Enlarge image

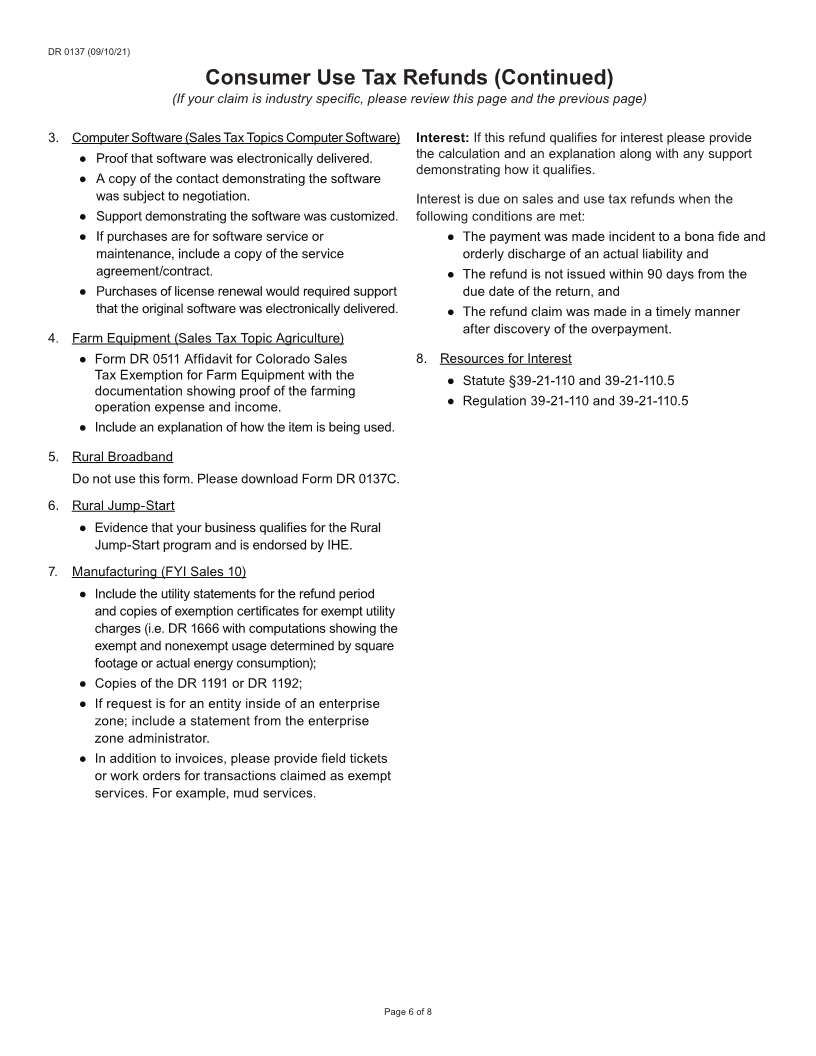

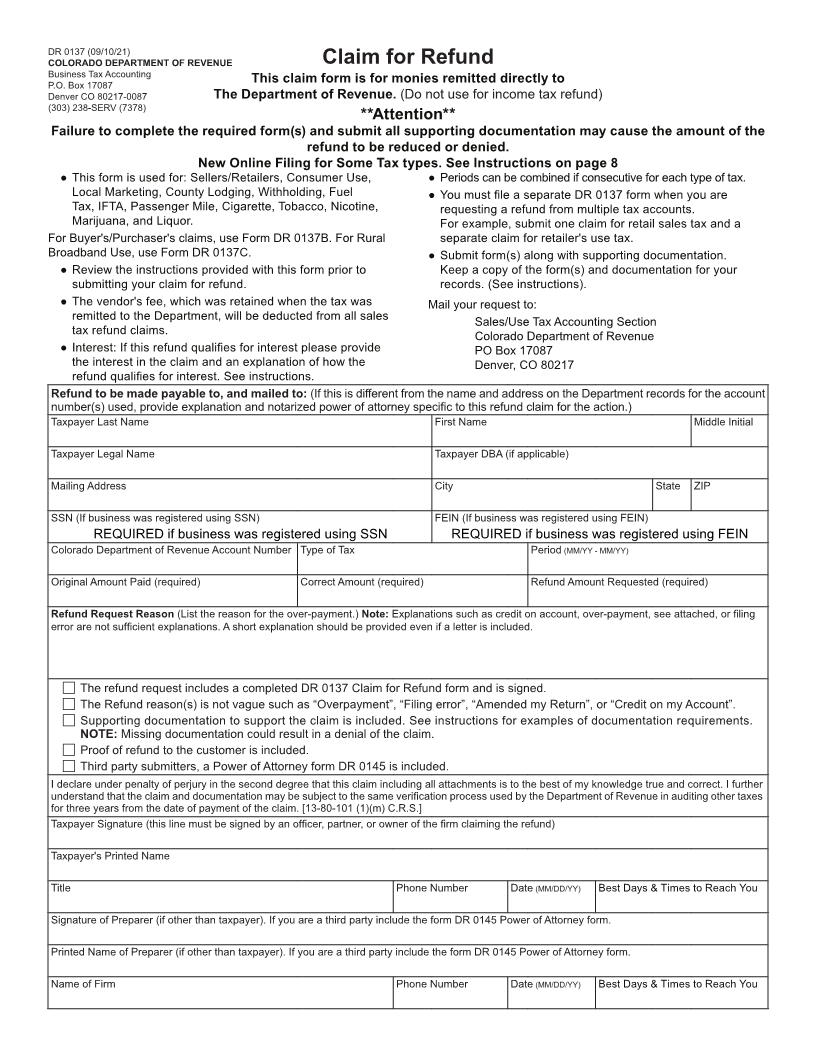

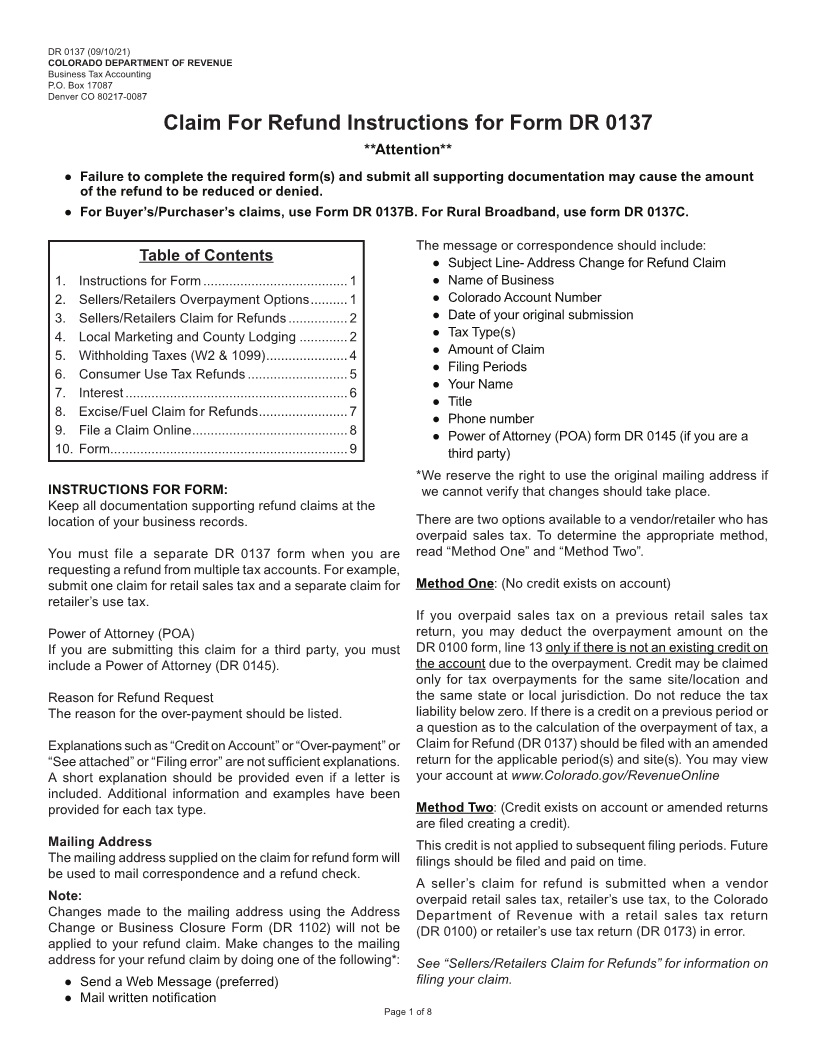

DR 0137 (09/10/21)

COLORADO DEPARTMENT OF REVENUE

Business Tax Accounting

P.O. Box 17087

Denver CO 80217-0087

Claim For Refund Instructions for Form DR 0137

**Attention**

● Failure to complete the required form(s) and submit all supporting documentation may cause the amount

of the refund to be reduced or denied.

● For Buyer’s/Purchaser’s claims, use Form DR 0137B. For Rural Broadband, use form DR 0137C.

The message or correspondence should include:

Table of Contents ● Subject Line- Address Change for Refund Claim

1. Instructions for Form .......................................1 ● Name of Business

2. Sellers/Retailers Overpayment Options ..........1 ● Colorado Account Number

3. Sellers/Retailers Claim for Refunds ................2 ● Date of your original submission

4. Local Marketing and County Lodging .............2 ● Tax Type(s)

5. Withholding Taxes (W2 & 1099) ......................4 ● Amount of Claim

● Filing Periods

6. Consumer Use Tax Refunds ...........................5

● Your Name

7. Interest ............................................................6

● Title

8. Excise/Fuel Claim for Refunds ........................7

● Phone number

9. File a Claim Online ..........................................8 ● Power of Attorney (POA) form DR 0145 (if you are a

10. Form... .............................................................9 third party)

* We reserve the right to use the original mailing address if

INSTRUCTIONS FOR FORM: we cannot verify that changes should take place.

Keep all documentation supporting refund claims at the

location of your business records. There are two options available to a vendor/retailer who has

overpaid sales tax. To determine the appropriate method,

You must file a separate DR 0137 form when you are read “Method One” and “Method Two”.

requesting a refund from multiple tax accounts. For example,

submit one claim for retail sales tax and a separate claim for Method One: (No credit exists on account)

retailer’s use tax.

If you overpaid sales tax on a previous retail sales tax

Power of Attorney (POA) return, you may deduct the overpayment amount on the

If you are submitting this claim for a third party, you must DR 0100 form, line 13 only if there is not an existing credit on

include a Power of Attorney (DR 0145). the account due to the overpayment. Credit may be claimed

only for tax overpayments for the same site/location and

Reason for Refund Request the same state or local jurisdiction. Do not reduce the tax

The reason for the over-payment should be listed. liability below zero. If there is a credit on a previous period or

a question as to the calculation of the overpayment of tax, a

Explanations such as “Credit on Account” or “Over-payment” or Claim for Refund (DR 0137) should be filed with an amended

“See attached” or “Filing error” are not sufficient explanations. return for the applicable period(s) and site(s). You may view

A short explanation should be provided even if a letter is your account at www.Colorado.gov/RevenueOnline

included. Additional information and examples have been

provided for each tax type. Method Two: (Credit exists on account or amended returns

are filed creating a credit).

Mailing Address This credit is not applied to subsequent filing periods. Future

The mailing address supplied on the claim for refund form will filings should be filed and paid on time.

be used to mail correspondence and a refund check.

A seller’s claim for refund is submitted when a vendor

Note: overpaid retail sales tax, retailer’s use tax, to the Colorado

Changes made to the mailing address using the Address Department of Revenue with a retail sales tax return

Change or Business Closure Form (DR 1102) will not be (DR 0100) or retailer’s use tax return (DR 0173) in error.

applied to your refund claim. Make changes to the mailing

address for your refund claim by doing one of the following*: See “Sellers/Retailers Claim for Refunds” for information on

● Send a Web Message (preferred) filing your claim.

● Mail written notification

Page 1 of 8