Enlarge image

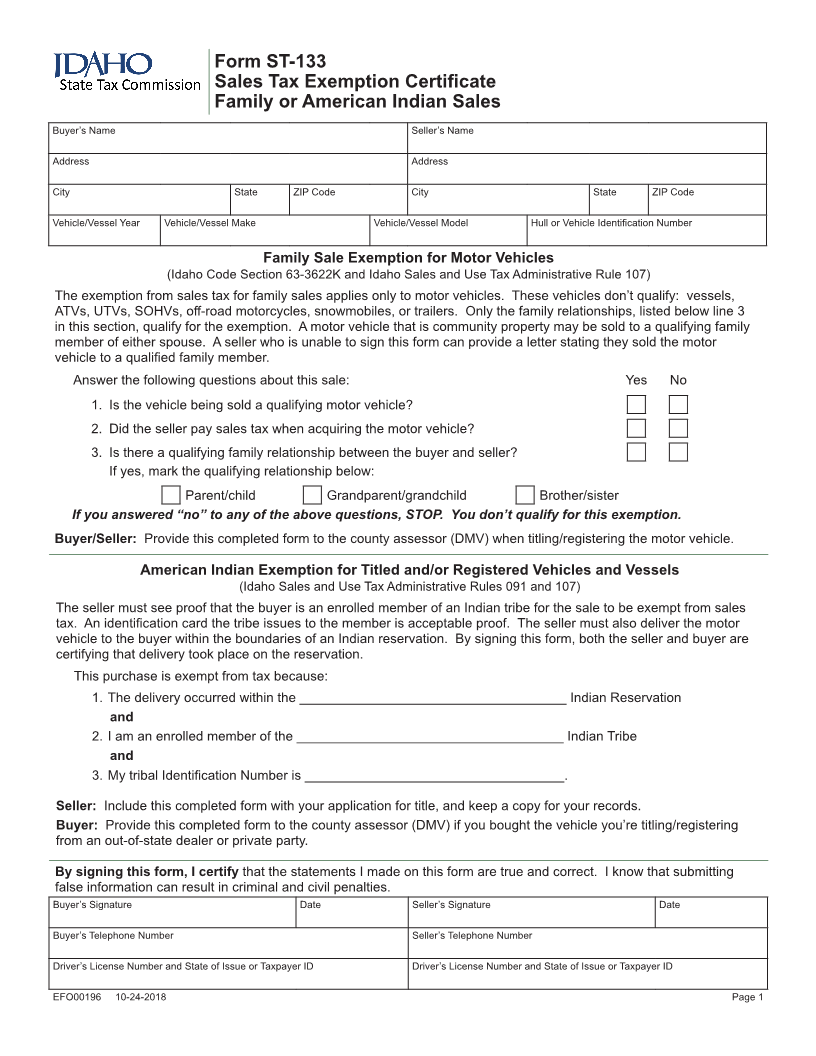

Form ST-133

Sales Tax Exemption Certificate

Family or American Indian Sales

Buyer’s Name Seller’s Name

Address Address

City State ZIP Code City State ZIP Code

Vehicle/Vessel Year Vehicle/Vessel Make Vehicle/Vessel Model Hull or Vehicle Identification Number

Family Sale Exemption for Motor Vehicles

(Idaho Code Section 63-3622K and Idaho Sales and Use Tax Administrative Rule 107)

The exemption from sales tax for family sales applies only to motor vehicles. These vehicles don’t qualify: vessels,

ATVs, UTVs, SOHVs, off-road motorcycles, snowmobiles, or trailers. Only the family relationships, listed below line 3

in this section, qualify for the exemption. A motor vehicle that is community property may be sold to a qualifying family

member of either spouse. A seller who is unable to sign this form can provide a letter stating they sold the motor

vehicle to a qualified family member.

Answer the following questions about this sale: Yes No

1. Is the vehicle being sold a qualifying motor vehicle?

2. Did the seller pay sales tax when acquiring the motor vehicle?

3. Is there a qualifying family relationship between the buyer and seller?

If yes, mark the qualifying relationship below:

Parent/child Grandparent/grandchild Brother/sister

If you answered “no” to any of the above questions, STOP. You don’t qualify for this exemption.

Buyer/Seller: Provide this completed form to the county assessor (DMV) when titling/registering the motor vehicle.

American Indian Exemption for Titled and/or Registered Vehicles and Vessels

(Idaho Sales and Use Tax Administrative Rules 091 and 107)

The seller must see proof that the buyer is an enrolled member of an Indian tribe for the sale to be exempt from sales

tax. An identification card the tribe issues to the member is acceptable proof. The seller must also deliver the motor

vehicle to the buyer within the boundaries of an Indian reservation. By signing this form, both the seller and buyer are

certifying that delivery took place on the reservation.

This purchase is exempt from tax because:

1. The delivery occurred within the ____________________________________ Indian Reservation

and

2. I am an enrolled member of the ____________________________________ Indian Tribe

and

3. My tribal Identification Number is ___________________________________.

Seller: Include this completed form with your application for title, and keep a copy for your records.

Buyer: Provide this completed form to the county assessor (DMV) if you bought the vehicle you’re titling/registering

from an out-of-state dealer or private party.

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting

false information can result in criminal and civil penalties.

Buyer’s Signature Date Seller’s Signature Date

Buyer’s Telephone Number Seller’s Telephone Number

Driver’s License Number and State of Issue or Taxpayer ID Driver’s License Number and State of Issue or Taxpayer ID

EFO00196 10-24-2018 Page 1