Enlarge image

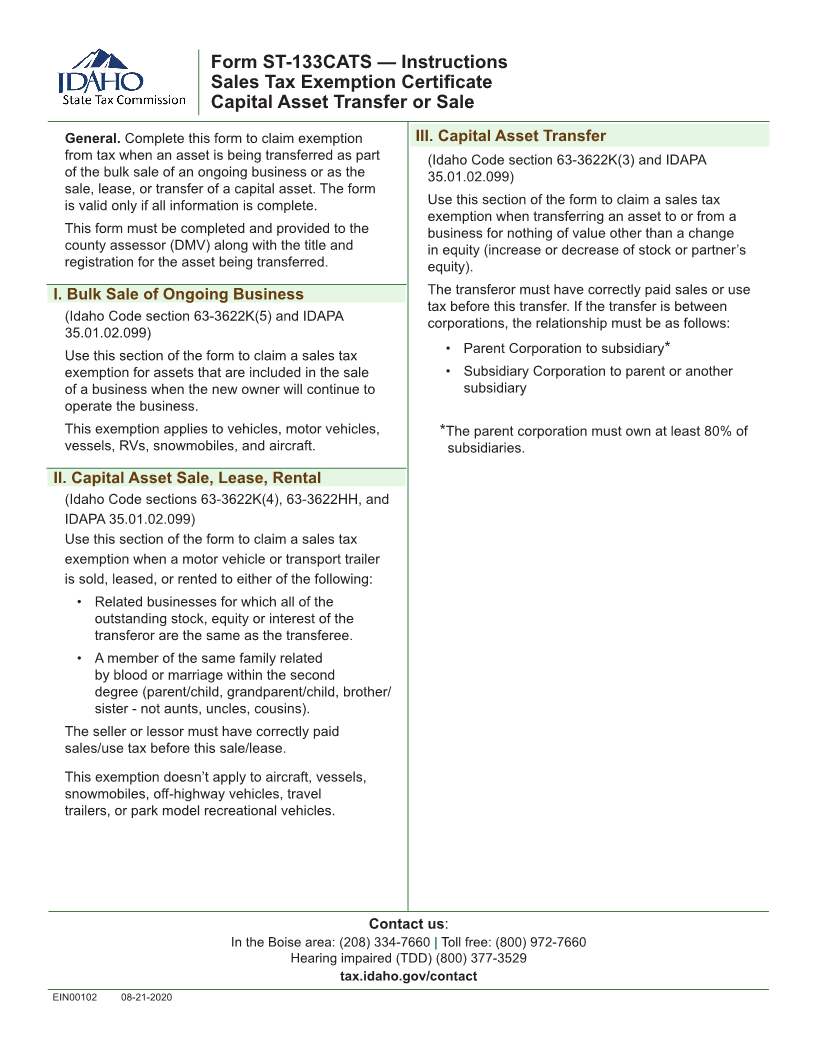

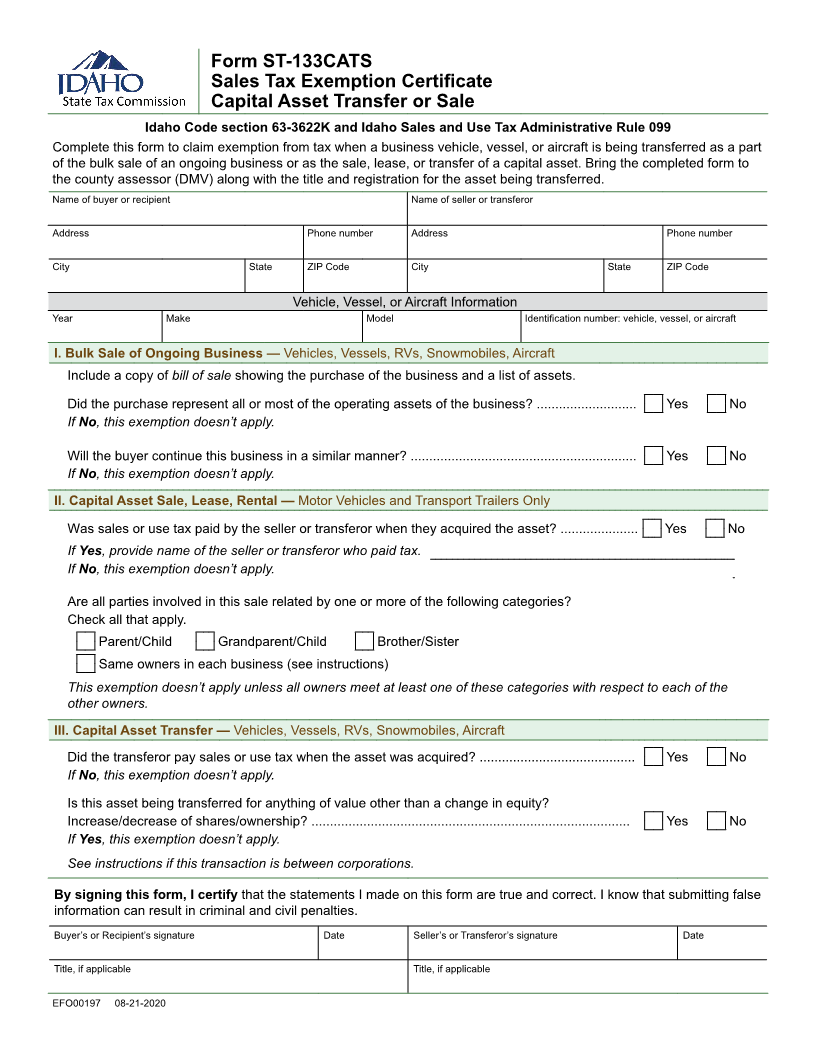

Form ST-133CATS

Sales Tax Exemption Certificate

Capital Asset Transfer or Sale

Idaho Code section 63-3622K and Idaho Sales and Use Tax Administrative Rule 099

Complete this form to claim exemption from tax when a business vehicle, vessel, or aircraft is being transferred as a part

of the bulk sale of an ongoing business or as the sale, lease, or transfer of a capital asset. Bring the completed form to

the county assessor (DMV) along with the title and registration for the asset being transferred.

Name of buyer or recipient Name of seller or transferor

Address Phone number Address Phone number

City State ZIP Code City State ZIP Code

Vehicle, Vessel, or Aircraft Information

Year Make Model Identification number: vehicle, vessel, or aircraft

I. Bulk Sale of Ongoing Business — Vehicles, Vessels, RVs, Snowmobiles, Aircraft

Include a copy of bill of sale showing the purchase of the business and a list of assets.

Did the purchase represent all or most of the operating assets of the business? ........................... Yes No

If No, this exemption doesn’t apply.

Will the buyer continue this business in a similar manner? ............................................................. Yes No

If No, this exemption doesn’t apply.

II. Capital Asset Sale, Lease, Rental — Motor Vehicles and Transport Trailers Only

Was sales or use tax paid by the seller or transferor when they acquired the asset? ..................... Yes No

If Yes, provide name of the seller or transferor who paid tax.

If No, this exemption doesn’t apply.

Are all parties involved in this sale related by one or more of the following categories?

Check all that apply.

Parent/Child Grandparent/Child Brother/Sister

Same owners in each business (see instructions)

This exemption doesn’t apply unless all owners meet at least one of these categories with respect to each of the

other owners.

III. Capital Asset Transfer — Vehicles, Vessels, RVs, Snowmobiles, Aircraft

Did the transferor pay sales or use tax when the asset was acquired? .......................................... Yes No

If No, this exemption doesn’t apply.

Is this asset being transferred for anything of value other than a change in equity?

Increase/decrease of shares/ownership? ...................................................................................... Yes No

If Yes, this exemption doesn’t apply.

See instructions if this transaction is between corporations.

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false

information can result in criminal and civil penalties.

Buyer’s or Recipient’s signature Date Seller’s or Transferor’s signature Date

Title, if applicable Title, if applicable

EFO00197 08-21-2020