Enlarge image

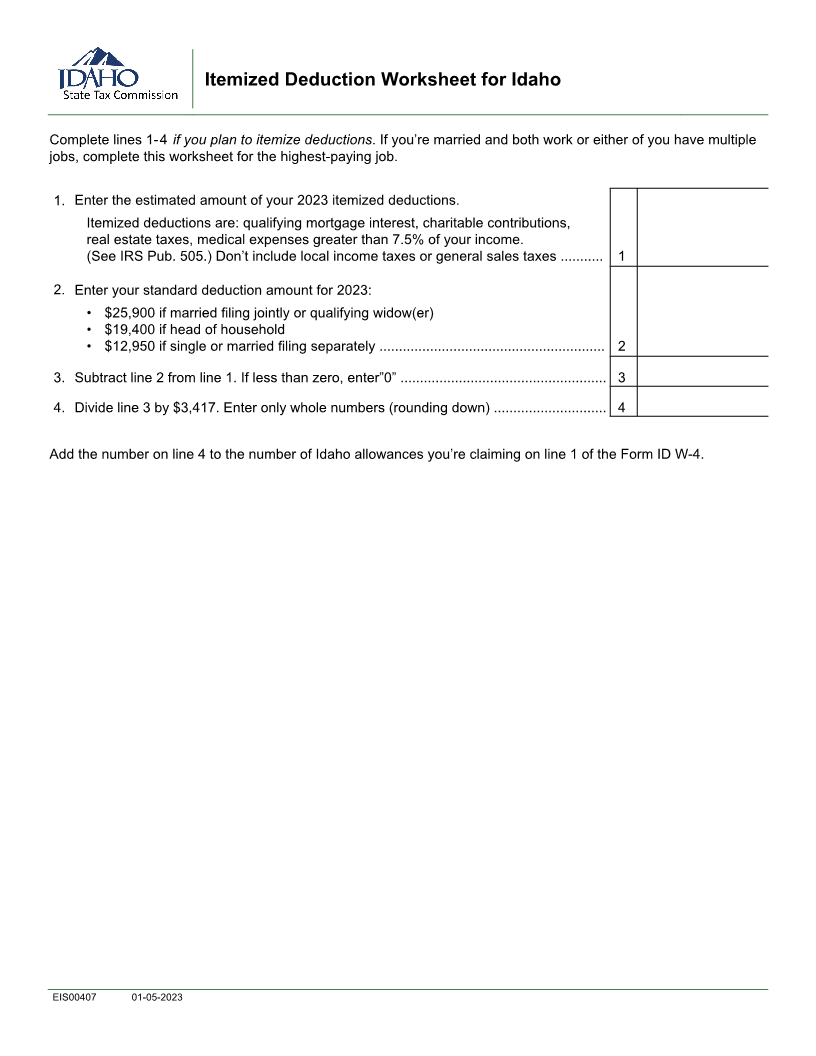

Itemized Deduction Worksheet for Idaho

Complete lines 1-4 if you plan to itemize deductions. If you’re married and both work or either of you have multiple

jobs, complete this worksheet for the highest-paying job.

1. Enter the estimated amount of your 2023 itemized deductions.

Itemized deductions are: qualifying mortgage interest, charitable contributions,

real estate taxes, medical expenses greater than 7.5% of your income.

(See IRS Pub. 505.) Don’t include local income taxes or general sales taxes ........... 1

2. Enter your standard deduction amount for 2023:

• $25,900 if married filing jointly or qualifying widow(er)

• $19,400 if head of household

• $12,950 if single or married filing separately .......................................................... 2

3. Subtract line 2 from line 1. If less than zero, enter”0” ..................................................... 3

4. Divide line 3 by $3,417. Enter only whole numbers (rounding down) ............................. 4

Add the number on line 4 to the number of Idaho allowances you’re claiming on line 1 of the Form ID W-4.

EIS00407 01-05-2023