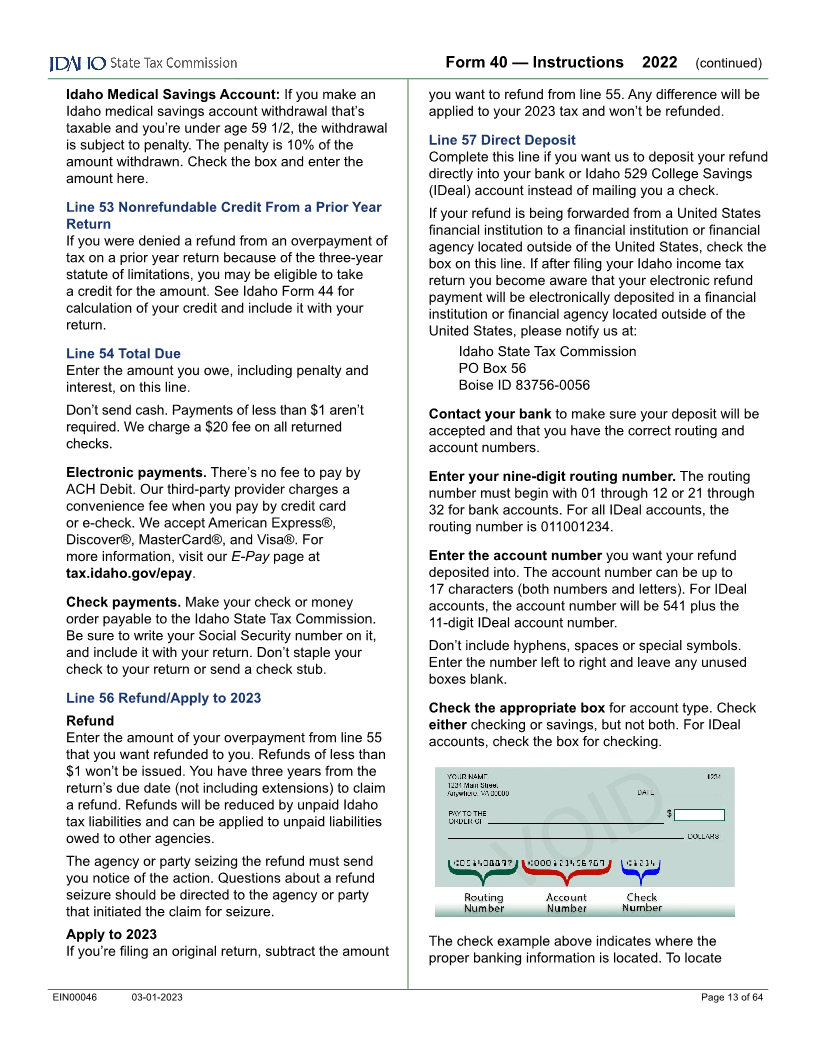

- 57 -

Enlarge image

|

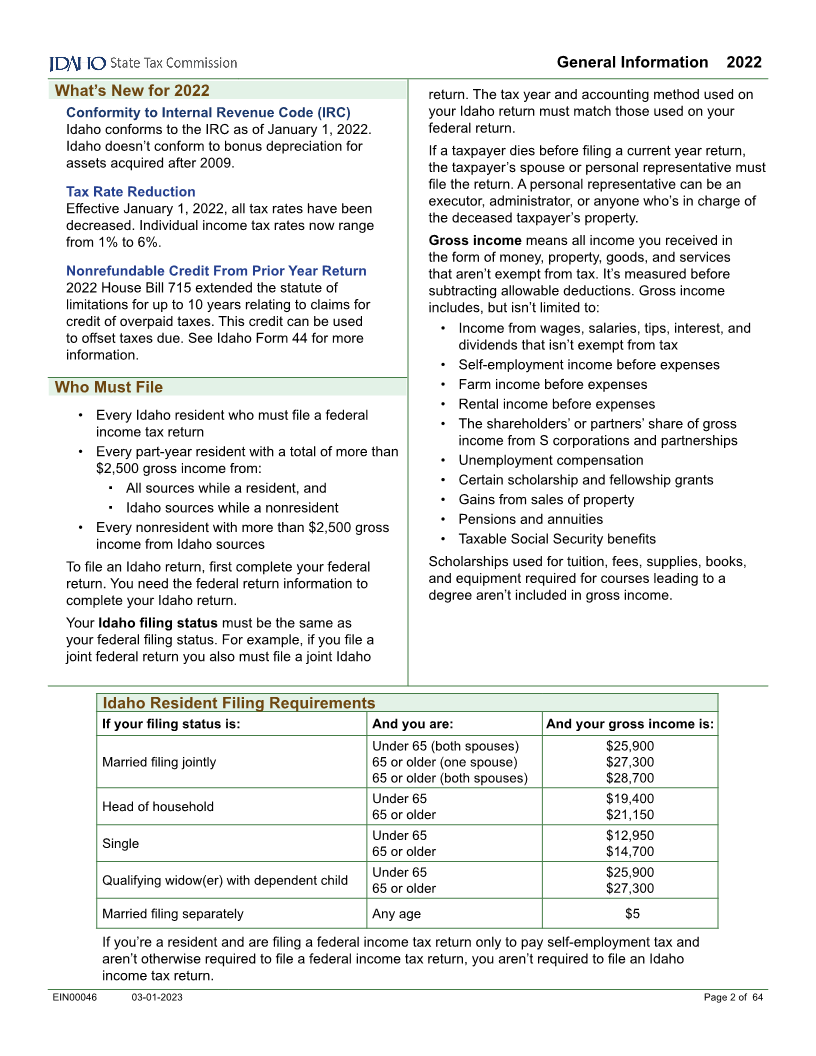

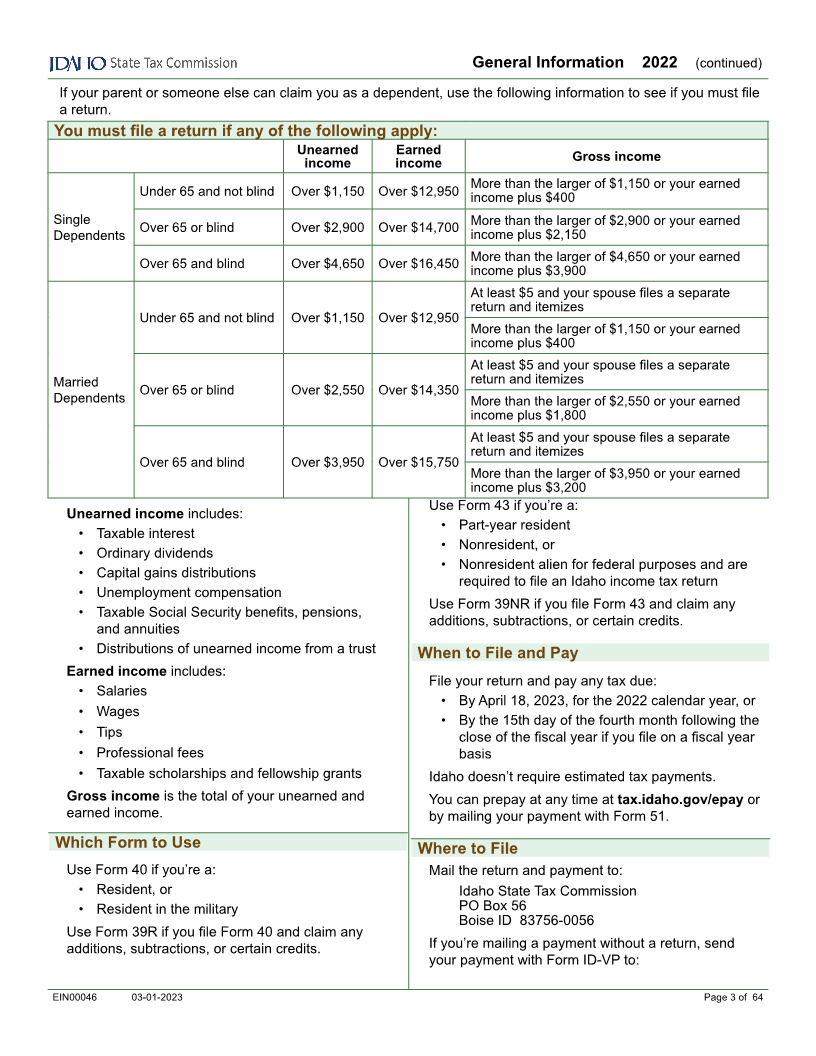

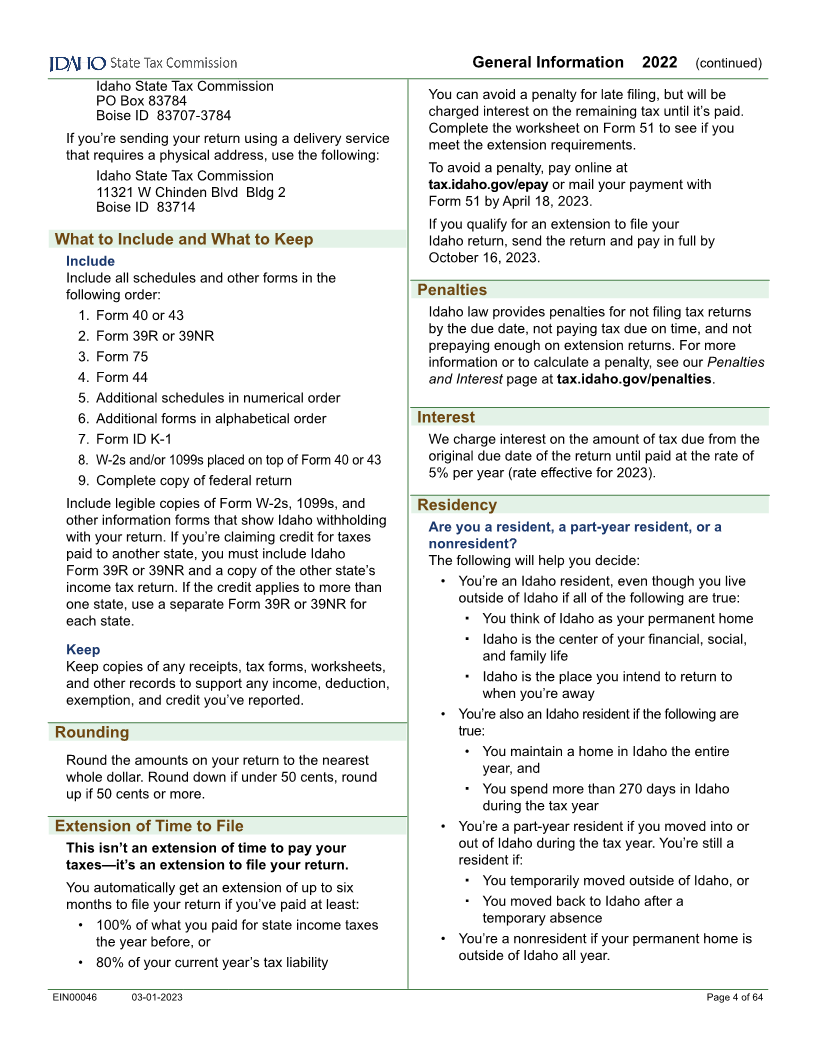

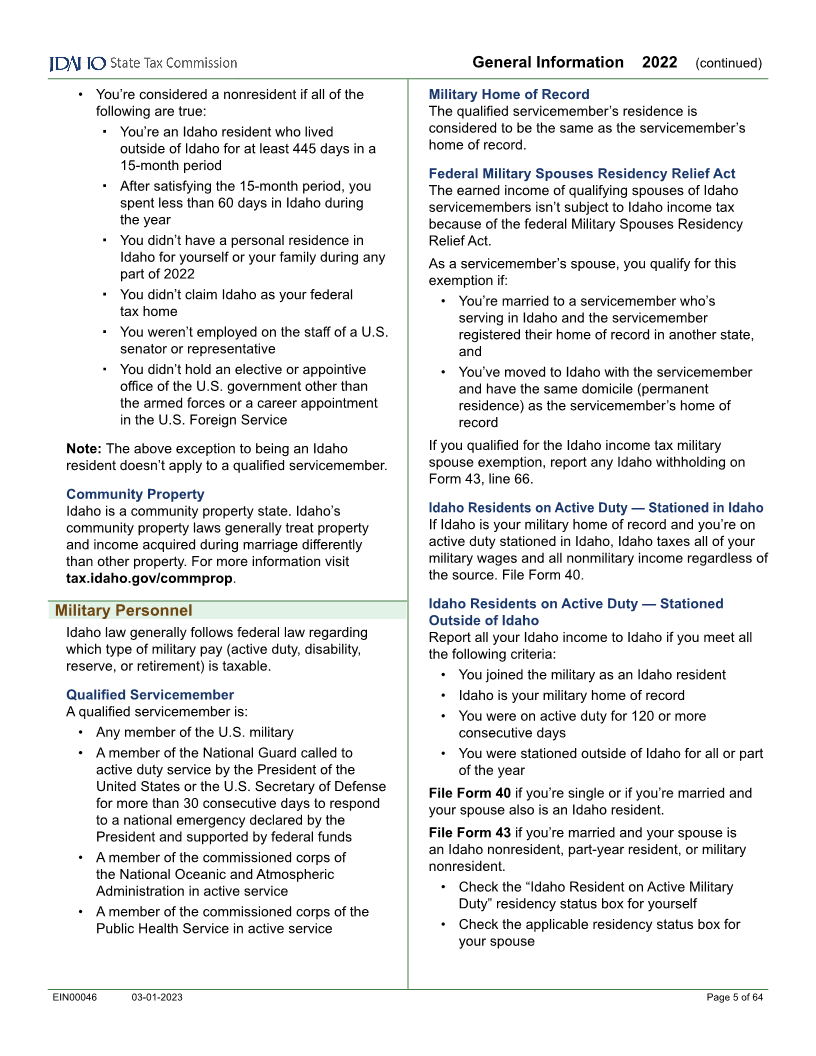

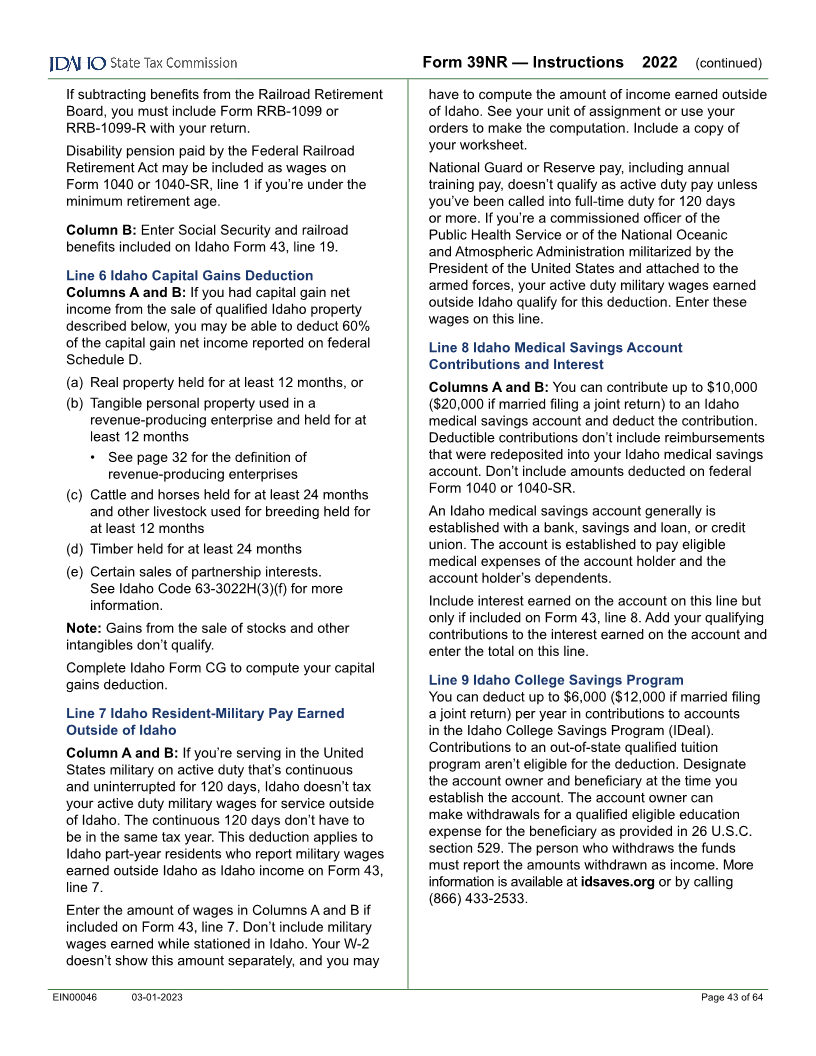

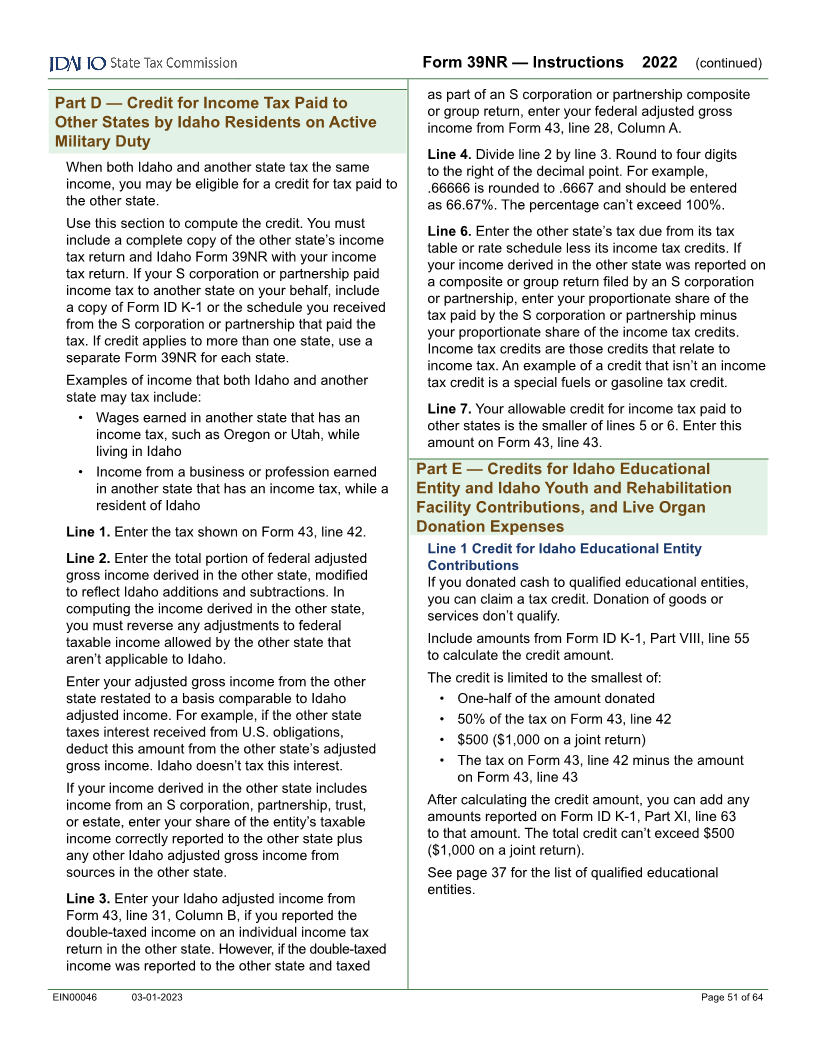

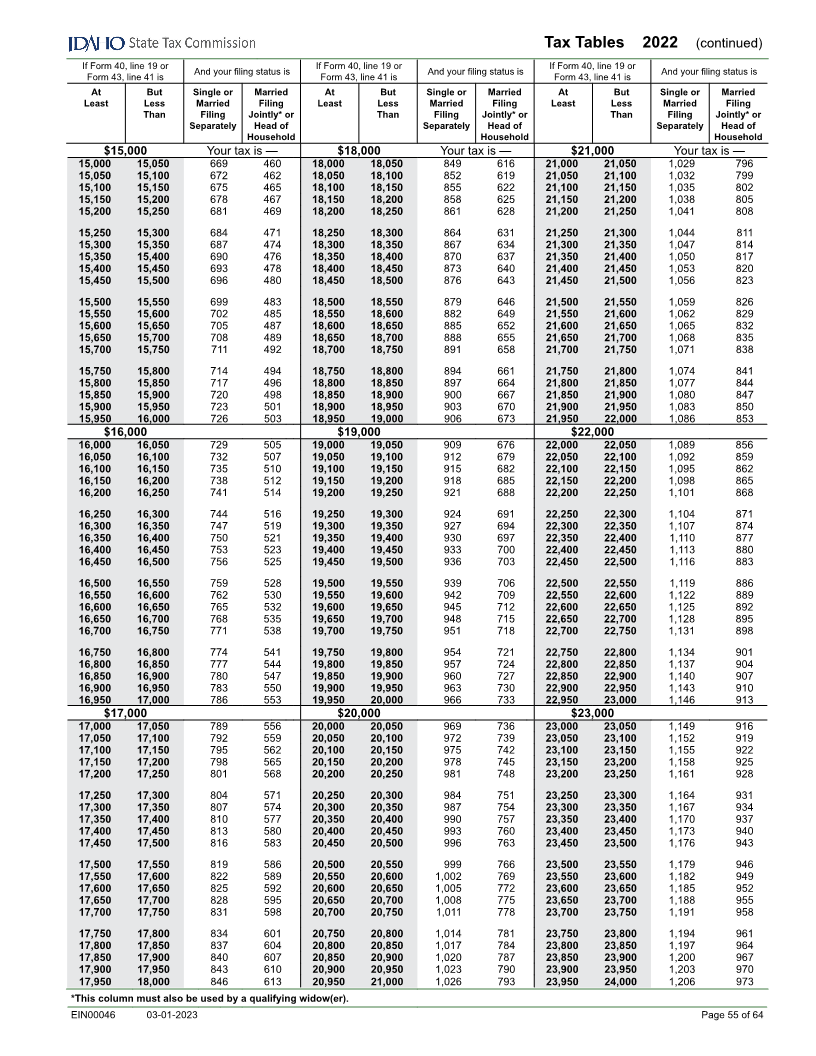

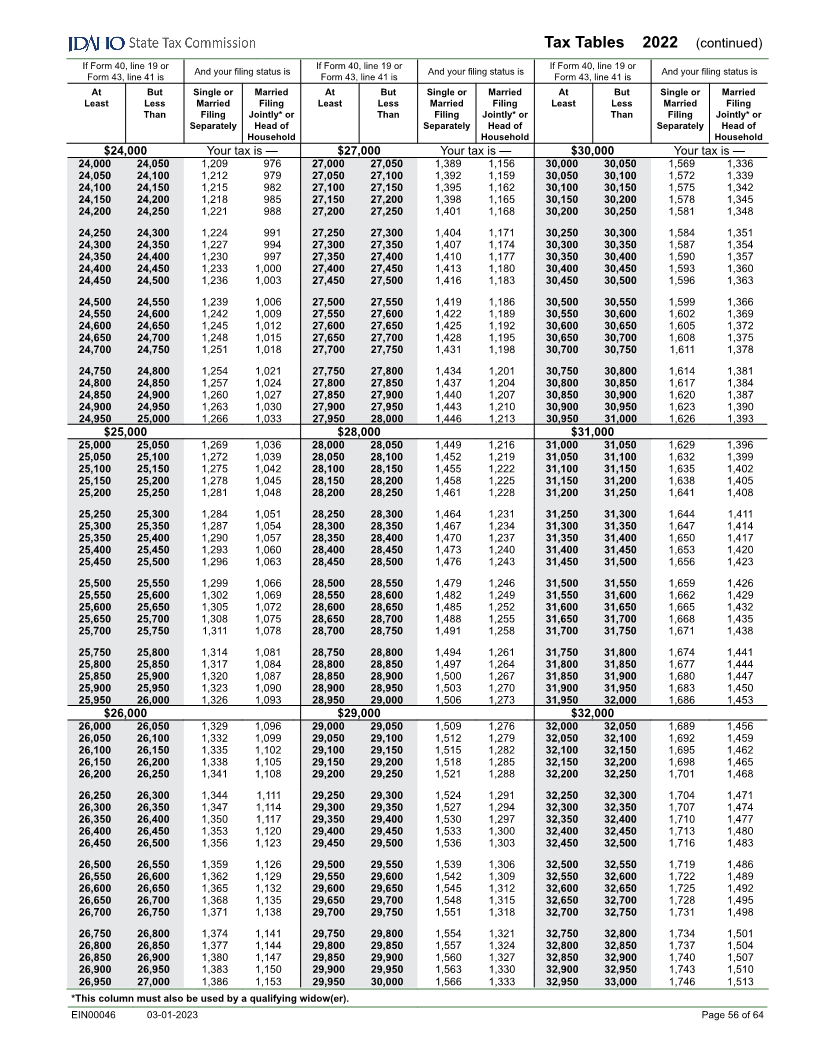

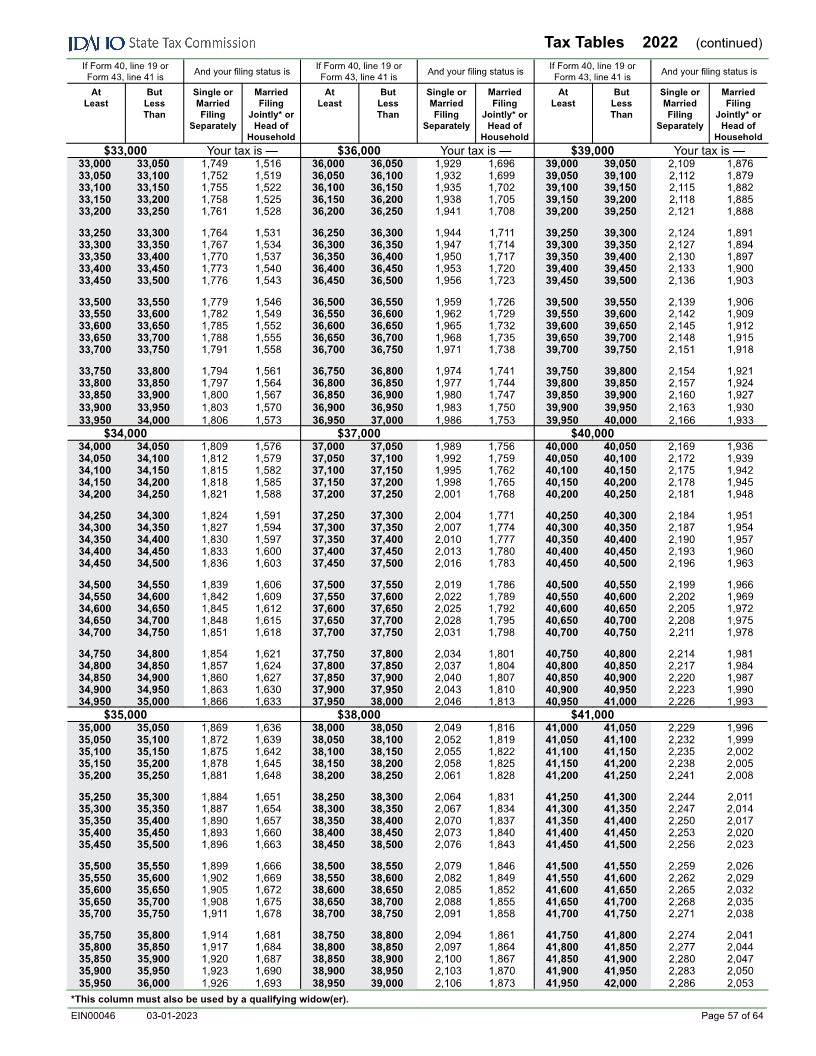

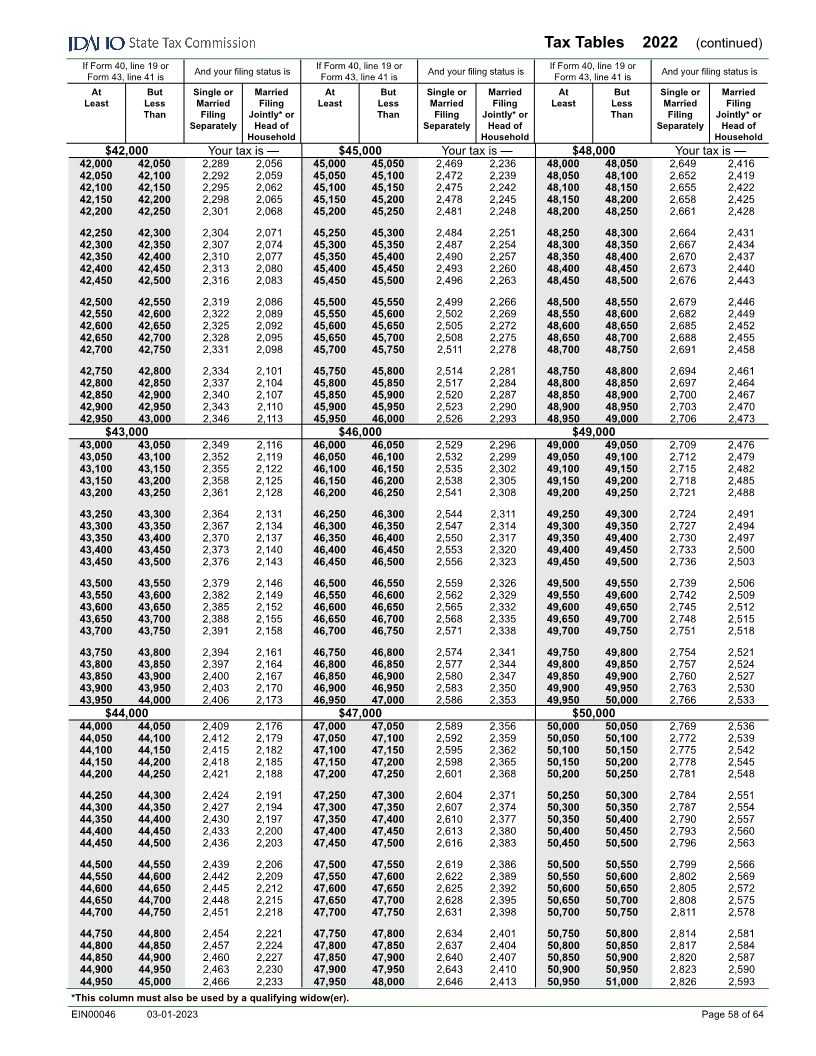

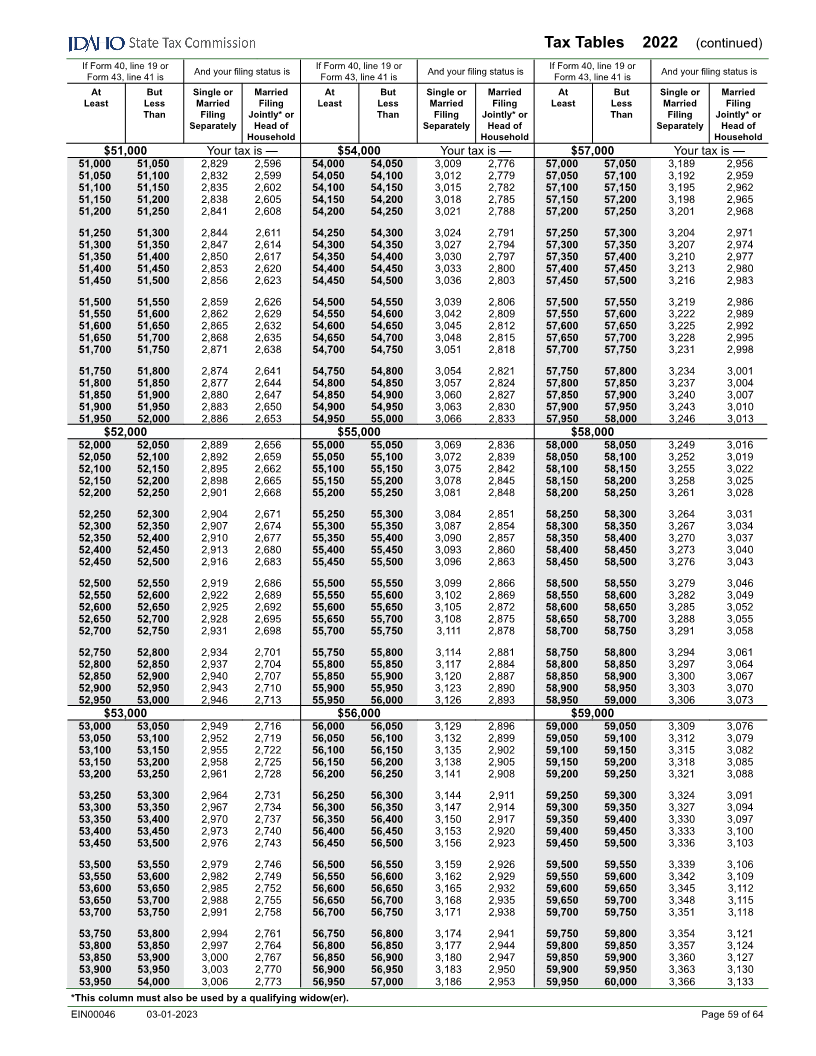

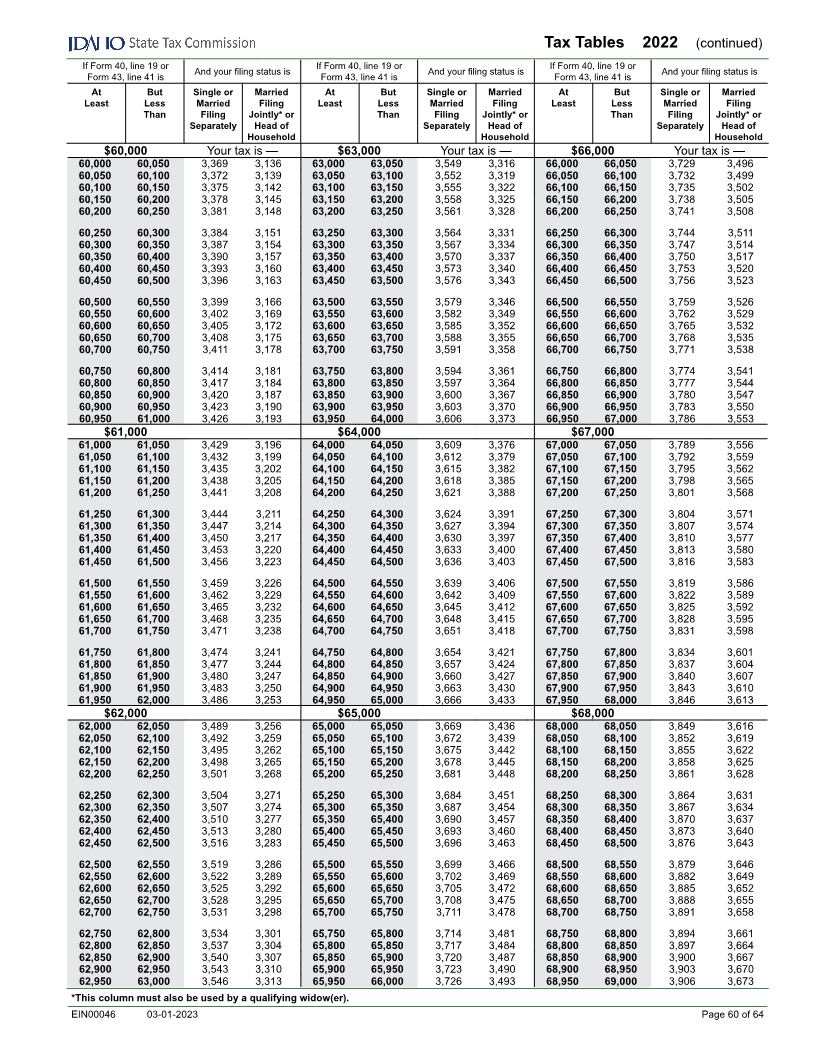

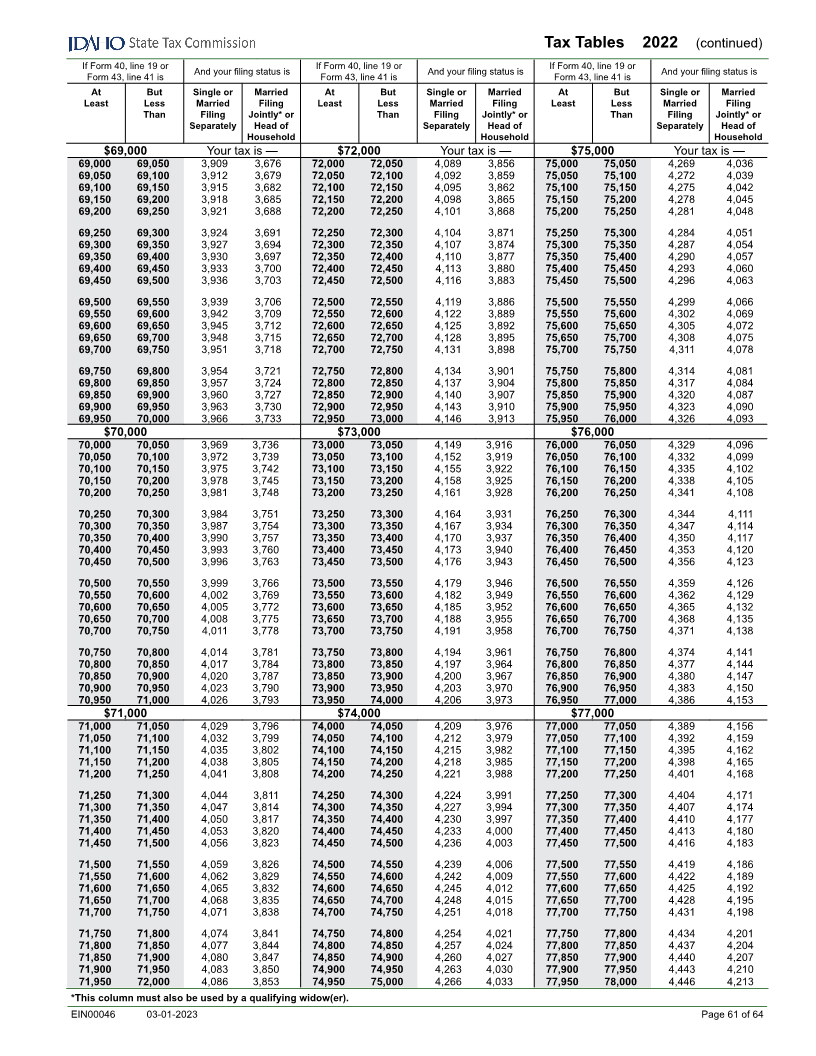

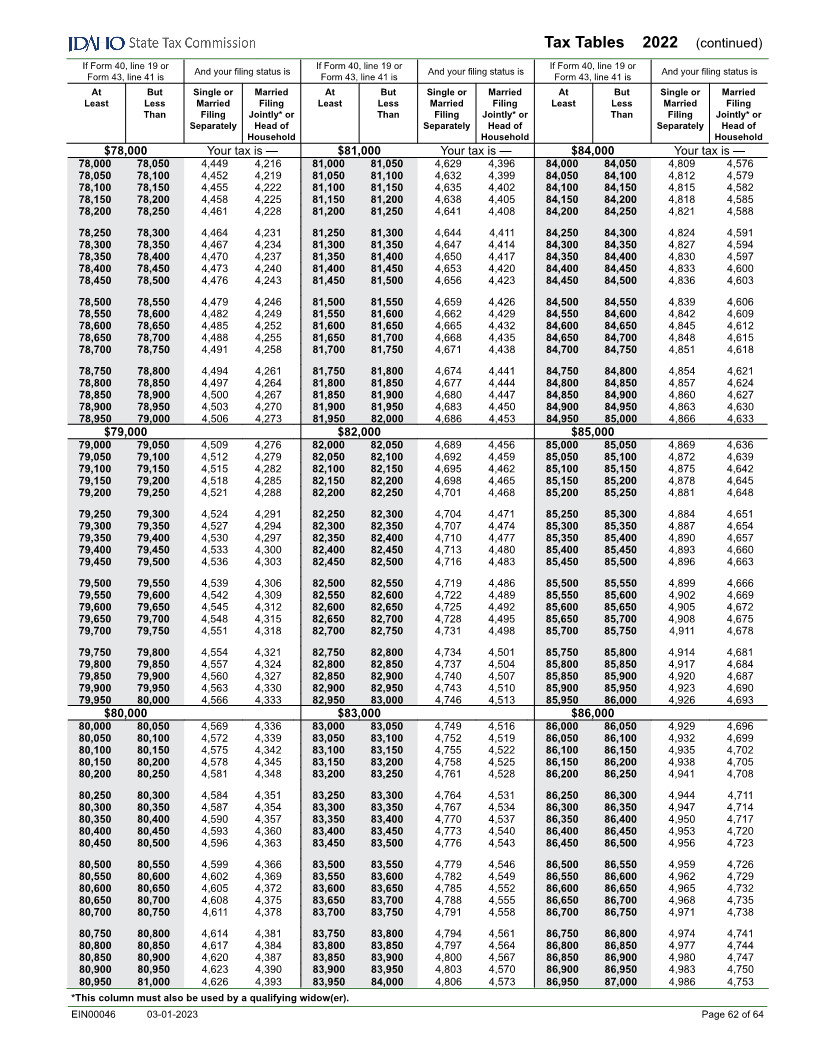

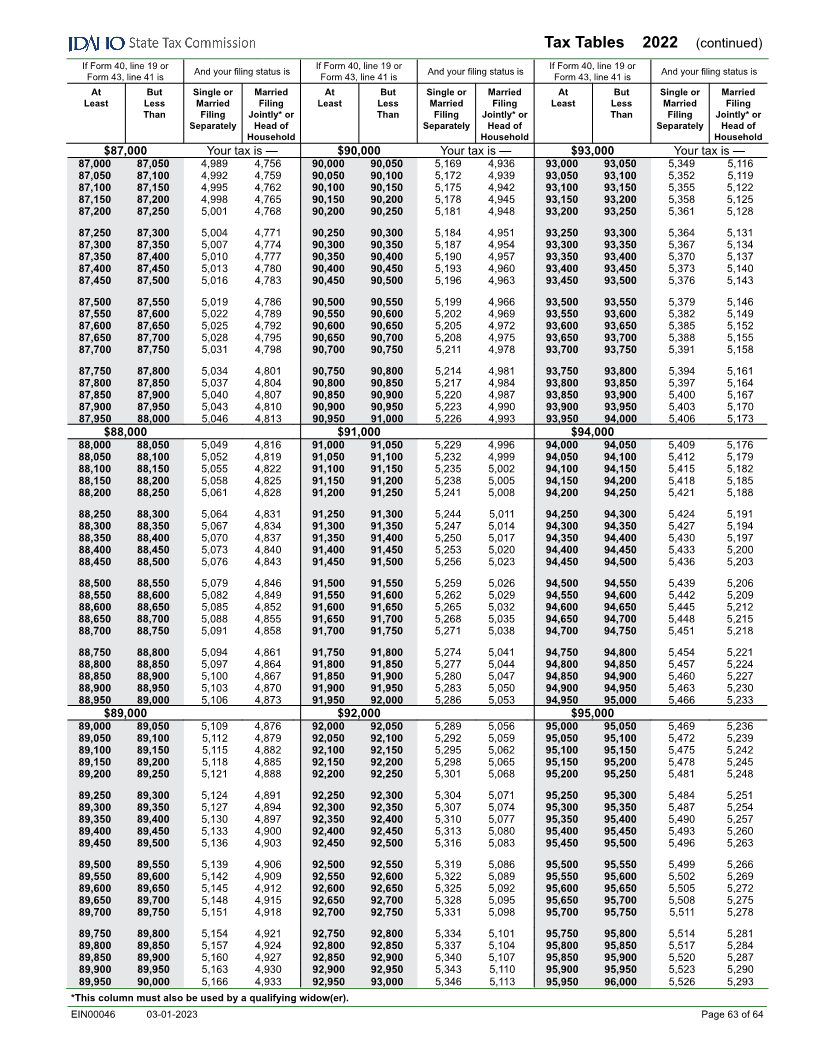

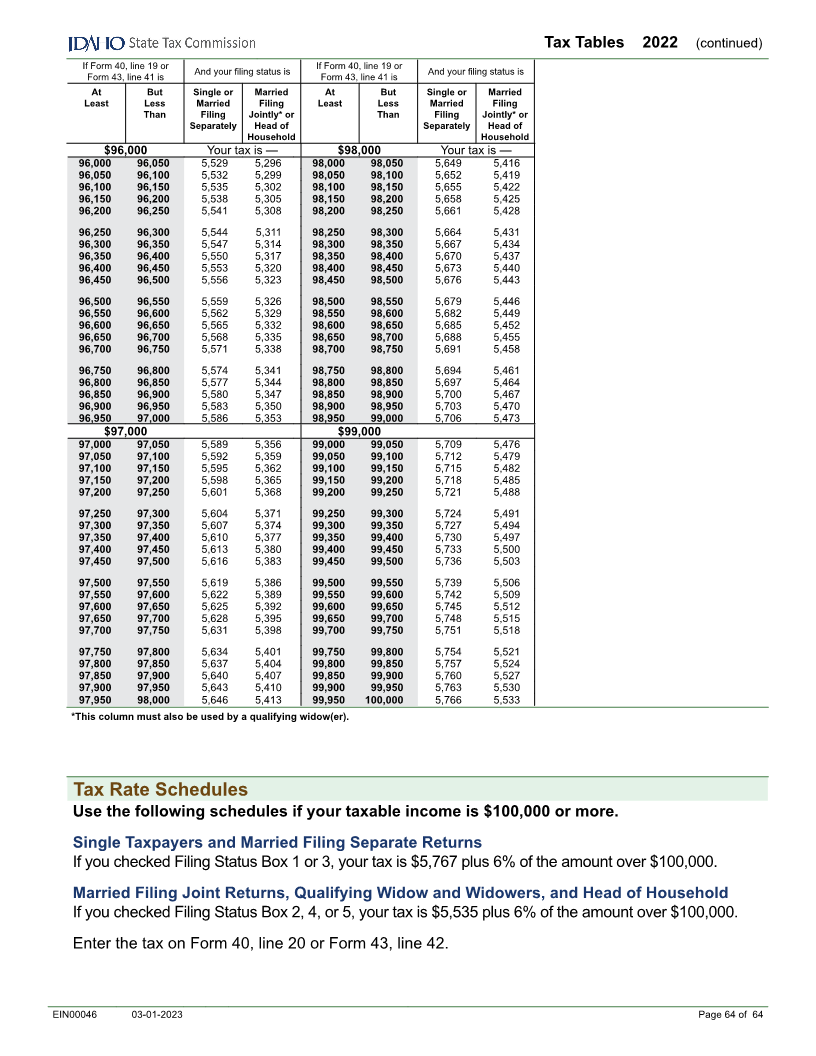

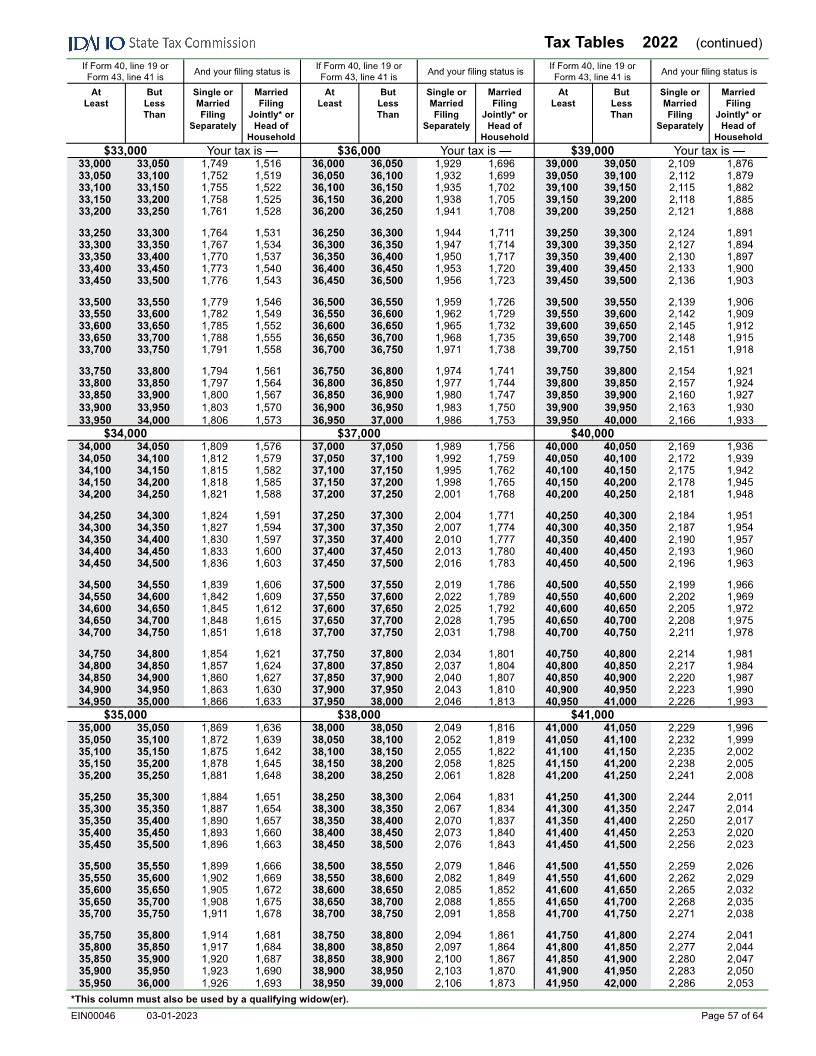

Tax Tables 2022 (continued)

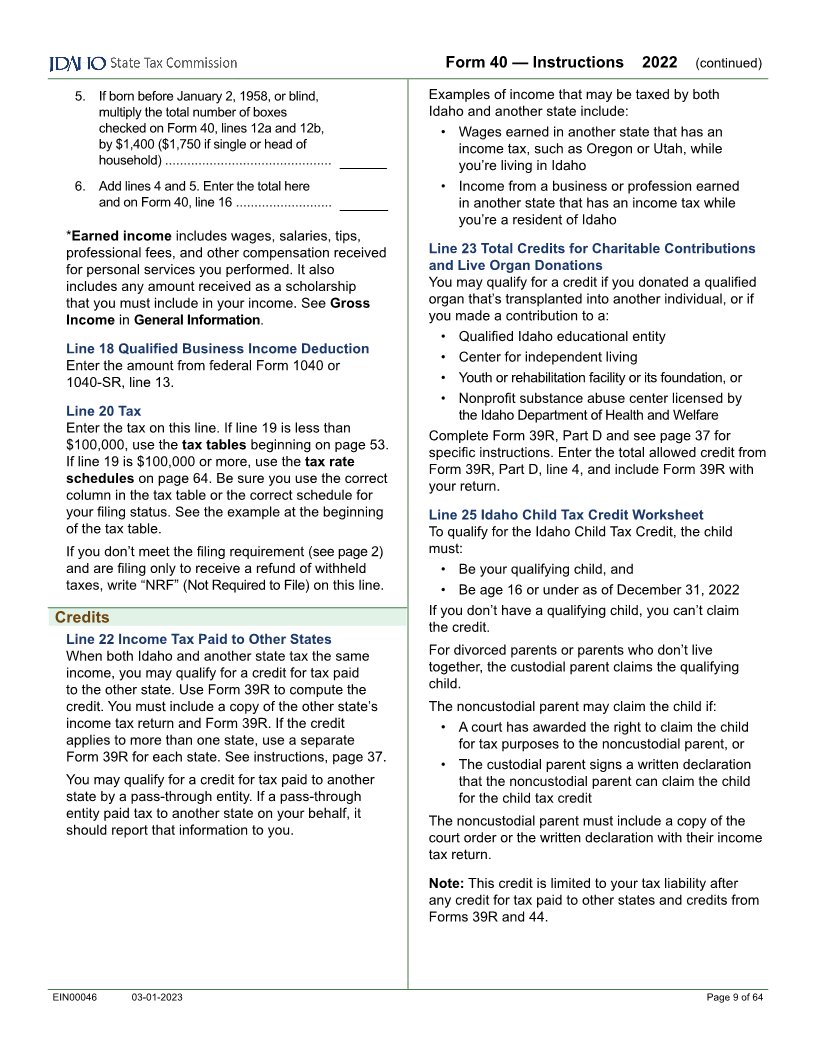

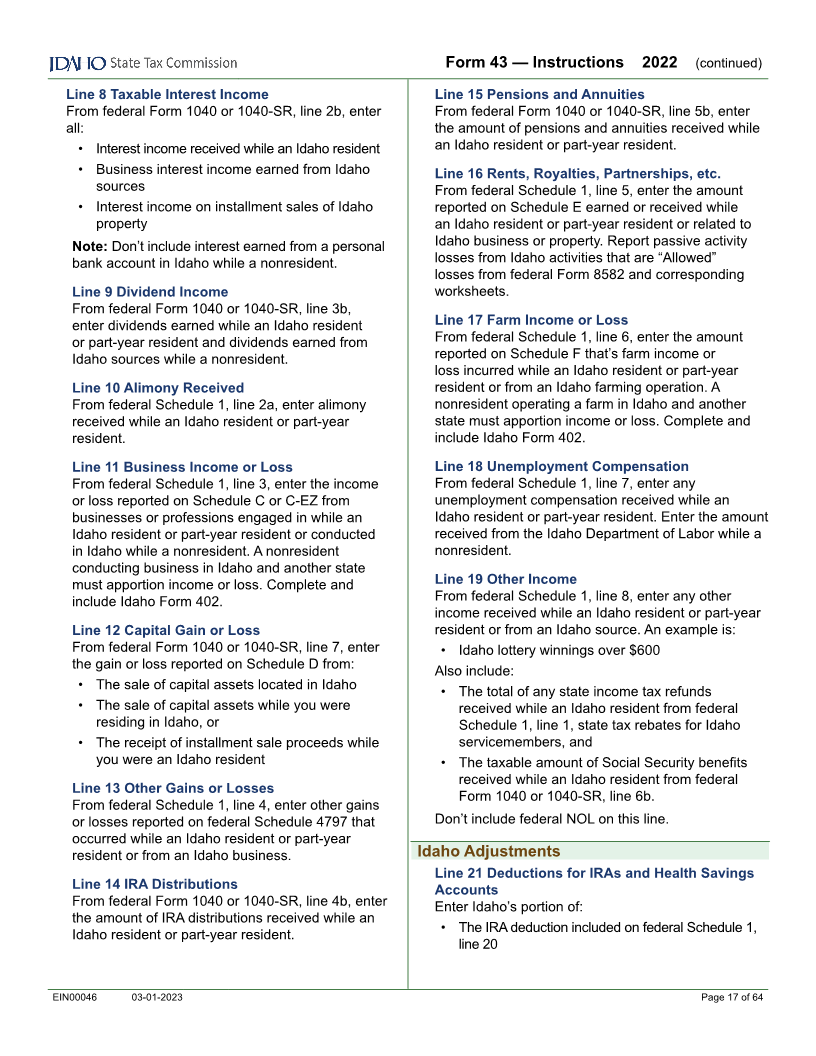

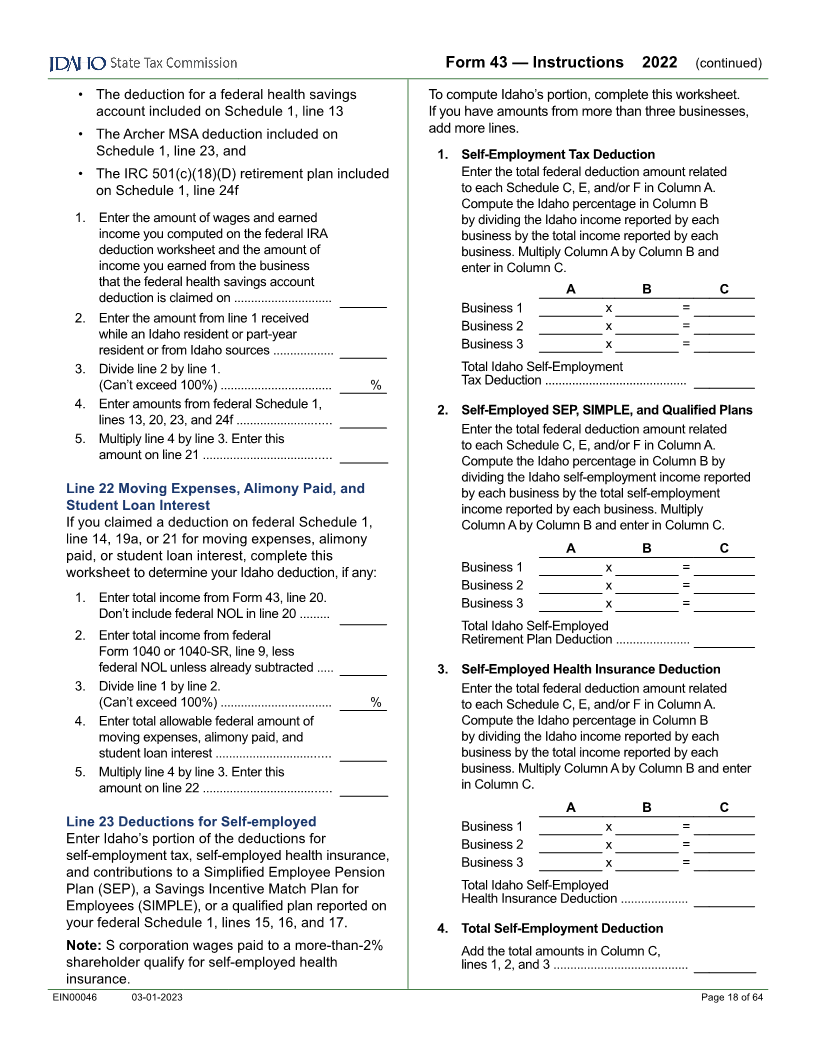

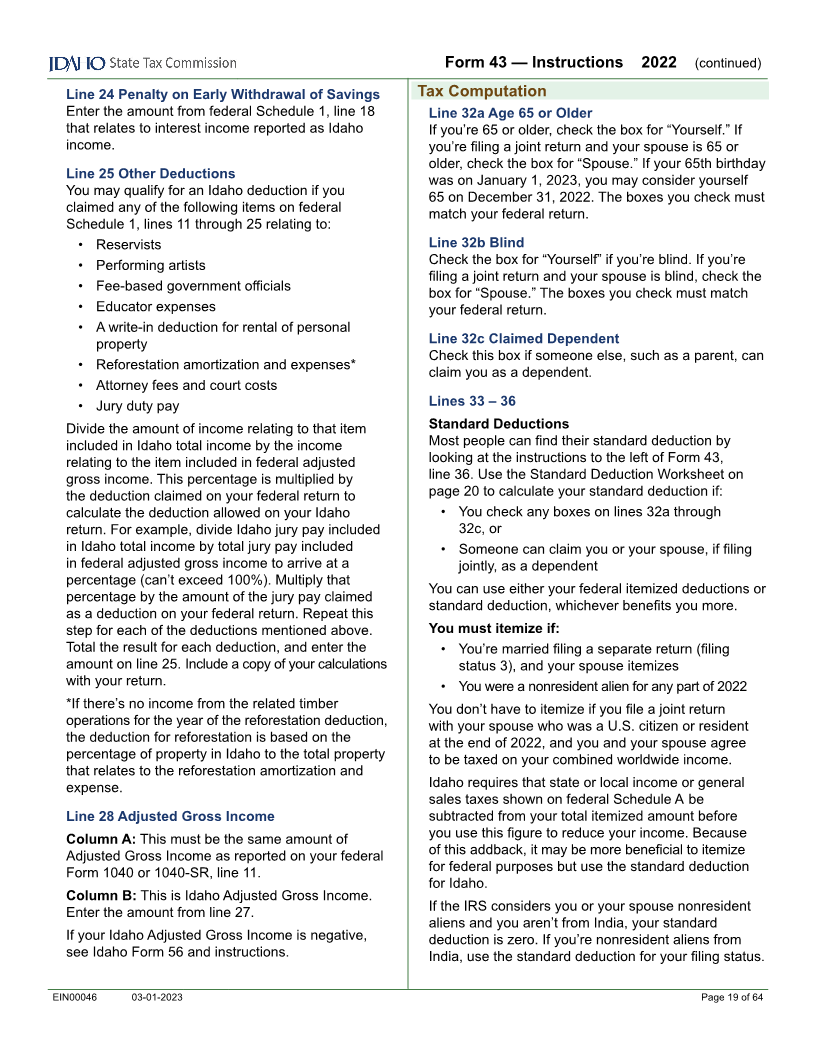

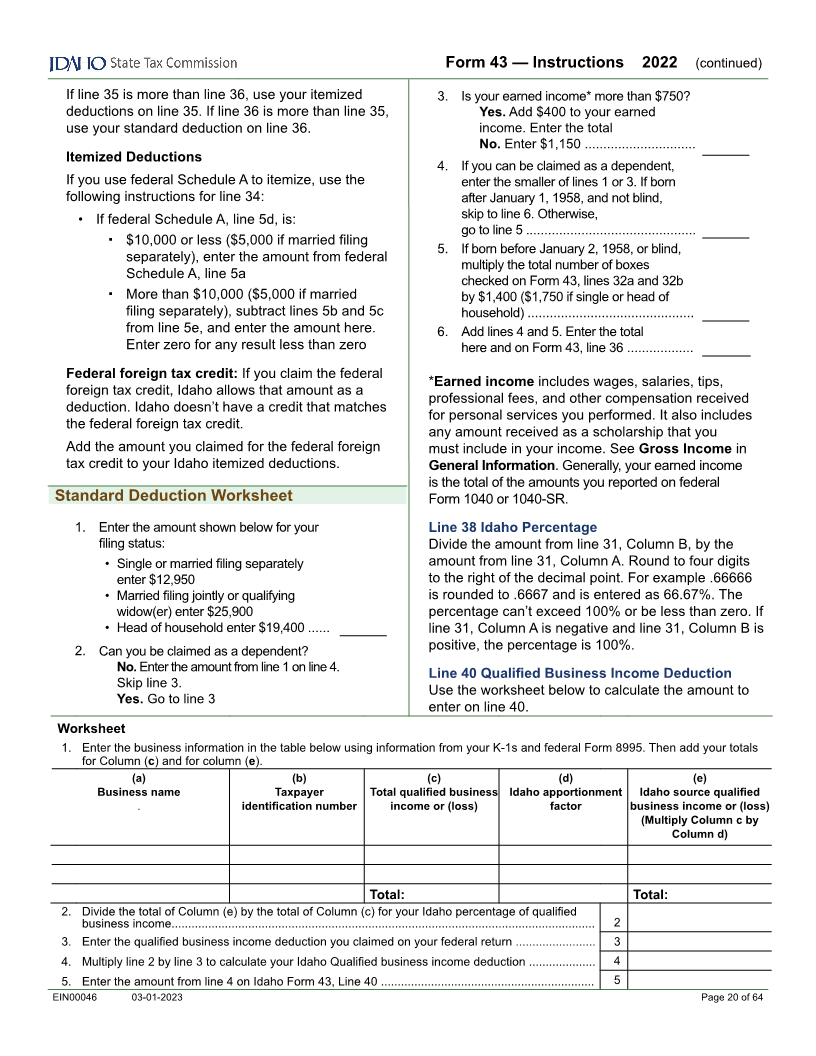

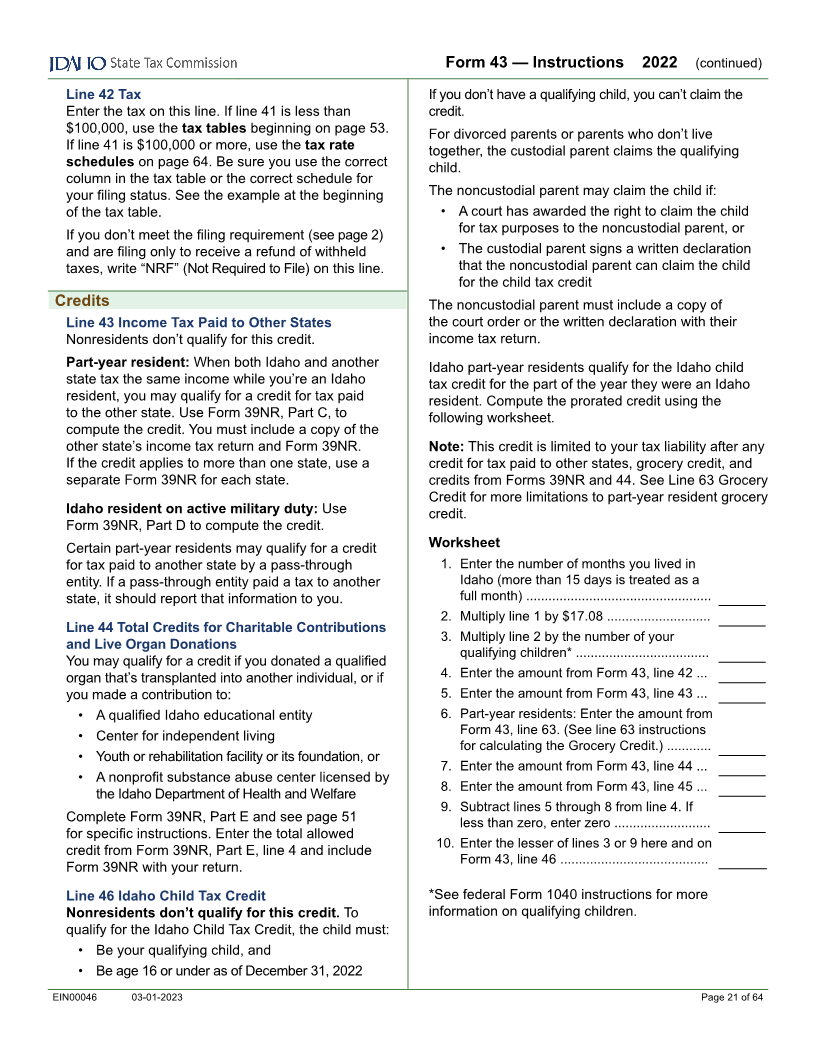

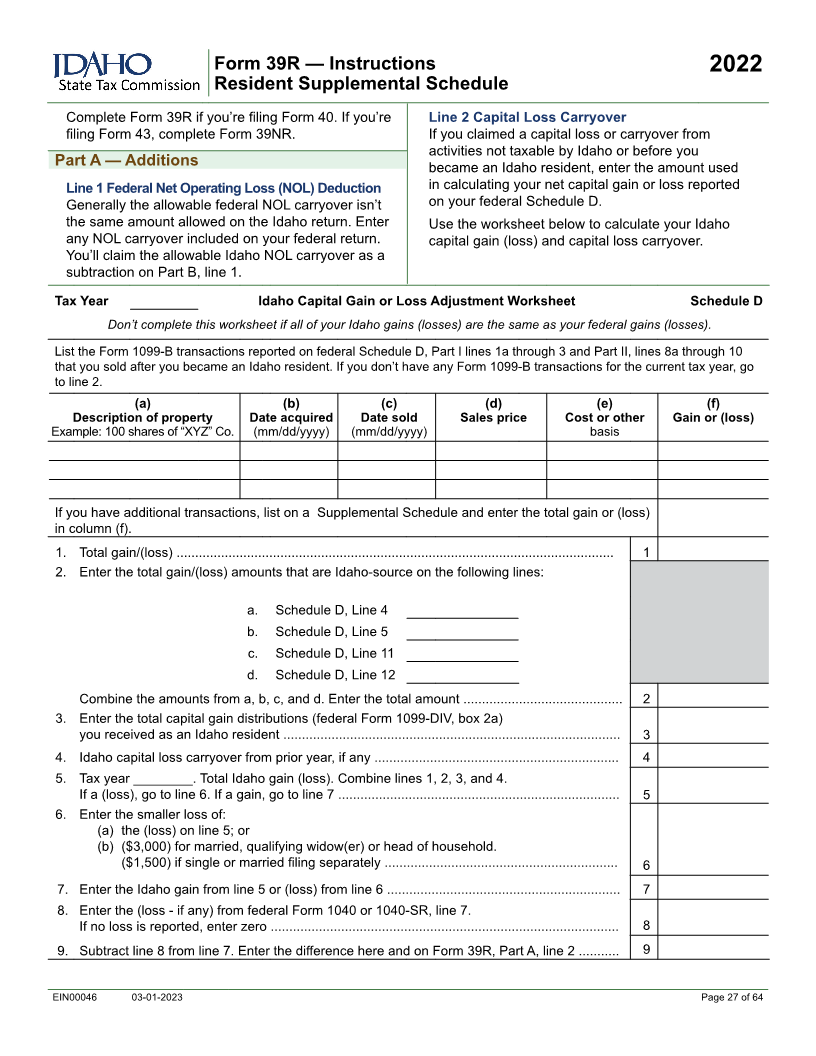

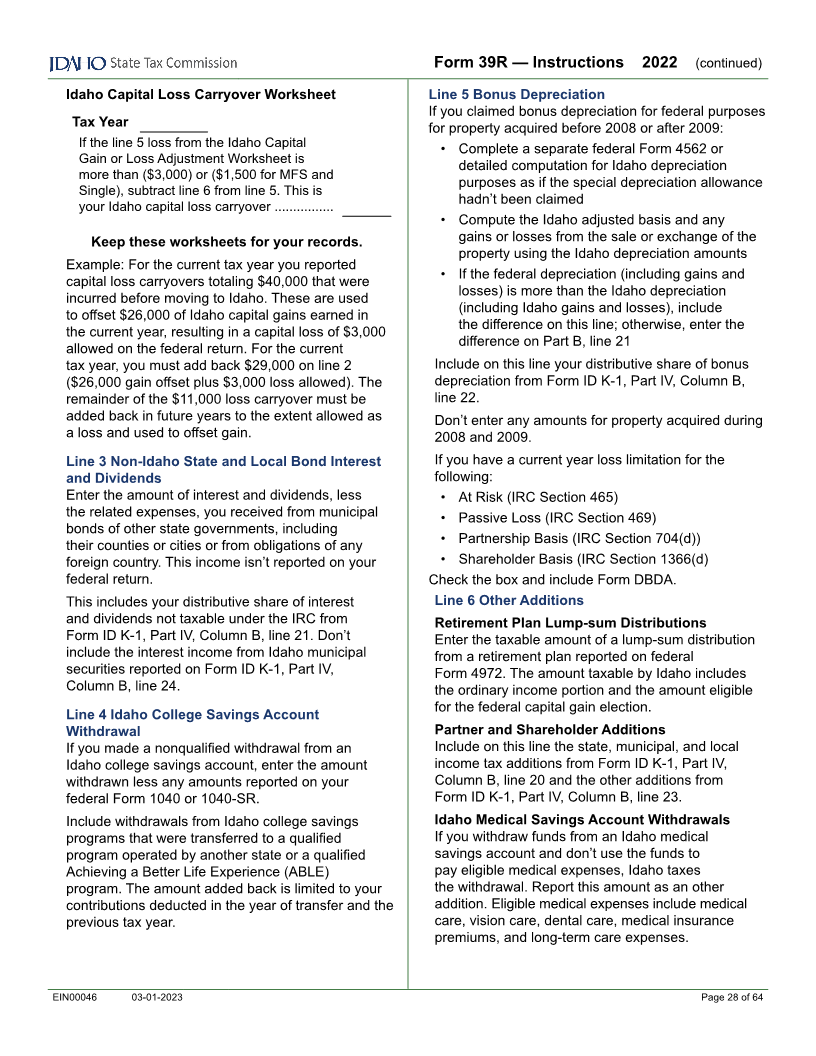

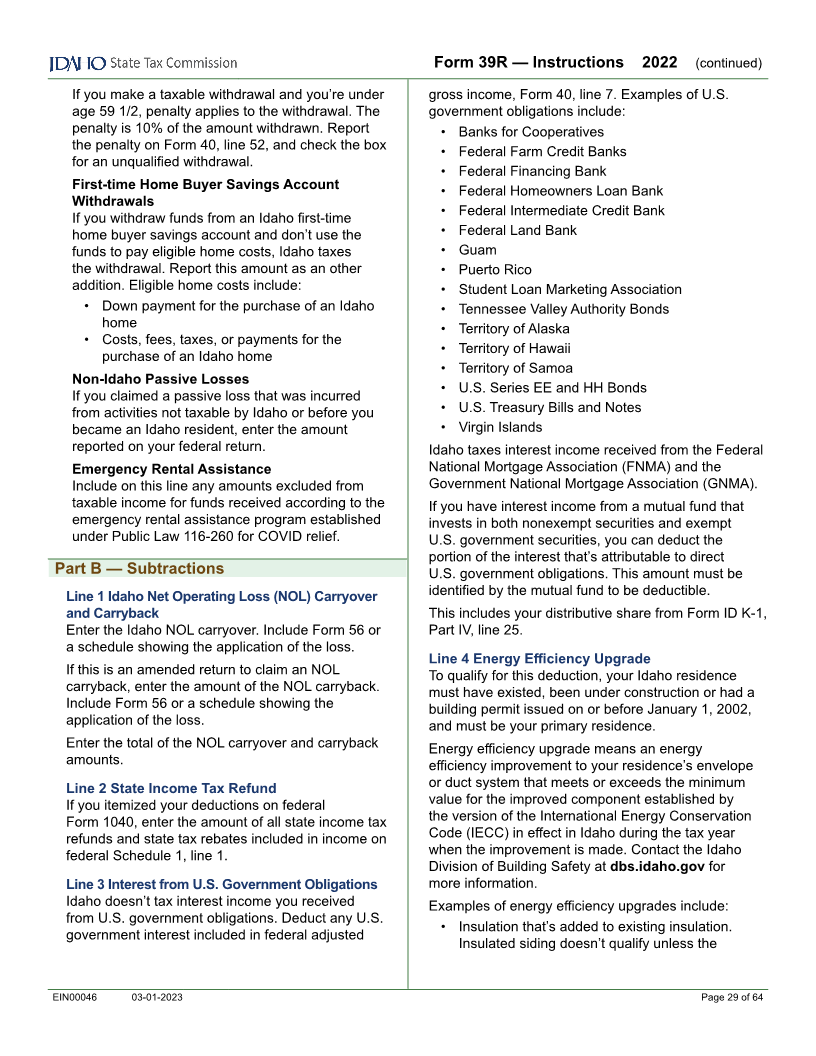

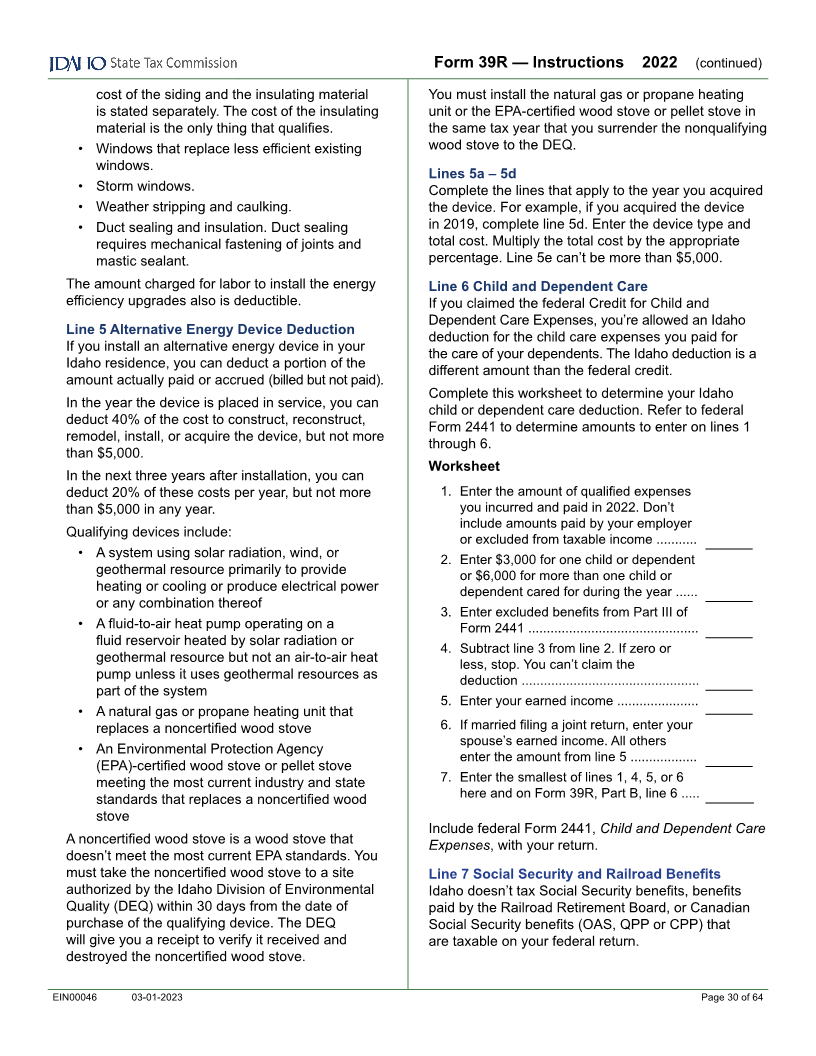

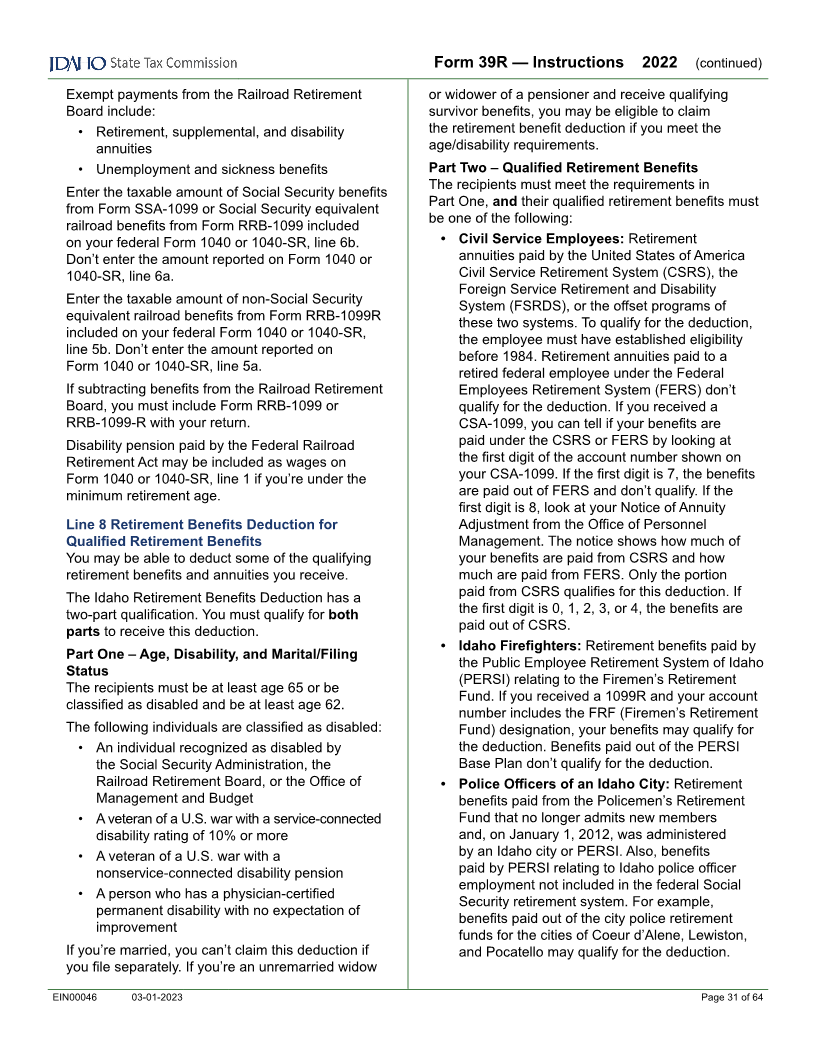

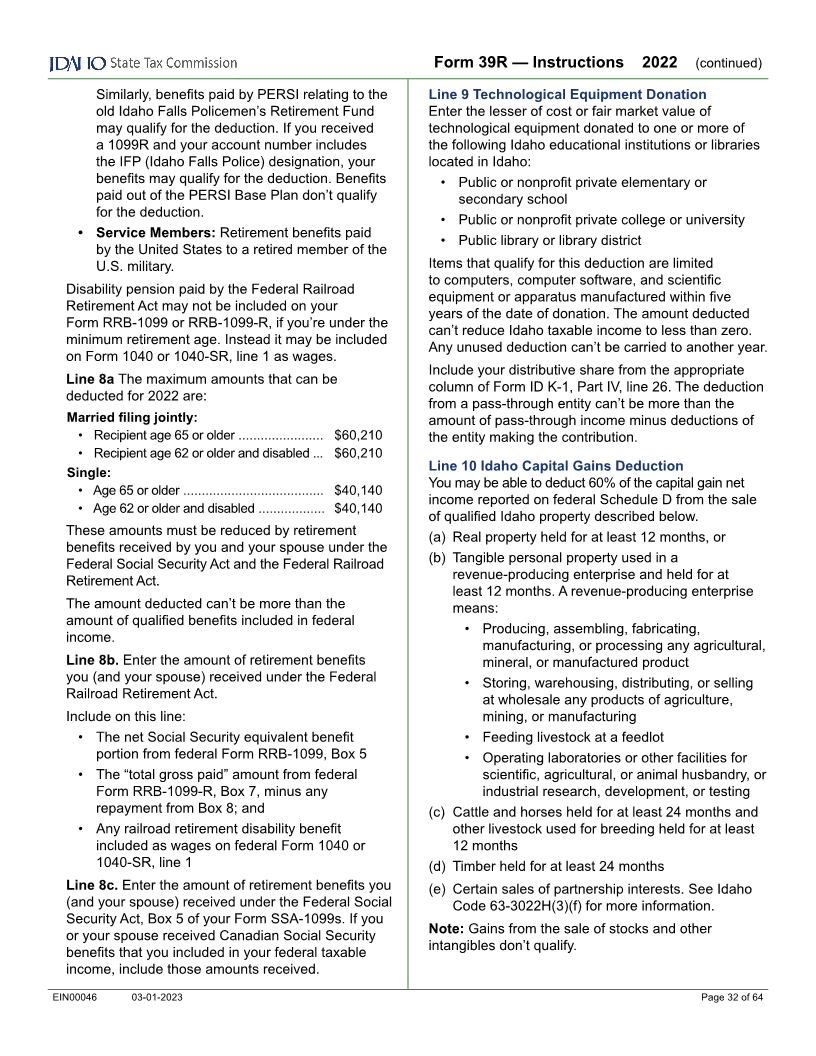

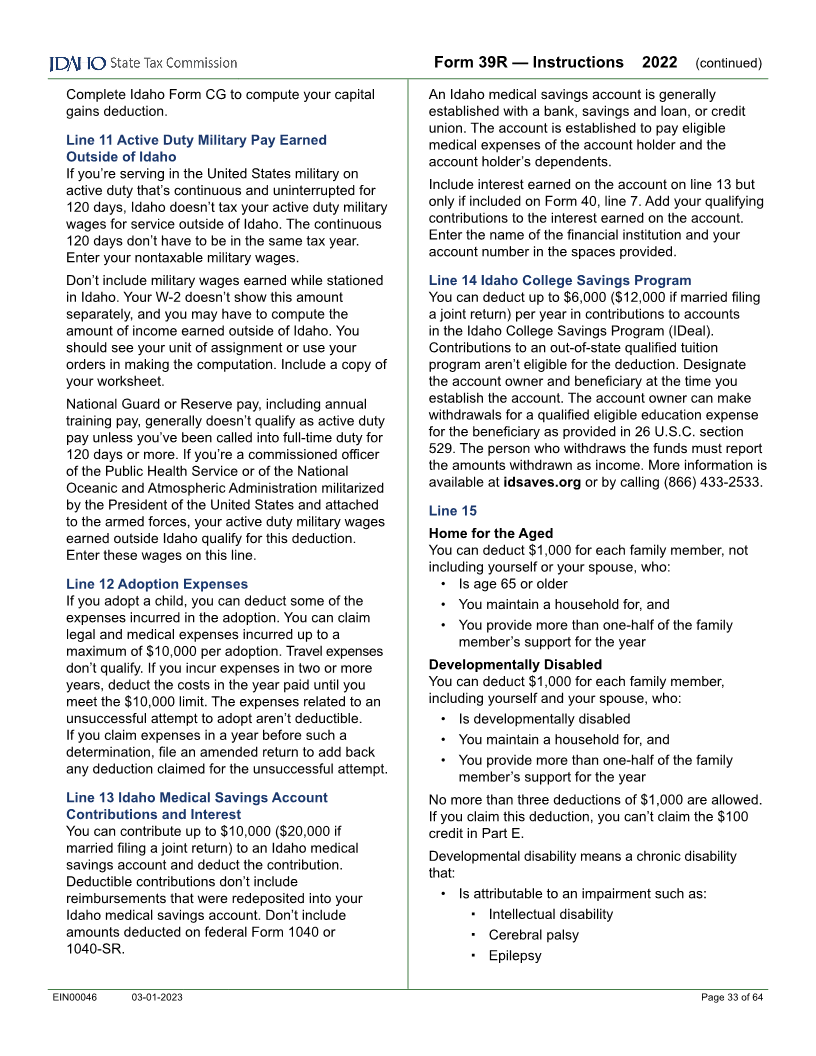

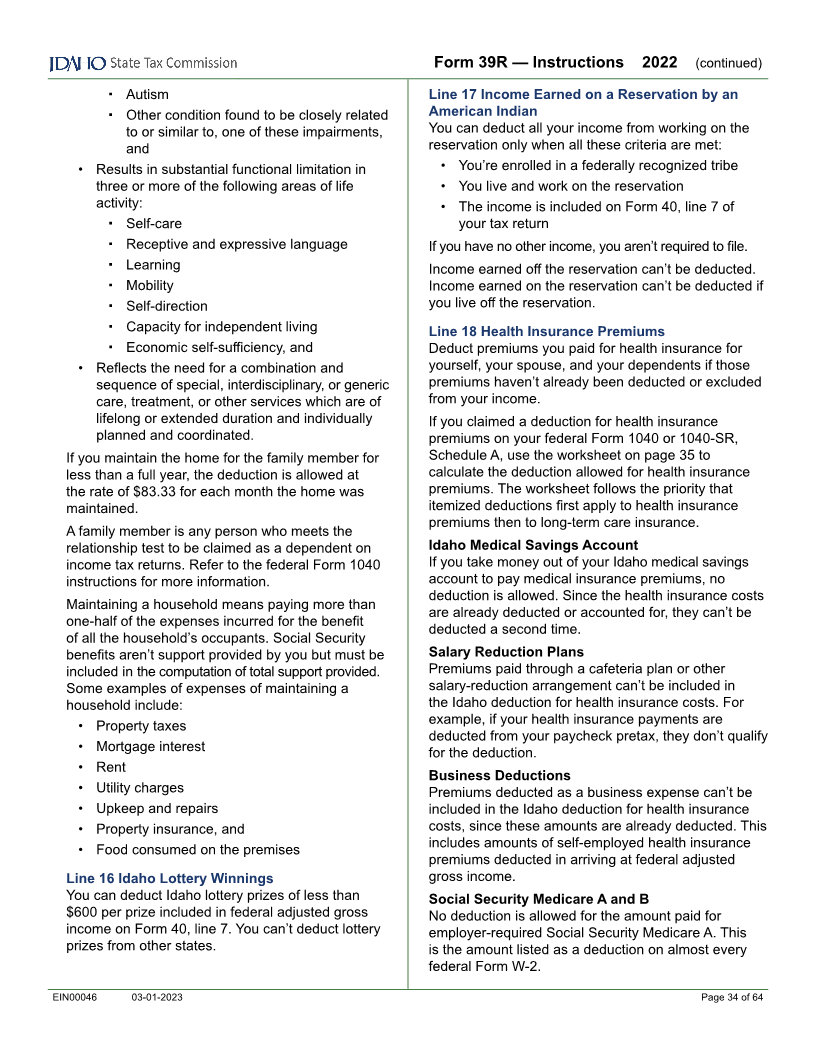

If Form 40, line 19 or And your filing status is If Form 40, line 19 or And your filing status is If Form 40, line 19 or And your filing status is

Form 43, line 41 is Form 43, line 41 is Form 43, line 41 is

At But Single or Married At But Single or Married At But Single or Married

Least Less Married Filing Least Less Married Filing Least Less Married Filing

Than Filing Jointly* or Than Filing Jointly* or Than Filing Jointly* or

Separately Head of Separately Head of Separately Head of

Household Household Household

$33,000 Your tax is — $36,000 Your tax is — $39,000 Your tax is —

33,000 33,050 1,749 1,516 36,000 36,050 1,929 1,696 39,000 39,050 2,109 1,876

33,050 33,100 1,752 1,519 36,050 36,100 1,932 1,699 39,050 39,100 2,112 1,879

33,100 33,150 1,755 1,522 36,100 36,150 1,935 1,702 39,100 39,150 2,115 1,882

33,150 33,200 1,758 1,525 36,150 36,200 1,938 1,705 39,150 39,200 2,118 1,885

33,200 33,250 1,761 1,528 36,200 36,250 1,941 1,708 39,200 39,250 2,121 1,888

33,250 33,300 1,764 1,531 36,250 36,300 1,944 1,711 39,250 39,300 2,124 1,891

33,300 33,350 1,767 1,534 36,300 36,350 1,947 1,714 39,300 39,350 2,127 1,894

33,350 33,400 1,770 1,537 36,350 36,400 1,950 1,717 39,350 39,400 2,130 1,897

33,400 33,450 1,773 1,540 36,400 36,450 1,953 1,720 39,400 39,450 2,133 1,900

33,450 33,500 1,776 1,543 36,450 36,500 1,956 1,723 39,450 39,500 2,136 1,903

33,500 33,550 1,779 1,546 36,500 36,550 1,959 1,726 39,500 39,550 2,139 1,906

33,550 33,600 1,782 1,549 36,550 36,600 1,962 1,729 39,550 39,600 2,142 1,909

33,600 33,650 1,785 1,552 36,600 36,650 1,965 1,732 39,600 39,650 2,145 1,912

33,650 33,700 1,788 1,555 36,650 36,700 1,968 1,735 39,650 39,700 2,148 1,915

33,700 33,750 1,791 1,558 36,700 36,750 1,971 1,738 39,700 39,750 2,151 1,918

33,750 33,800 1,794 1,561 36,750 36,800 1,974 1,741 39,750 39,800 2,154 1,921

33,800 33,850 1,797 1,564 36,800 36,850 1,977 1,744 39,800 39,850 2,157 1,924

33,850 33,900 1,800 1,567 36,850 36,900 1,980 1,747 39,850 39,900 2,160 1,927

33,900 33,950 1,803 1,570 36,900 36,950 1,983 1,750 39,900 39,950 2,163 1,930

33,950 34,000 1,806 1,573 36,950 37,000 1,986 1,753 39,950 40,000 2,166 1,933

$34,000 $37,000 $40,000

34,000 34,050 1,809 1,576 37,000 37,050 1,989 1,756 40,000 40,050 2,169 1,936

34,050 34,100 1,812 1,579 37,050 37,100 1,992 1,759 40,050 40,100 2,172 1,939

34,100 34,150 1,815 1,582 37,100 37,150 1,995 1,762 40,100 40,150 2,175 1,942

34,150 34,200 1,818 1,585 37,150 37,200 1,998 1,765 40,150 40,200 2,178 1,945

34,200 34,250 1,821 1,588 37,200 37,250 2,001 1,768 40,200 40,250 2,181 1,948

34,250 34,300 1,824 1,591 37,250 37,300 2,004 1,771 40,250 40,300 2,184 1,951

34,300 34,350 1,827 1,594 37,300 37,350 2,007 1,774 40,300 40,350 2,187 1,954

34,350 34,400 1,830 1,597 37,350 37,400 2,010 1,777 40,350 40,400 2,190 1,957

34,400 34,450 1,833 1,600 37,400 37,450 2,013 1,780 40,400 40,450 2,193 1,960

34,450 34,500 1,836 1,603 37,450 37,500 2,016 1,783 40,450 40,500 2,196 1,963

34,500 34,550 1,839 1,606 37,500 37,550 2,019 1,786 40,500 40,550 2,199 1,966

34,550 34,600 1,842 1,609 37,550 37,600 2,022 1,789 40,550 40,600 2,202 1,969

34,600 34,650 1,845 1,612 37,600 37,650 2,025 1,792 40,600 40,650 2,205 1,972

34,650 34,700 1,848 1,615 37,650 37,700 2,028 1,795 40,650 40,700 2,208 1,975

34,700 34,750 1,851 1,618 37,700 37,750 2,031 1,798 40,700 40,750 2,211 1,978

34,750 34,800 1,854 1,621 37,750 37,800 2,034 1,801 40,750 40,800 2,214 1,981

34,800 34,850 1,857 1,624 37,800 37,850 2,037 1,804 40,800 40,850 2,217 1,984

34,850 34,900 1,860 1,627 37,850 37,900 2,040 1,807 40,850 40,900 2,220 1,987

34,900 34,950 1,863 1,630 37,900 37,950 2,043 1,810 40,900 40,950 2,223 1,990

34,950 35,000 1,866 1,633 37,950 38,000 2,046 1,813 40,950 41,000 2,226 1,993

$35,000 $38,000 $41,000

35,000 35,050 1,869 1,636 38,000 38,050 2,049 1,816 41,000 41,050 2,229 1,996

35,050 35,100 1,872 1,639 38,050 38,100 2,052 1,819 41,050 41,100 2,232 1,999

35,100 35,150 1,875 1,642 38,100 38,150 2,055 1,822 41,100 41,150 2,235 2,002

35,150 35,200 1,878 1,645 38,150 38,200 2,058 1,825 41,150 41,200 2,238 2,005

35,200 35,250 1,881 1,648 38,200 38,250 2,061 1,828 41,200 41,250 2,241 2,008

35,250 35,300 1,884 1,651 38,250 38,300 2,064 1,831 41,250 41,300 2,244 2,011

35,300 35,350 1,887 1,654 38,300 38,350 2,067 1,834 41,300 41,350 2,247 2,014

35,350 35,400 1,890 1,657 38,350 38,400 2,070 1,837 41,350 41,400 2,250 2,017

35,400 35,450 1,893 1,660 38,400 38,450 2,073 1,840 41,400 41,450 2,253 2,020

35,450 35,500 1,896 1,663 38,450 38,500 2,076 1,843 41,450 41,500 2,256 2,023

35,500 35,550 1,899 1,666 38,500 38,550 2,079 1,846 41,500 41,550 2,259 2,026

35,550 35,600 1,902 1,669 38,550 38,600 2,082 1,849 41,550 41,600 2,262 2,029

35,600 35,650 1,905 1,672 38,600 38,650 2,085 1,852 41,600 41,650 2,265 2,032

35,650 35,700 1,908 1,675 38,650 38,700 2,088 1,855 41,650 41,700 2,268 2,035

35,700 35,750 1,911 1,678 38,700 38,750 2,091 1,858 41,700 41,750 2,271 2,038

35,750 35,800 1,914 1,681 38,750 38,800 2,094 1,861 41,750 41,800 2,274 2,041

35,800 35,850 1,917 1,684 38,800 38,850 2,097 1,864 41,800 41,850 2,277 2,044

35,850 35,900 1,920 1,687 38,850 38,900 2,100 1,867 41,850 41,900 2,280 2,047

35,900 35,950 1,923 1,690 38,900 38,950 2,103 1,870 41,900 41,950 2,283 2,050

35,950 36,000 1,926 1,693 38,950 39,000 2,106 1,873 41,950 42,000 2,286 2,053

*This column must also be used by a qualifying widow(er).

EIN00046 03-01-2023 Page 57 of 64

|