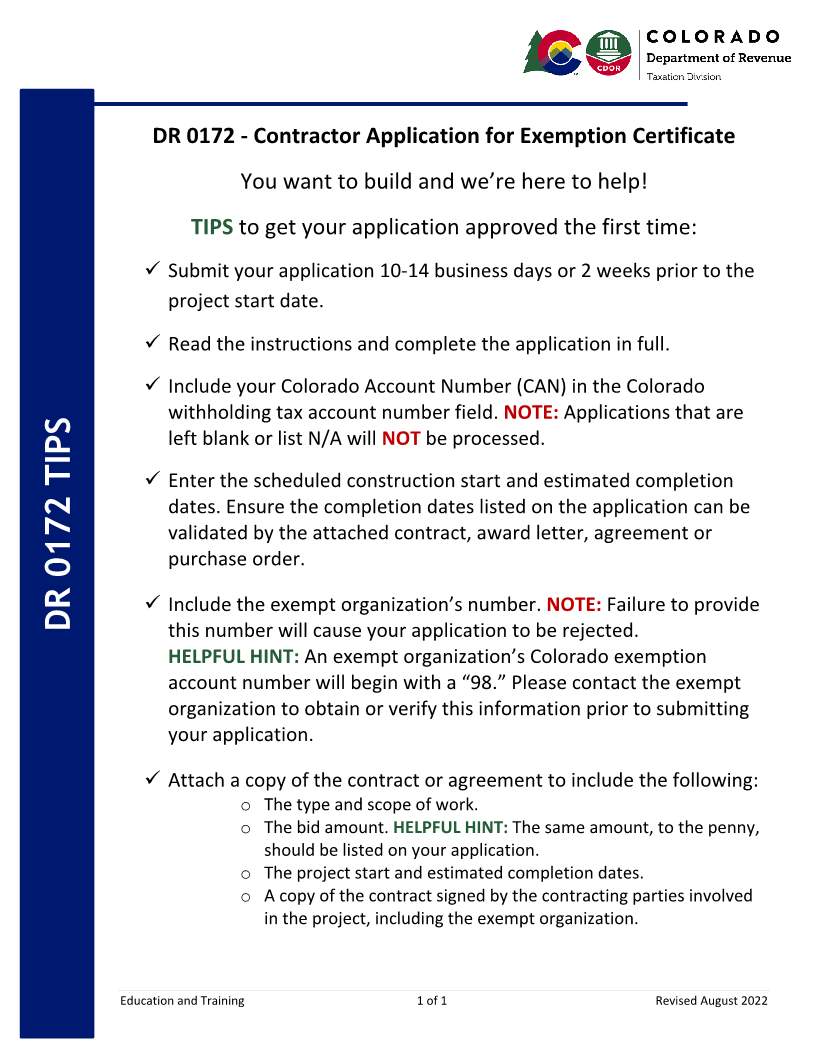

DR 0172 - Contractor Application for Exemption Certificate You want to build and we’re here to help! TIPS to get your application approved the first time: ✓ Submit your application 10-14 business days or 2 weeks prior to the project start date. ✓ Read the instructions and complete the application in full. ✓ Include your Colorado Account Number (CAN) in the Colorado withholding tax account number field. NOTE: Applications that are left blank or list N/A will NOT be processed. ✓ Enter the scheduled construction start and estimated completion dates. Ensure the completion dates listed on the application can be validated by the attached contract, award letter, agreement or purchase order. ✓ Include the exempt organization’s number. NOTE: Failure to provide DR 0172 TIPS this number will cause your application to be rejected. HELPFUL HINT: An exempt organization’s Colorado exemption account number will begin with a “98 ”. Please contact the exempt organization to obtain or verify this information prior to submitting your application. ✓ Attach a copy of the contract or agreement to include the following: o The type and scope of work. o The bid amount. HELPFUL HINT: The same amount, to the penny, should be listed on your application. o The project start and estimated completion dates. o A copy of the contract signed by the contracting parties involved in the project, including the exempt organization. Education and Training 1 of 1 Revised August 2022