Enlarge image

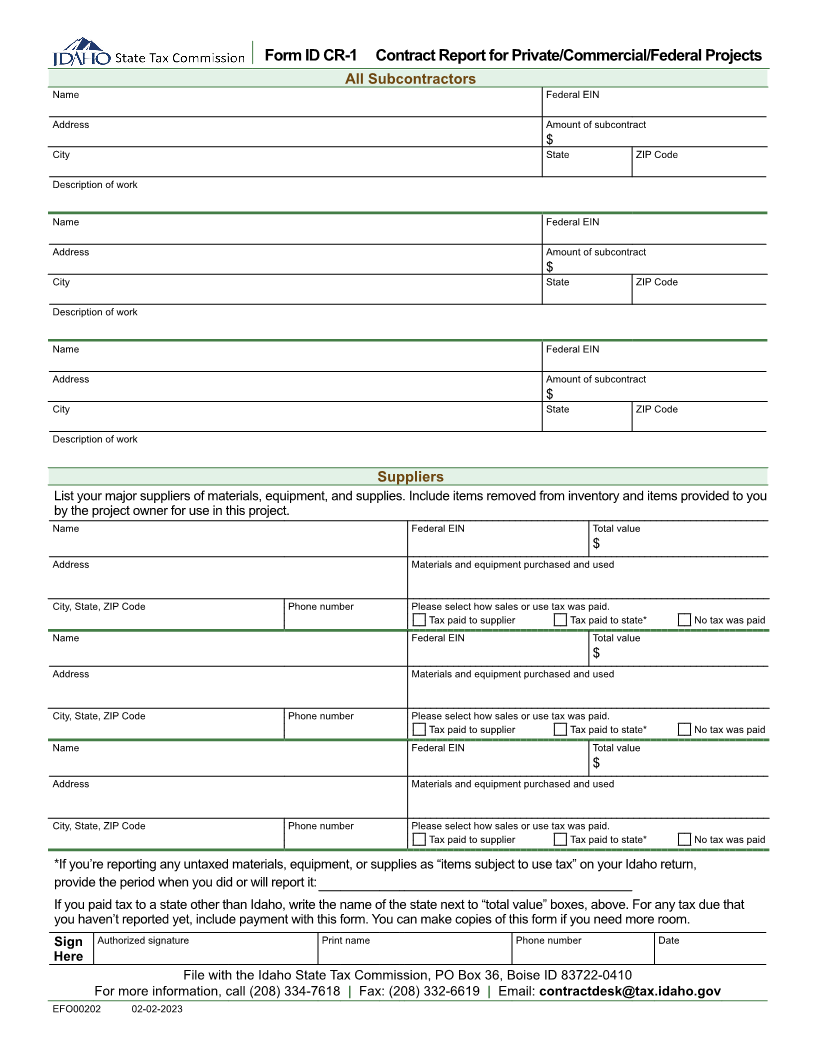

Form ID CR-1 Contract Report for Private/Commercial/Federal Projects

All Subcontractors

Name Federal EIN

Address Amount of subcontract

$

City State ZIP Code

Description of work

Name Federal EIN

Address Amount of subcontract

$

City State ZIP Code

Description of work

Name Federal EIN

Address Amount of subcontract

$

City State ZIP Code

Description of work

Suppliers

List your major suppliers of materials, equipment, and supplies. Include items removed from inventory and items provided to you

by the project owner for use in this project.

Name Federal EIN Total value

$

Address Materials and equipment purchased and used

City, State, ZIP Code Phone number Please select how sales or use tax was paid.

Tax paid to supplier Tax paid to state* No tax was paid

Name Federal EIN Total value

$

Address Materials and equipment purchased and used

City, State, ZIP Code Phone number Please select how sales or use tax was paid.

Tax paid to supplier Tax paid to state* No tax was paid

Name Federal EIN Total value

$

Address Materials and equipment purchased and used

City, State, ZIP Code Phone number Please select how sales or use tax was paid.

Tax paid to supplier Tax paid to state* No tax was paid

*If you’re reporting any untaxed materials, equipment, or supplies as “items subject to use tax” on your Idaho return,

provide the period when you did or will report it:

If you paid tax to a state other than Idaho, write the name of the state next to “total value” boxes, above. For any tax due that

you haven’t reported yet, include payment with this form. You can make copies of this form if you need more room.

Sign Authorized signature Print name Phone number Date

Here

File with the Idaho State Tax Commission, PO Box 36, Boise ID 83722-0410

For more information, call (208) 334-7618 | Fax: (208) 332-6619 | Email: contractdesk@tax.idaho.gov

EFO00202 02-02-2023