Enlarge image

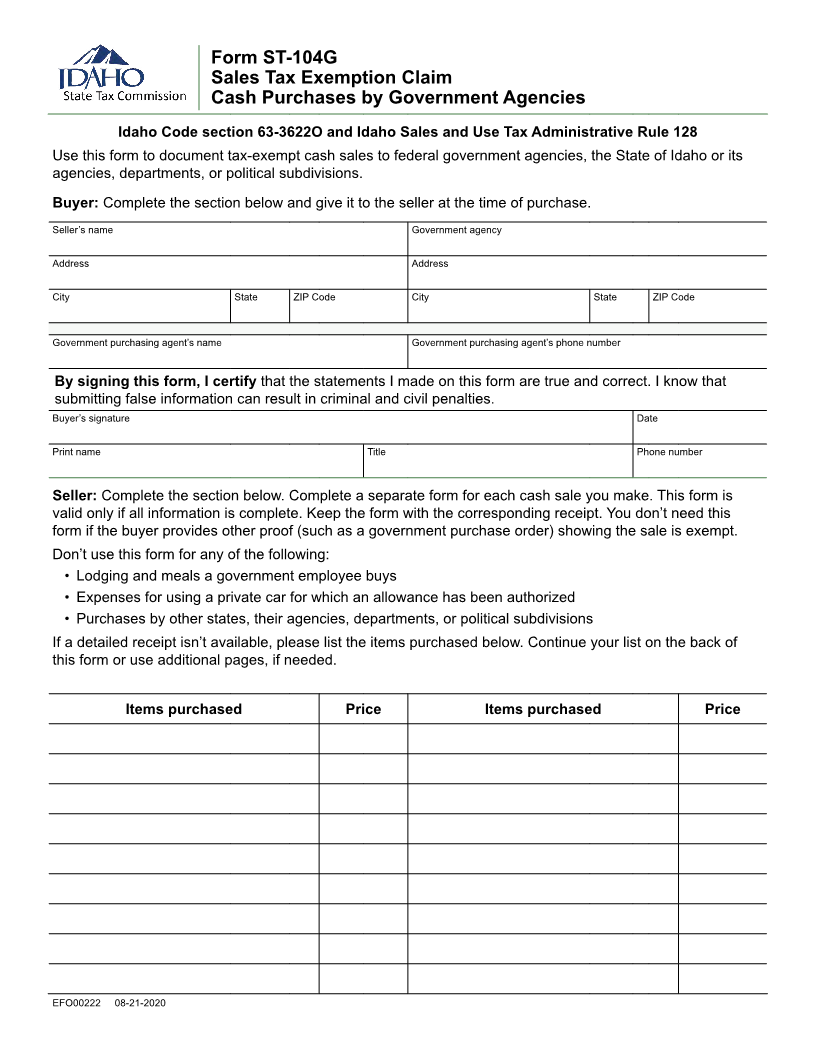

Form ST-104G

Sales Tax Exemption Claim

Cash Purchases by Government Agencies

Idaho Code section 63-3622O and Idaho Sales and Use Tax Administrative Rule 128

Use this form to document tax-exempt cash sales to federal government agencies, the State of Idaho or its

agencies, departments, or political subdivisions.

Buyer: Complete the section below and give it to the seller at the time of purchase.

Seller’s name Government agency

Address Address

City State ZIP Code City State ZIP Code

Government purchasing agent’s name Government purchasing agent’s phone number

By signing this form, I certify that the statements I made on this form are true and correct. I know that

submitting false information can result in criminal and civil penalties.

Buyer’s signature Date

Print name Title Phone number

Seller: Complete the section below. Complete a separate form for each cash sale you make. This form is

valid only if all information is complete. Keep the form with the corresponding receipt. You don’t need this

form if the buyer provides other proof (such as a government purchase order) showing the sale is exempt.

Don’t use this form for any of the following:

• Lodging and meals a government employee buys

• Expenses for using a private car for which an allowance has been authorized

• Purchases by other states, their agencies, departments, or political subdivisions

If a detailed receipt isn’t available, please list the items purchased below. Continue your list on the back of

this form or use additional pages, if needed.

Items purchased Price Items purchased Price

EFO00222 08-21-2020