Enlarge image

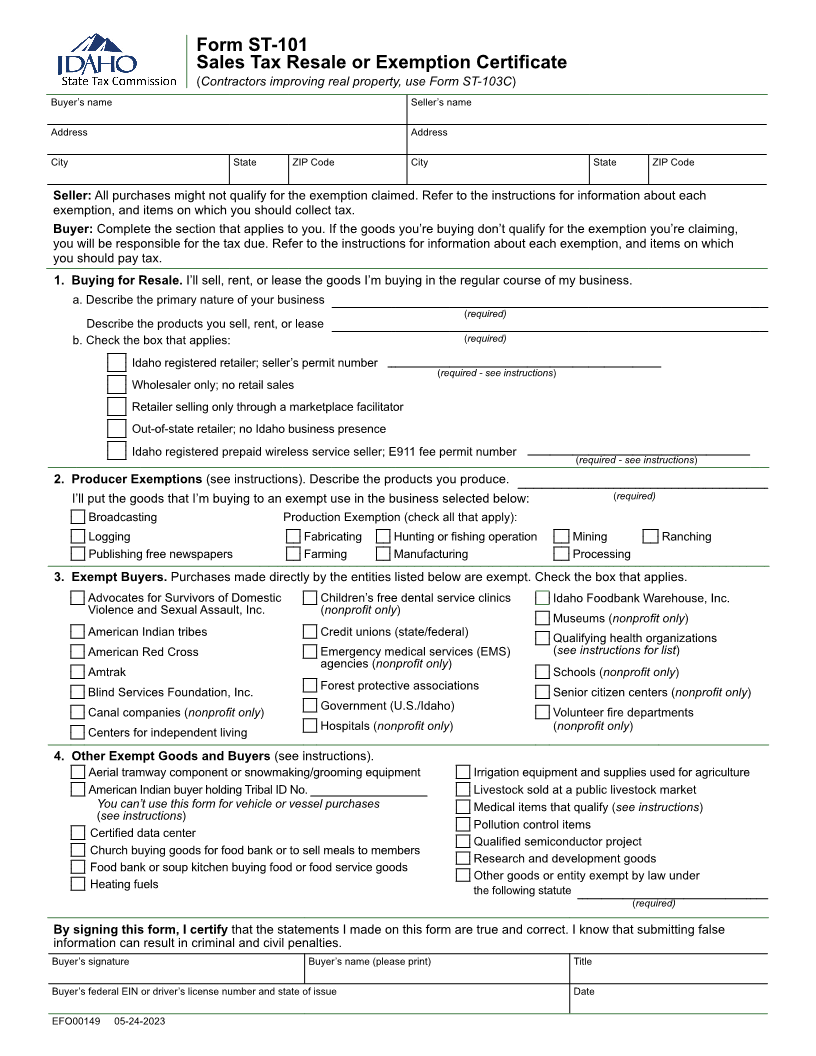

Form ST-101

Sales Tax Resale or Exemption Certificate

(Contractors improving real property, use Form ST-103C)

Buyer’s name Seller’s name

Address Address

City State ZIP Code City State ZIP Code

Seller: All purchases might not qualify for the exemption claimed. Refer to the instructions for information about each

exemption, and items on which you should collect tax.

Buyer: Complete the section that applies to you. If the goods you’re buying don’t qualify for the exemption you’re claiming,

you will be responsible for the tax due. Refer to the instructions for information about each exemption, and items on which

you should pay tax.

1. Buying for Resale. I’ll sell, rent, or lease the goods I’m buying in the regular course of my business.

a. Describe the primary nature of your business

(required)

Describe the products you sell, rent, or lease

b. Check the box that applies: (required)

Idaho registered retailer; seller’s permit number

(required - see instructions)

Wholesaler only; no retail sales

Retailer selling only through a marketplace facilitator

Out-of-state retailer; no Idaho business presence

Idaho registered prepaid wireless service seller; E911 fee permit number

(required - see instructions)

2. Producer Exemptions (see instructions). Describe the products you produce.

I’ll put the goods that I’m buying to an exempt use in the business selected below: (required)

Broadcasting Production Exemption (check all that apply):

Logging Fabricating Hunting or fishing operation Mining Ranching

Publishing free newspapers Farming Manufacturing Processing

3. Exempt Buyers. Purchases made directly by the entities listed below are exempt. Check the box that applies.

Advocates for Survivors of Domestic Children’s free dental service clinics Idaho Foodbank Warehouse, Inc.

Violence and Sexual Assault, Inc. (nonprofit only)

Museums (nonprofit only)

American Indian tribes Credit unions (state/federal) Qualifying health organizations

American Red Cross Emergency medical services (EMS) (see instructions for list)

agencies (nonprofit only)

Amtrak Schools (nonprofit only)

Forest protective associations

Blind Services Foundation, Inc. Senior citizen centers (nonprofit only)

Government (U.S./Idaho)

Canal companies (nonprofit only) Volunteer fire departments

Hospitals (nonprofit only) (nonprofit only)

Centers for independent living

4. Other Exempt Goods and Buyers (see instructions).

Aerial tramway component or snowmaking/grooming equipment Irrigation equipment and supplies used for agriculture

American Indian buyer holding Tribal ID No. Livestock sold at a public livestock market

You can’t use this form for vehicle or vessel purchases Medical items that qualify (see instructions)

(see instructions)

Pollution control items

Certified data center

Qualified semiconductor project

Church buying goods for food bank or to sell meals to members

Research and development goods

Food bank or soup kitchen buying food or food service goods

Other goods or entity exempt by law under

Heating fuels the following statute

(required)

By signing this form, I certify that the statements I made on this form are true and correct. I know that submitting false

information can result in criminal and civil penalties.

Buyer’s signature Buyer’s name (please print) Title

Buyer’s federal EIN or driver’s license number and state of issue Date

EFO00149 05-24-2023