Enlarge image

DR 0172 (01/17/23)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261 - 0009

*DO=NOT=SEND* (303) 238-SERV (7378)

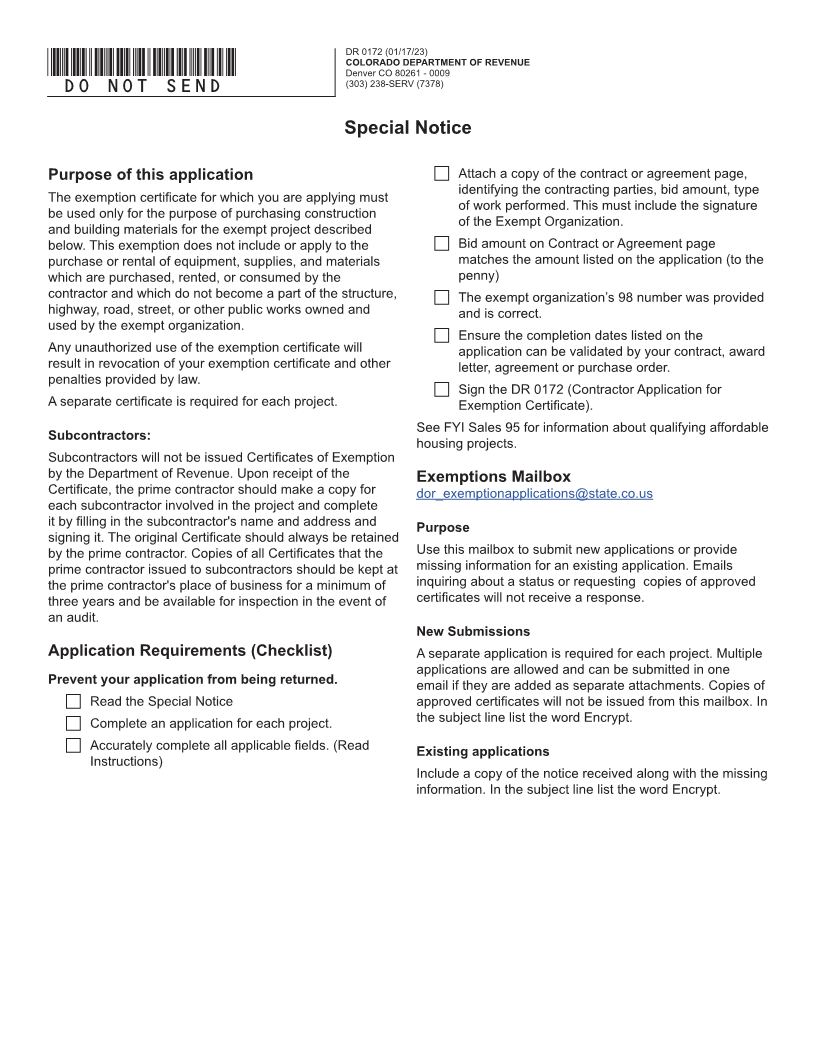

Special Notice

Purpose of this application F Attach a copy of the contract or agreement page,

identifying the contracting parties, bid amount, type

The exemption certificate for which you are applying must

of work performed. This must include the signature

be used only for the purpose of purchasing construction

of the Exempt Organization.

and building materials for the exempt project described

below. This exemption does not include or apply to the F Bid amount on Contract or Agreement page

purchase or rental of equipment, supplies, and materials matches the amount listed on the application (to the

which are purchased, rented, or consumed by the penny)

contractor and which do not become a part of the structure, F The exempt organization’s 98 number was provided

highway, road, street, or other public works owned and and is correct.

used by the exempt organization.

F Ensure the completion dates listed on the

Any unauthorized use of the exemption certificate will application can be validated by your contract, award

result in revocation of your exemption certificate and other letter, agreement or purchase order.

penalties provided by law.

F Sign the DR 0172 (Contractor Application for

A separate certificate is required for each project. Exemption Certificate).

See FYI Sales 95 for information about qualifying affordable

Subcontractors:

housing projects.

Subcontractors will not be issued Certificates of Exemption

by the Department of Revenue. Upon receipt of the Exemptions Mailbox

Certificate, the prime contractor should make a copy for dor_exemptionapplications@state.co.us

each subcontractor involved in the project and complete

it by filling in the subcontractor's name and address and

Purpose

signing it. The original Certificate should always be retained

by the prime contractor. Copies of all Certificates that the Use this mailbox to submit new applications or provide

prime contractor issued to subcontractors should be kept at missing information for an existing application. Emails

the prime contractor's place of business for a minimum of inquiring about a status or requesting copies of approved

three years and be available for inspection in the event of certificates will not receive a response.

an audit.

New Submissions

Application Requirements (Checklist) A separate application is required for each project. Multiple

applications are allowed and can be submitted in one

Prevent your application from being returned. email if they are added as separate attachments. Copies of

F Read the Special Notice approved certificates will not be issued from this mailbox. In

F Complete an application for each project. the subject line list the word Encrypt.

F Accurately complete all applicable fields. (Read

Existing applications

Instructions)

Include a copy of the notice received along with the missing

information. In the subject line list the word Encrypt.