Enlarge image

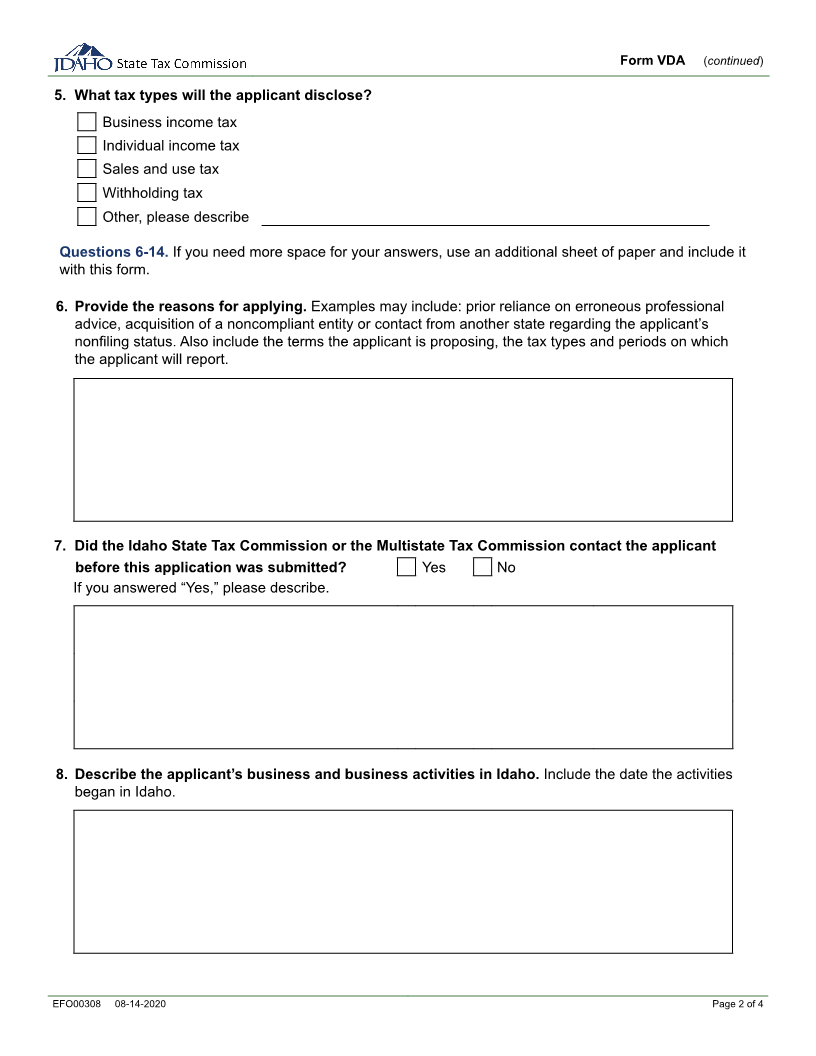

Form VDA

Voluntary Disclosure Agreement Application

Idaho’s Voluntary Disclosure Agreement (VDA) program helps out-of-state businesses involved in multistate

commerce voluntarily report and pay prior taxes.

Benefits of participating

• Possible waiver of some or all penalties.

• Limit the tax due to an agreed-upon look-back period. The look-back period generally is at least three

years but its length will depend on the type of business activities and the taxes in question. Idaho law

requires you to remit to the Tax Commission all taxes you’ve collected from customers or withheld from

employees.

• The look-back period for voluntary disclosure might be shorter than it would be if we discovered your

noncompliance.

Qualifying for voluntary disclosure

To qualify for a voluntary disclosure agreement, your business must:

• Owe more than $500 for the agreed look-back period.

• Not have any business locations in Idaho during the look-back period.

• Not be under current review by the Idaho State Tax Commission or the Multistate Tax Commission (MTC).

Your business agrees to:

1. Register for all applicable permits.

2. File returns or schedules specified in the agreement.

3. Pay the tax due plus accrued interest for the look-back period.

You don’t have to reveal the name of your company or any information that could readily identify it until the

agreement is finalized. For more information about the VDA Program, visit tax.idaho.gov/vda.

Please provide the following information:

1. Primary contact (tax representative or other):

Name

Address

City State ZIP Code

Phone number Email address

2. Business type. Check the box that applies:

C Corporation S Corporation Partnership Sole Proprietor

Nonprofit Limited Liability Company (LLC) - Filing as

3. Pass-through entities. Provide the number of shareholders, members, or partners:

4. What’s the end date of the applicant’s tax year?

EFO00308 08-14-2020 Page 1 of 4