Enlarge image

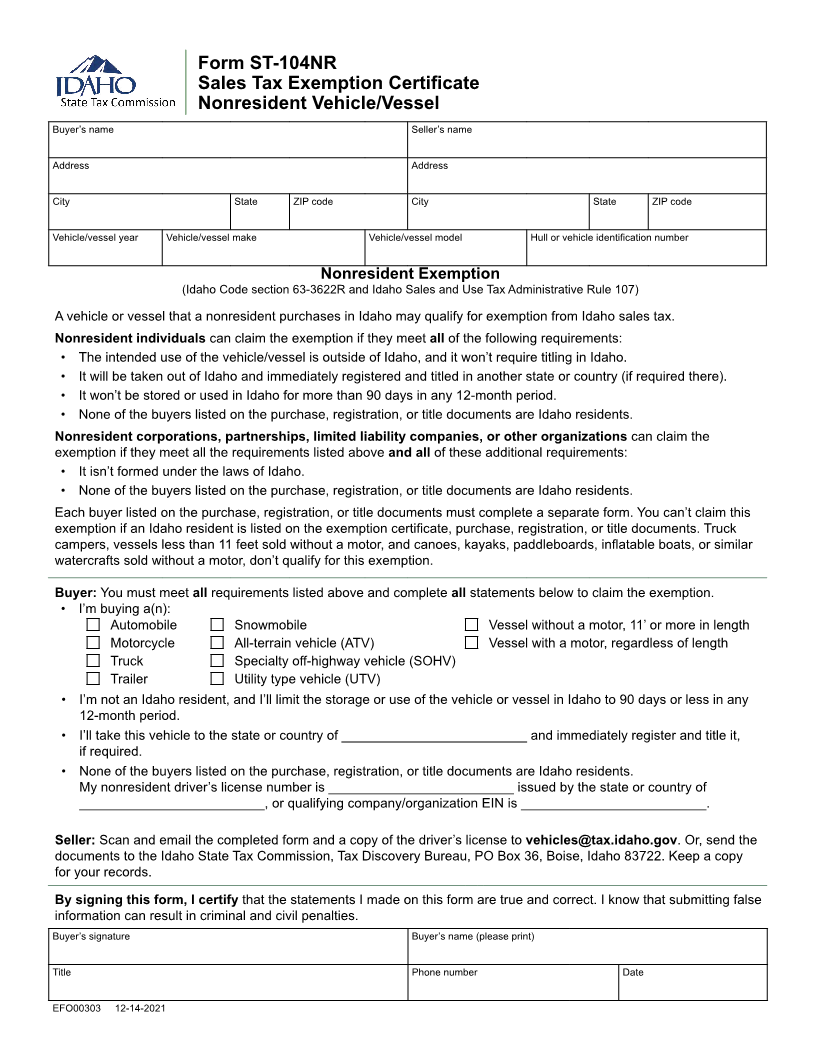

Form ST-104NR

Sales Tax Exemption Certificate

Nonresident Vehicle/Vessel

Buyer’s name Seller’s name

Address Address

City State ZIP code City State ZIP code

Vehicle/vessel year Vehicle/vessel make Vehicle/vessel model Hull or vehicle identification number

Nonresident Exemption

(Idaho Code section 63-3622R and Idaho Sales and Use Tax Administrative Rule 107)

A vehicle or vessel that a nonresident purchases in Idaho may qualify for exemption from Idaho sales tax.

Nonresident individuals can claim the exemption if they meet all of the following requirements:

• The intended use of the vehicle/vessel is outside of Idaho, and it won’t require titling in Idaho.

• It will be taken out of Idaho and immediately registered and titled in another state or country (if required there).

• It won’t be stored or used in Idaho for more than 90 days in any 12-month period.

• None of the buyers listed on the purchase, registration, or title documents are Idaho residents.

Nonresident corporations, partnerships, limited liability companies, or other organizations can claim the

exemption if they meet all the requirements listed above and all of these additional requirements:

• It isn’t formed under the laws of Idaho.

• None of the buyers listed on the purchase, registration, or title documents are Idaho residents.

Each buyer listed on the purchase, registration, or title documents must complete a separate form. You can’t claim this

exemption if an Idaho resident is listed on the exemption certificate, purchase, registration, or title documents. Truck

campers, vessels less than 11 feet sold without a motor, and canoes, kayaks, paddleboards, inflatable boats, or similar

watercrafts sold without a motor, don’t qualify for this exemption.

Buyer: You must meet all requirements listed above and complete all statements below to claim the exemption.

• I’m buying a(n):

Automobile Snowmobile Vessel without a motor, 11’ or more in length

Motorcycle All-terrain vehicle (ATV) Vessel with a motor, regardless of length

Truck Specialty off-highway vehicle (SOHV)

Trailer Utility type vehicle (UTV)

• I’m not an Idaho resident, and I’ll limit the storage or use of the vehicle or vessel in Idaho to 90 days or less in any

12-month period.

• I’ll take this vehicle to the state or country of _________________________ and immediately register and title it,

if required.

• None of the buyers listed on the purchase, registration, or title documents are Idaho residents.

My nonresident driver’s license number is _________________________ issued by the state or country of

_________________________, or qualifying company/organization EIN is _________________________.

Seller: Scan and email the completed form and a copy of the driver’s license to vehicles@tax.idaho.gov. Or, send the

documents to the Idaho State Tax Commission, Tax Discovery Bureau, PO Box 36, Boise, Idaho 83722. Keep a copy

for your records.

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false

information can result in criminal and civil penalties.

Buyer’s signature Buyer’s name (please print)

Title Phone number Date

EFO00303 12-14-2021