Enlarge image

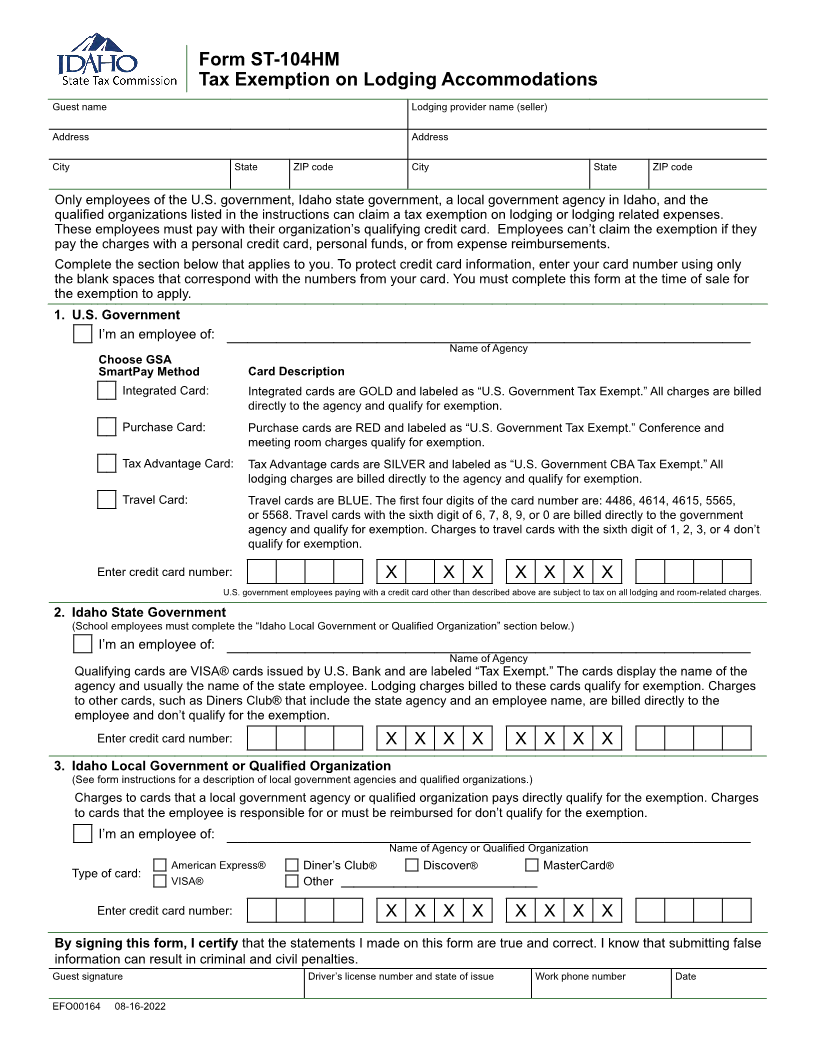

Form ST-104HM

Tax Exemption on Lodging Accommodations

Guest name Lodging provider name (seller)

Address Address

City State ZIP code City State ZIP code

Only employees of the U.S. government, Idaho state government, a local government agency in Idaho, and the

qualified organizations listed in the instructions can claim a tax exemption on lodging or lodging related expenses.

These employees must pay with their organization’s qualifying credit card. Employees can’t claim the exemption if they

pay the charges with a personal credit card, personal funds, or from expense reimbursements.

Complete the section below that applies to you. To protect credit card information, enter your card number using only

the blank spaces that correspond with the numbers from your card. You must complete this form at the time of sale for

the exemption to apply.

1. U.S. Government

I’m an employee of:

Name of Agency

Choose GSA

SmartPay Method Card Description

Integrated Card: Integrated cards are GOLD and labeled as “U.S. Government Tax Exempt.” All charges are billed

directly to the agency and qualify for exemption.

Purchase Card: Purchase cards are RED and labeled as “U.S. Government Tax Exempt.” Conference and

meeting room charges qualify for exemption.

Tax Advantage Card: Tax Advantage cards are SILVER and labeled as “U.S. Government CBA Tax Exempt.” All

lodging charges are billed directly to the agency and qualify for exemption.

Travel Card: Travel cards are BLUE. The first four digits of the card number are: 4486, 4614, 4615, 5565,

or 5568. Travel cards with the sixth digit of 6, 7, 8, 9, or 0 are billed directly to the government

agency and qualify for exemption. Charges to travel cards with the sixth digit of 1, 2, 3, or 4 don’t

qualify for exemption.

Enter credit card number: X X X X X X X

U.S. government employees paying with a credit card other than described above are subject to tax on all lodging and room-related charges.

2. Idaho State Government

(School employees must complete the “Idaho Local Government or Qualified Organization” section below.)

I’m an employee of:

Name of Agency

Qualifying cards are VISA® cards issued by U.S. Bank and are labeled “Tax Exempt.” The cards display the name of the

agency and usually the name of the state employee. Lodging charges billed to these cards qualify for exemption. Charges

to other cards, such as Diners Club® that include the state agency and an employee name, are billed directly to the

employee and don’t qualify for the exemption.

Enter credit card number: X X X X X X X X

3. Idaho Local Government or Qualified Organization

(See form instructions for a description of local government agencies and qualified organizations.)

Charges to cards that a local government agency or qualified organization pays directly qualify for the exemption. Charges

to cards that the employee is responsible for or must be reimbursed for don’t qualify for the exemption.

I’m an employee of:

Name of Agency or Qualified Organization

American Express® Diner’s Club® Discover® MasterCard®

Type of card:

VISA® Other

Enter credit card number: X X X X X X X X

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false

information can result in criminal and civil penalties.

Guest signature Driver’s license number and state of issue Work phone number Date

EFO00164 08-16-2022