Enlarge image

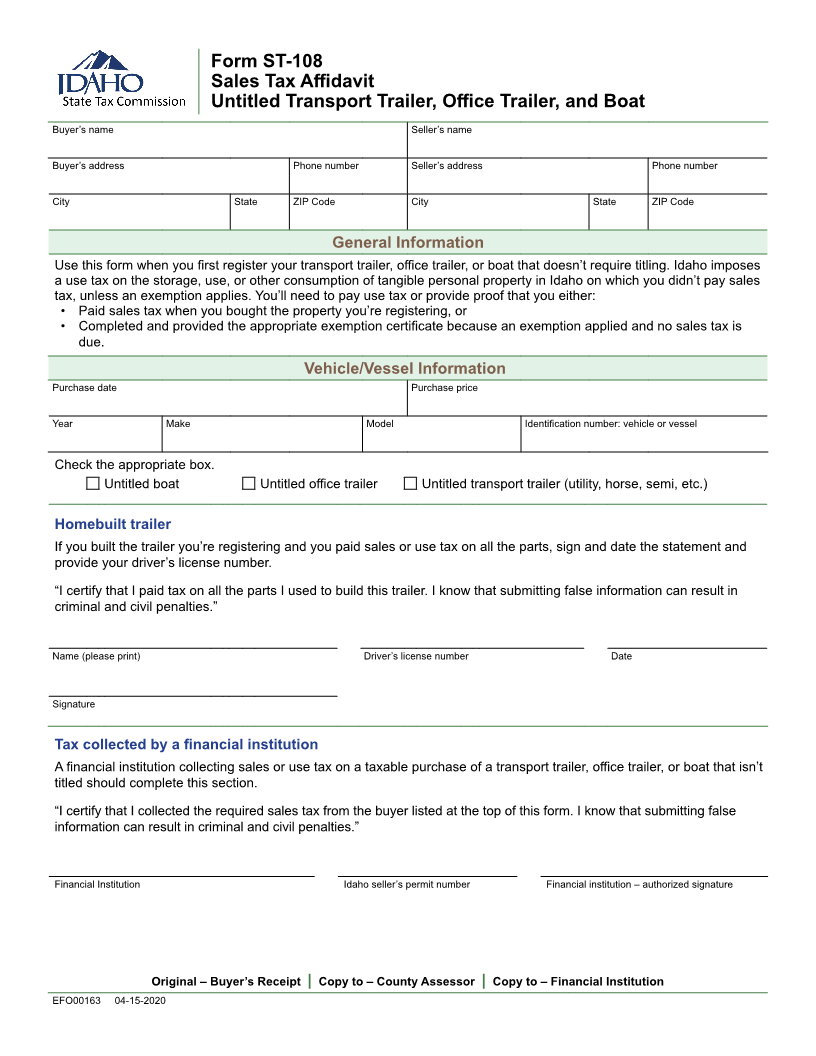

Form ST-108

Sales Tax Affidavit

Untitled Transport Trailer, Office Trailer, and Boat

Buyer’s name Seller’s name

Buyer’s address Phone number Seller’s address Phone number

City State ZIP Code City State ZIP Code

General Information

Use this form when you first register your transport trailer, office trailer, or boat that doesn’t require titling. Idaho imposes

a use tax on the storage, use, or other consumption of tangible personal property in Idaho on which you didn’t pay sales

tax, unless an exemption applies. You’ll need to pay use tax or provide proof that you either:

• Paid sales tax when you bought the property you’re registering, or

• Completed and provided the appropriate exemption certificate because an exemption applied and no sales tax is

due.

Vehicle/Vessel Information

Purchase date Purchase price

Year Make Model Identification number: vehicle or vessel

Check the appropriate box.

Untitled boat Untitled office trailer Untitled transport trailer (utility, horse, semi, etc.)

Homebuilt trailer

If you built the trailer you’re registering and you paid sales or use tax on all the parts, sign and date the statement and

provide your driver’s license number.

“I certify that I paid tax on all the parts I used to build this trailer. I know that submitting false information can result in

criminal and civil penalties.”

Name (please print) Driver’s license number Date

Signature

Tax collected by a financial institution

A financial institution collecting sales or use tax on a taxable purchase of a transport trailer, office trailer, or boat that isn’t

titled should complete this section.

“I certify that I collected the required sales tax from the buyer listed at the top of this form. I know that submitting false

information can result in criminal and civil penalties.”

Financial Institution Idaho seller’s permit number Financial institution – authorized signature

Original – Buyer’s Receipt | Copy to – County Assessor | Copy to – Financial Institution

EFO00163 04-15-2020