Enlarge image

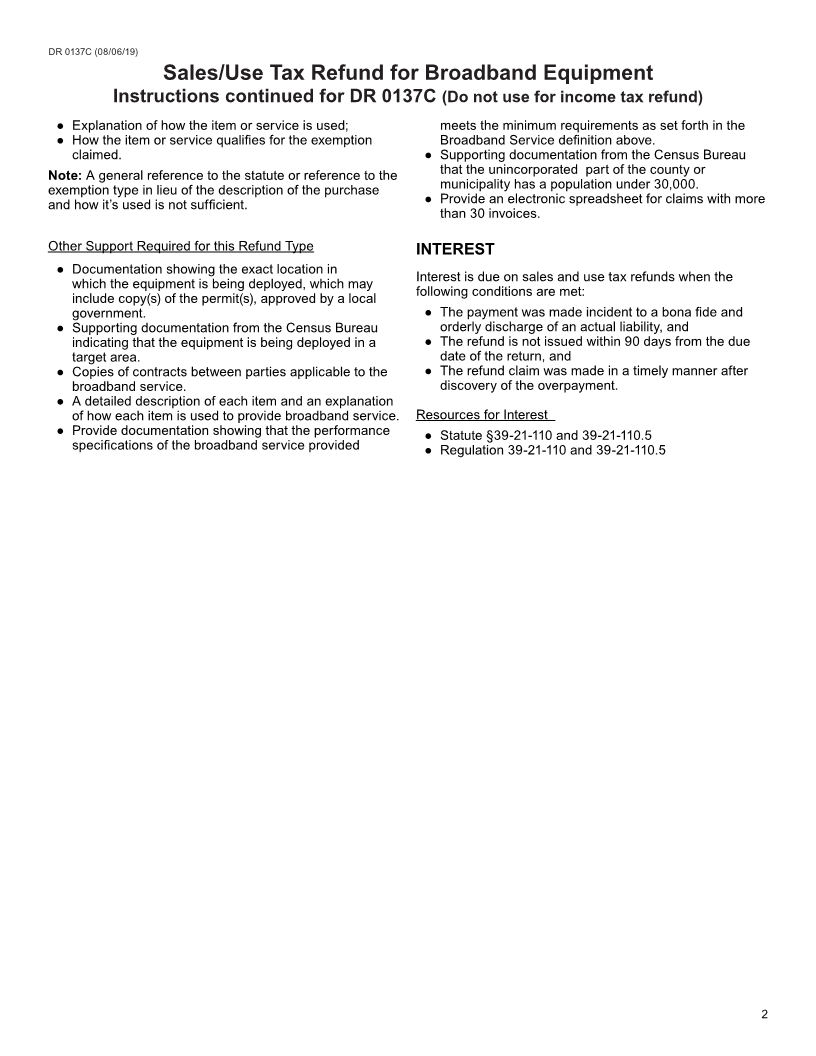

DR 0137C (08/06/19)

COLORADO DEPARTMENT OF REVENUE

Business Tax Accounting, Room 208

PO Box 17087

Denver CO 80217-0087

(303) 238-SERV (7378)

Sales/Use Tax Refund for Broadband Equipment

Instructions for DR 0137C (Do not use for income tax refund)

**Attention**

● Failure to complete the required form(s) and submit all supporting documentation, may cause the amount of the refund

to be reduced or denied.

● For Sellers/Retailers, Consumer Use, Local Marketing, County Lodging and Withholding use Form DR 0137. For

Buyer’s/Purchaser’s claims, use Form DR 0137B.

GENERAL INFORMATION AND RURAL If your claim contains 100 or more invoices, submit at least

BROADBAND PURPOSE: 25% for review which should include the following:

● The majority should be the larger dollar amounts

Do not combine sales and use tax refunds on the same requested.

claim; file a separate claim for each tax account type. If you ● Invoices for each vendor submitted in the claim.

are submitting this claim for a third party, you must include ● Select invoices from each filing period requested in the

a Power of Attorney (DR 0145). Keep all documentation claim.

supporting refund claims at the location of your business ● Invoices from the vendor the items were purchased

records. For assistance in determining the breakdown of from should be submitted. Do not submit internal

the tax rate on your invoice, see publication DR 1002. invoices. If your claim contains internal invoices,

provide the purchase order.

● Bundled using paper clips or binder clips. Do not staple

BROADBAND EQUIPMENT REFUND documents together.

A broadband provider is allowed to claim a refund for

Please note: The department may request additional

equipment used in providing broadband service in a

invoices if it is deemed necessary.

target area. The refund only applies to state sales tax or

state use tax. Proof of Payment

Claims must be received no earlier than January 1st ● Sales Tax receipt from vendor. This should list the

and no later than April 1st for the immediately preceding purchases, the sales tax charged, and record of the

calendar year. The total amount of refunds is limited to one payment.

million dollars for each calendar year. In the event that the ● For purchases made using invoices or purchase orders

total refunds claims exceed one million dollars, the refunds provide a copy of canceled check (front and back)

will be prorated to all broadband providers that submitted a or if paid electronically the bank statement or EFT

valid claim. transaction details and confirmation.

The Department of Revenue will not review claims until

after April 1st of each year. Spreadsheets

Broadband Provider means a person that provides Spreadsheets must be submitted in readable form (at

broadband service. least 10 point font or larger). Each vendor’s data must be

totaled separately.

Broadband Service means any communications service

having the capacity to transmit data to enable a subscriber Note: To reduce errors and for faster processing, electronic

to the service to originate and receive high-quality voice, spreadsheets are preferred (CD or USB).

data, graphics, and video at speeds of at least four megabits The invoices that are included with the spreadsheet should

per second for download and one megabit per second be numbered and match the spreadsheet. A spreadsheet

for upload or the Federal Communications Commission’s showing how the refund amount was calculated should be

definition of broadband service, whichever is faster. included with the following columns per invoice:

Target Area means the unincorporated part of a ● Store or vendor’s name;

county or municipality with a population of less than ● FEIN or Colorado Account number (CAN) of the

thirty thousand (30,000) people, according to the most vendor;

recently available population statistic of the United ● Date of purchase;

States Bureau of the Census. ● Invoice number;

● Sales price of item before tax;

● State sales/use tax paid, county sales/use tax paid,

REQUIRED DOCUMENTATION: city sales/use tax paid, special district sales/use tax

paid, etc. (separate column for each tax);

Invoices or purchase orders ● Total of each tax refund requested by tax type;

If your claim contains under 100 invoices, submit copies of ● Indication of whether a copy of this invoice is enclosed;

all invoices for review. ● A brief description of the item or service purchases;

1