Enlarge image

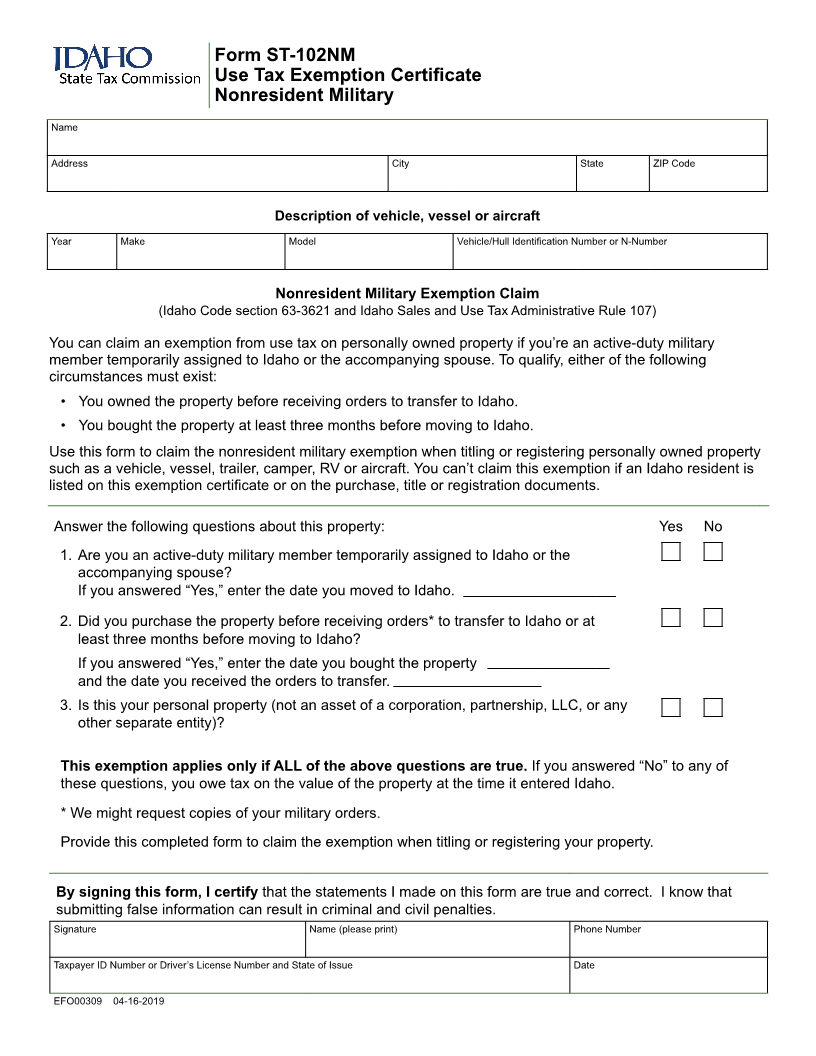

Form ST-102NM

Use Tax Exemption Certificate

Nonresident Military

Name

Address City State ZIP Code

Description of vehicle, vessel or aircraft

Year Make Model Vehicle/Hull Identification Number or N-Number

Nonresident Military Exemption Claim

(Idaho Code section 63-3621 and Idaho Sales and Use Tax Administrative Rule 107)

You can claim an exemption from use tax on personally owned property if you’re an active-duty military

member temporarily assigned to Idaho or the accompanying spouse. To qualify, either of the following

circumstances must exist:

• You owned the property before receiving orders to transfer to Idaho.

• You bought the property at least three months before moving to Idaho.

Use this form to claim the nonresident military exemption when titling or registering personally owned property

such as a vehicle, vessel, trailer, camper, RV or aircraft. You can’t claim this exemption if an Idaho resident is

listed on this exemption certificate or on the purchase, title or registration documents.

Answer the following questions about this property: Yes No

1. Are you an active-duty military member temporarily assigned to Idaho or the

accompanying spouse?

If you answered “Yes,” enter the date you moved to Idaho.

2. Did you purchase the property before receiving orders* to transfer to Idaho or at

least three months before moving to Idaho?

If you answered “Yes,” enter the date you bought the property

and the date you received the orders to transfer.

3. Is this your personal property (not an asset of a corporation, partnership, LLC, or any

other separate entity)?

This exemption applies only if ALL of the above questions are true. If you answered “No” to any of

these questions, you owe tax on the value of the property at the time it entered Idaho.

* We might request copies of your military orders.

Provide this completed form to claim the exemption when titling or registering your property.

By signing this form, I certify that the statements I made on this form are true and correct. I know that

submitting false information can result in criminal and civil penalties.

Signature Name (please print) Phone Number

Taxpayer ID Number or Driver’s License Number and State of Issue Date

EFO00309 04-16-2019