Enlarge image

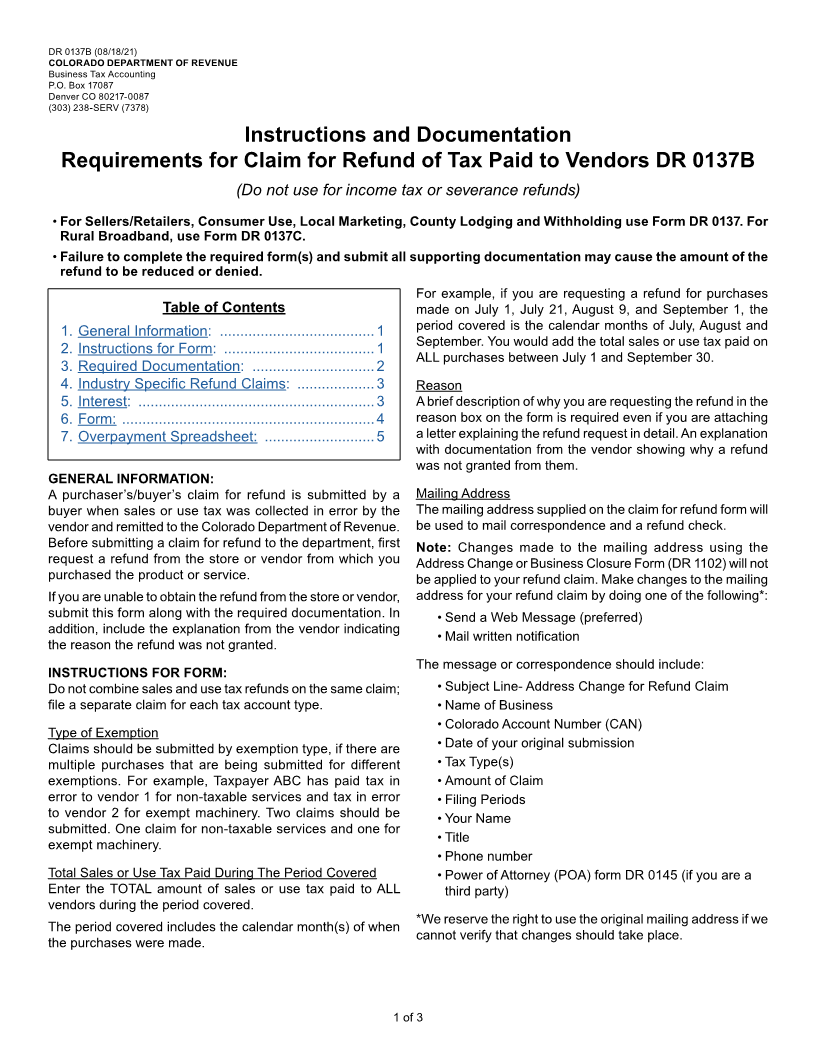

DR 0137B (08/18/21)

COLORADO DEPARTMENT OF REVENUE

Business Tax Accounting

P.O. Box 17087

Denver CO 80217-0087

(303) 238-SERV (7378)

Instructions and Documentation

Requirements for Claim for Refund of Tax Paid to Vendors DR 0137B

(Do not use for income tax or severance refunds)

• For Sellers/Retailers, Consumer Use, Local Marketing, County Lodging and Withholding use Form DR 0137. For

Rural Broadband, use Form DR 0137C.

• Failure to complete the required form(s) and submit all supporting documentation may cause the amount of the

refund to be reduced or denied.

For example, if you are requesting a refund for purchases

Table of Contents made on July 1, July 21, August 9, and September 1, the

1. General Information: ......................................1 period covered is the calendar months of July, August and

September. You would add the total sales or use tax paid on

2. Instructions for Form: .....................................1

ALL purchases between July 1 and September 30.

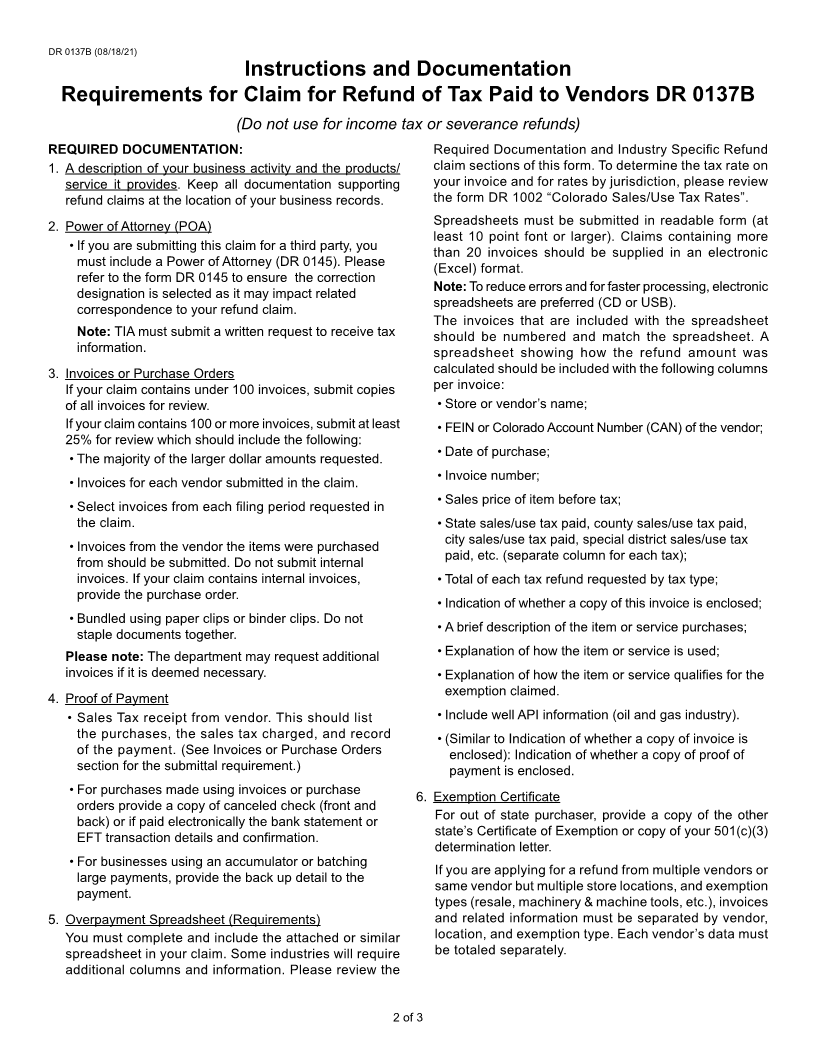

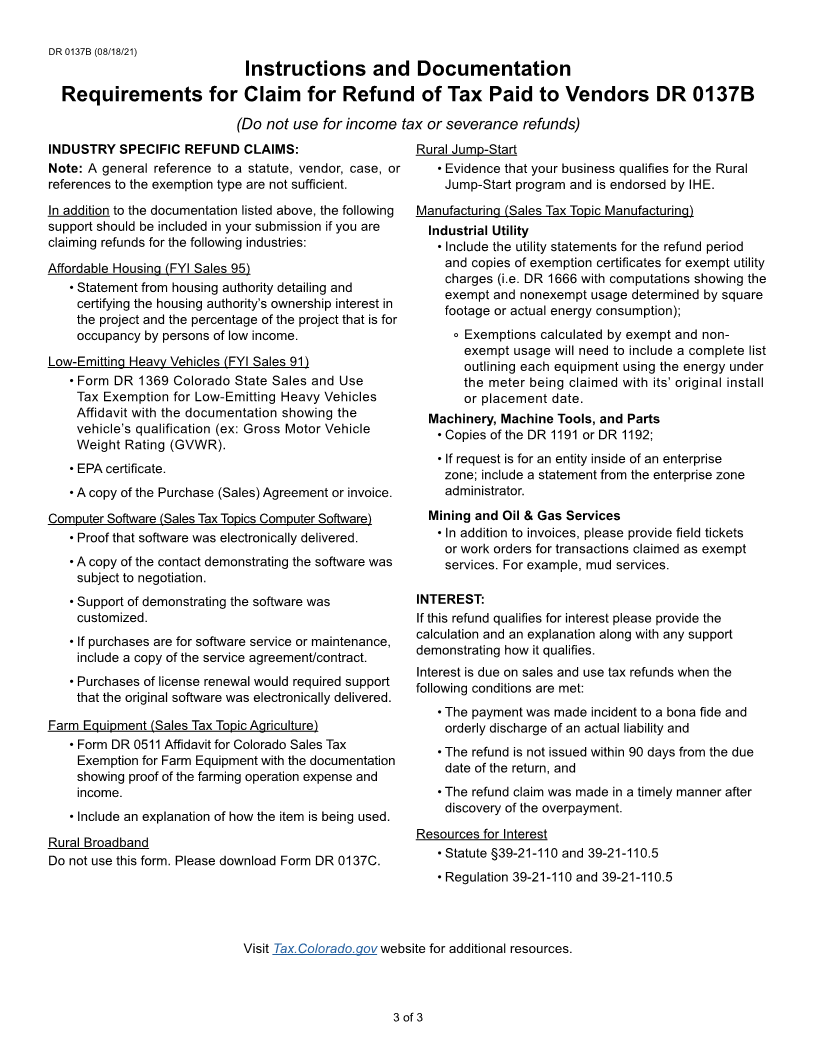

3. Required Documentation: ..............................2

4. Industry Specific Refund Claims: ...................3 Reason

5. Interest: ..........................................................3 A brief description of why you are requesting the refund in the

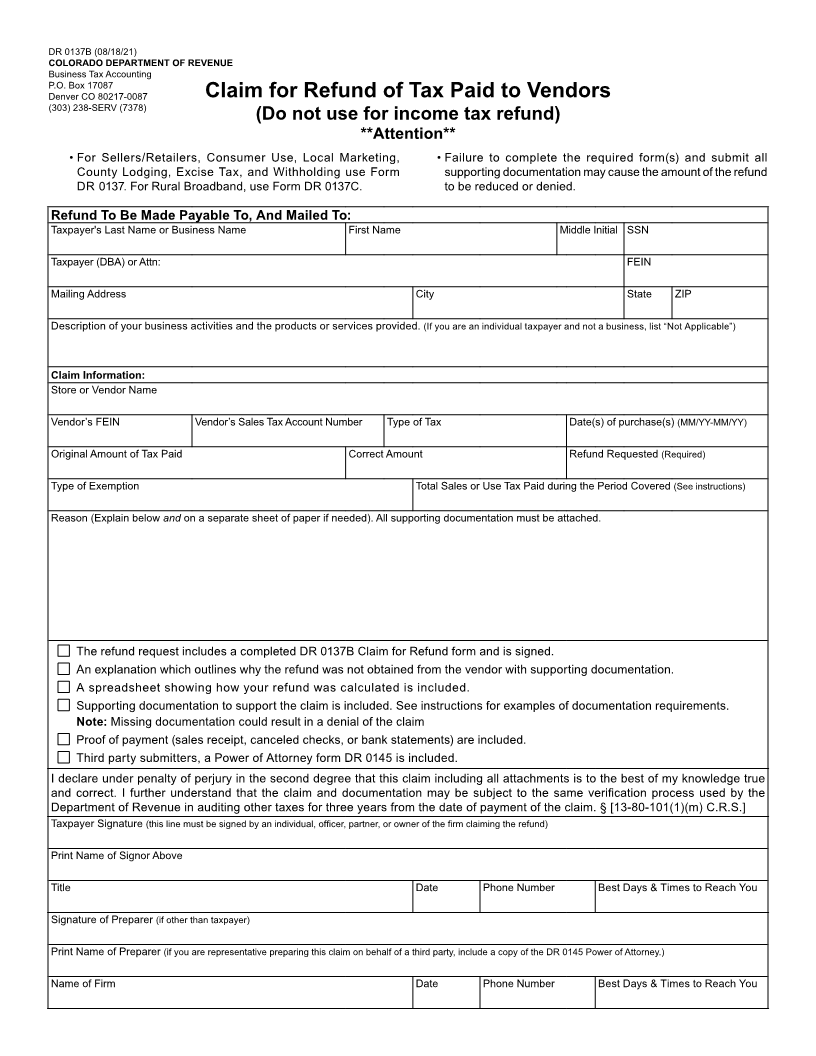

6. Form: ..............................................................4 reason box on the form is required even if you are attaching

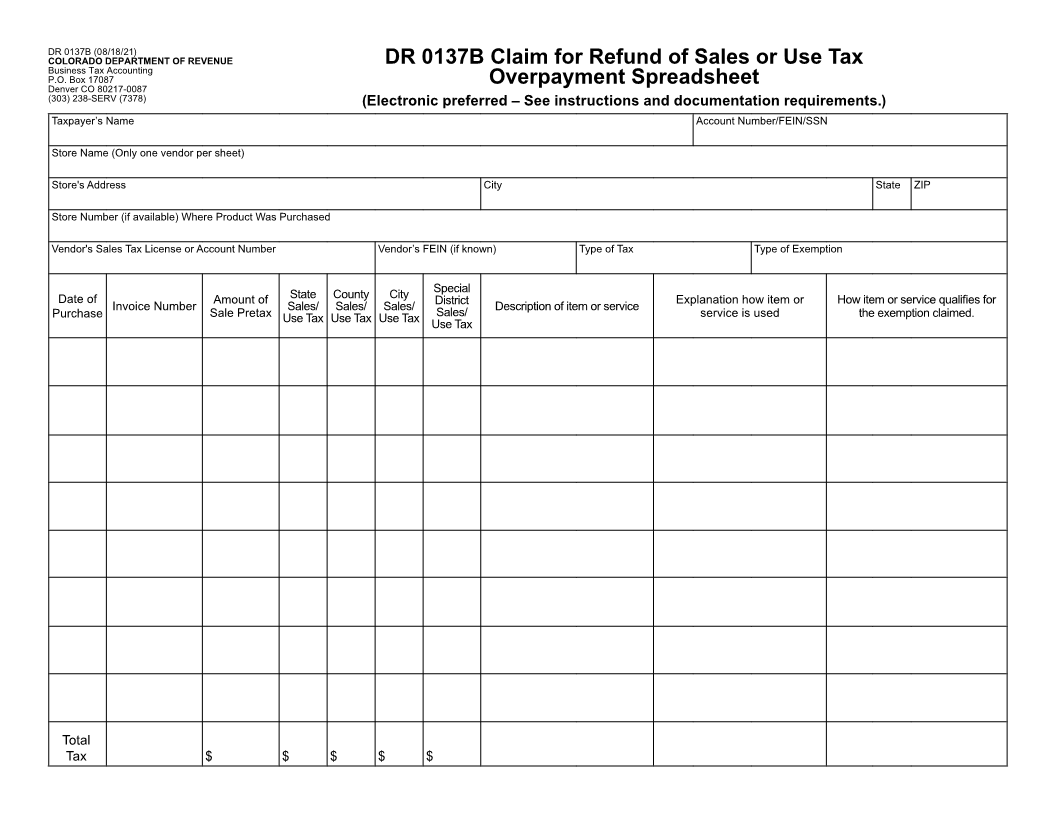

7. Overpayment Spreadsheet: ...........................5 a letter explaining the refund request in detail. An explanation

with documentation from the vendor showing why a refund

was not granted from them.

GENERAL INFORMATION:

A purchaser’s/buyer’s claim for refund is submitted by a Mailing Address

buyer when sales or use tax was collected in error by the The mailing address supplied on the claim for refund form will

vendor and remitted to the Colorado Department of Revenue. be used to mail correspondence and a refund check.

Before submitting a claim for refund to the department, first Note: Changes made to the mailing address using the

request a refund from the store or vendor from which you Address Change or Business Closure Form (DR 1102) will not

purchased the product or service. be applied to your refund claim. Make changes to the mailing

If you are unable to obtain the refund from the store or vendor, address for your refund claim by doing one of the following*:

submit this form along with the required documentation. In • Send a Web Message (preferred)

addition, include the explanation from the vendor indicating

• Mail written notification

the reason the refund was not granted.

The message or correspondence should include:

INSTRUCTIONS FOR FORM:

Do not combine sales and use tax refunds on the same claim; • Subject Line- Address Change for Refund Claim

file a separate claim for each tax account type. • Name of Business

• Colorado Account Number (CAN)

Type of Exemption

Claims should be submitted by exemption type, if there are • Date of your original submission

multiple purchases that are being submitted for different • Tax Type(s)

exemptions. For example, Taxpayer ABC has paid tax in • Amount of Claim

error to vendor 1 for non-taxable services and tax in error • Filing Periods

to vendor 2 for exempt machinery. Two claims should be • Your Name

submitted. One claim for non-taxable services and one for

• Title

exempt machinery.

• Phone number

Total Sales or Use Tax Paid During The Period Covered • Power of Attorney (POA) form DR 0145 (if you are a

Enter the TOTAL amount of sales or use tax paid to ALL third party)

vendors during the period covered.

*We reserve the right to use the original mailing address if we

The period covered includes the calendar month(s) of when

cannot verify that changes should take place.

the purchases were made.

1 of 3