Enlarge image

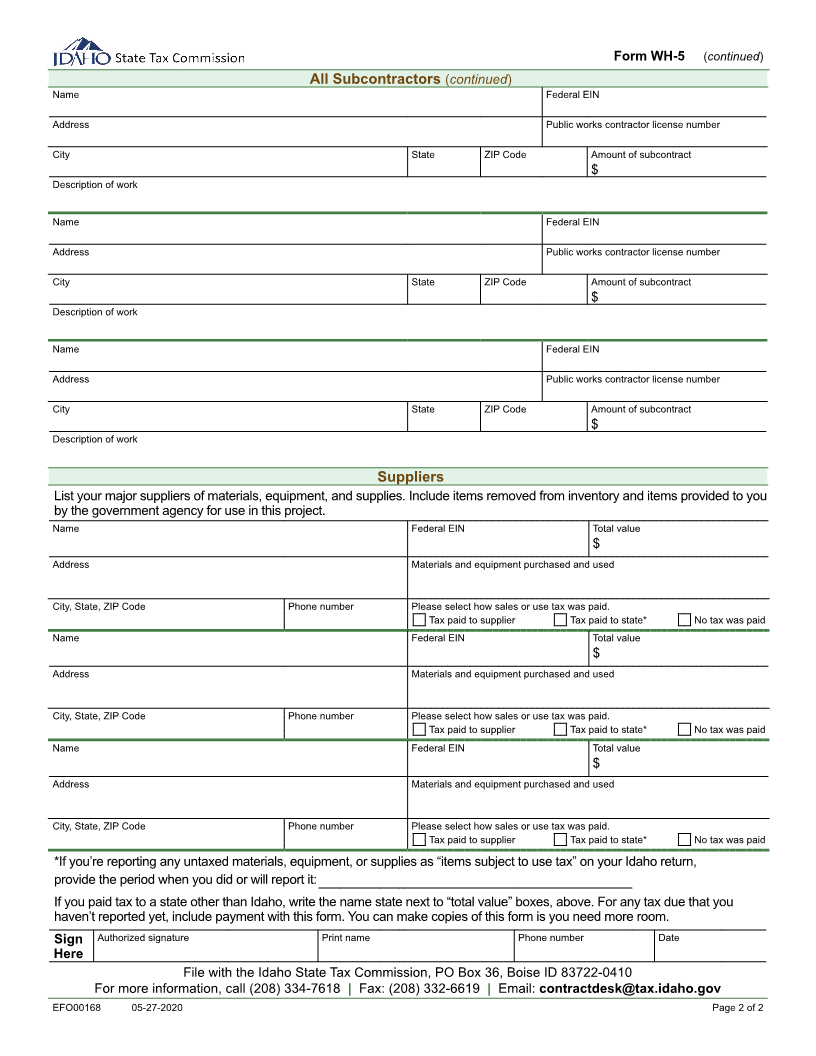

Form WH-5

Public Works Contract Report

Contractors awarded Idaho public works contracts must submit this form to the Tax Commission within 30 days of

receiving the award. (Idaho Code sections 54-1904A and 63-3624(g)).

Contract awarded by (public body and address)

Contract awarded to (contractor’s name and address)

State of incorporation Federal Employer Identification Number (EIN) Date qualified to do business in Idaho

Business operates as Public works contractor license number

Sole Proprietorship Partnership Corporation LLC

Sole proprietor’s Social Security number Idaho sellers permit number Idaho withholding tax permit number

Awarding agency project number Amount of contract

$

Description and location of work to be performed

Project Dates

Scheduled project start date: Completion date:

If the following information isn’t available at this time, please enter date it will be:

All Subcontractors

Name Federal EIN

Address Public works contractor license number

City State ZIP Code Amount of subcontract

$

Description of work

Name Federal EIN

Address Public works contractor license number

City State ZIP Code Amount of subcontract

$

Description of work

Name Federal EIN

Address Public works contractor number

City State ZIP Code Amount of subcontract

$

Description of work

Name Federal EIN

Address Public works contractor license number

City State ZIP Code Amount of subcontract

$

Description of work

EFO00168 05-27-2020 Page 1 of 2