Enlarge image

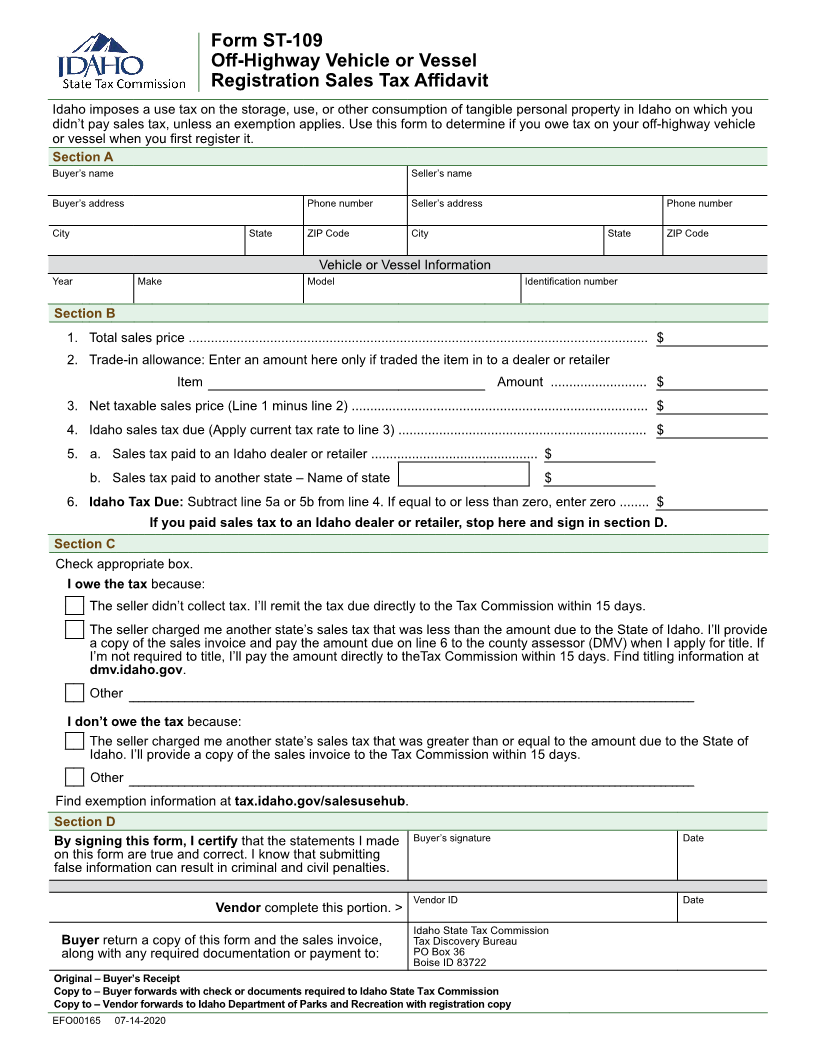

Form ST-109

Off-Highway Vehicle or Vessel

Registration Sales Tax Affidavit

Idaho imposes a use tax on the storage, use, or other consumption of tangible personal property in Idaho on which you

didn’t pay sales tax, unless an exemption applies. Use this form to determine if you owe tax on your off-highway vehicle

or vessel when you first register it.

Section A

Buyer’s name Seller’s name

Buyer’s address Phone number Seller’s address Phone number

City State ZIP Code City State ZIP Code

Vehicle or Vessel Information

Year Make Model Identification number

Section B

1. Total sales price ............................................................................................................................ $

2. Trade-in allowance: Enter an amount here only if traded the item in to a dealer or retailer

Item Amount .......................... $

3. Net taxable sales price (Line 1 minus line 2) ................................................................................ $

4. Idaho sales tax due (Apply current tax rate to line 3) ................................................................... $

5. a. Sales tax paid to an Idaho dealer or retailer ............................................. $

b. Sales tax paid to another state – Name of state $

6. Idaho Tax Due: Subtract line 5a or 5b from line 4. If equal to or less than zero, enter zero ........ $

If you paid sales tax to an Idaho dealer or retailer, stop here and sign in section D.

Section C

Check appropriate box.

I owe the tax because:

The seller didn’t collect tax. I’ll remit the tax due directly to the Tax Commission within 15 days.

The seller charged me another state’s sales tax that was less than the amount due to the State of Idaho. I’ll provide

a copy of the sales invoice and pay the amount due on line 6 to the county assessor (DMV) when I apply for title. If

I’m not required to title, I’ll pay the amount directly to theTax Commission within 15 days. Find titling information at

dmv.idaho.gov.

Other

I don’t owe the tax because:

The seller charged me another state’s sales tax that was greater than or equal to the amount due to the State of

Idaho. I’ll provide a copy of the sales invoice to the Tax Commission within 15 days.

Other

Find exemption information at tax.idaho.gov/salesusehub.

Section D

By signing this form, I certify that the statements I made Buyer’s signature Date

on this form are true and correct. I know that submitting

false information can result in criminal and civil penalties.

Vendor ID Date

Vendor complete this portion. >

Idaho State Tax Commission

Buyer return a copy of this form and the sales invoice, Tax Discovery Bureau

along with any required documentation or payment to: PO Box 36

Boise ID 83722

Original – Buyer’s Receipt

Copy to – Buyer forwards with check or documents required to Idaho State Tax Commission

Copy to – Vendor forwards to Idaho Department of Parks and Recreation with registration copy

EFO00165 07-14-2020