Enlarge image

DR 0593 (06/11/15)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

*150593==19999*

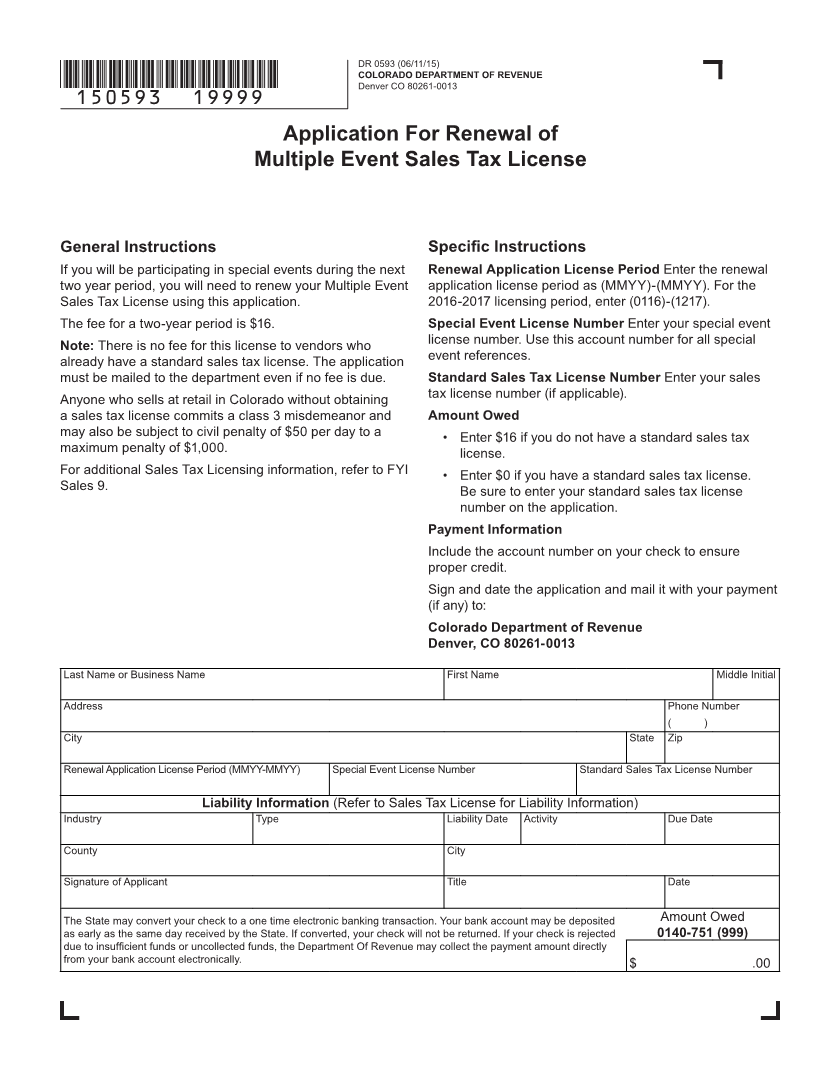

Application For Renewal of

Multiple Event Sales Tax License

General Instructions Specific Instructions

If you will be participating in special events during the next Renewal Application License Period Enter the renewal

two year period, you will need to renew your Multiple Event application license period as (MMYY)-(MMYY). For the

Sales Tax License using this application. 2016-2017 licensing period, enter (0116)-(1217).

The fee for a two-year period is $16. Special Event License Number Enter your special event

Note: There is no fee for this license to vendors who license number. Use this account number for all special

already have a standard sales tax license. The application event references.

must be mailed to the department even if no fee is due. Standard Sales Tax License Number Enter your sales

Anyone who sells at retail in Colorado without obtaining tax license number (if applicable).

a sales tax license commits a class 3 misdemeanor and Amount Owed

may also be subject to civil penalty of $50 per day to a • Enter $16 if you do not have a standard sales tax

maximum penalty of $1,000. license.

For additional Sales Tax Licensing information, refer to FYI • Enter $0 if you have a standard sales tax license.

Sales 9. Be sure to enter your standard sales tax license

number on the application.

Payment Information

Include the account number on your check to ensure

proper credit.

Sign and date the application and mail it with your payment

(if any) to:

Colorado Department of Revenue

Denver, CO 80261-0013

Last Name or Business Name First Name Middle Initial

Address Phone Number

( )

City State Zip

Renewal Application License Period (MMYY-MMYY) Special Event License Number Standard Sales Tax License Number

Liability Information (Refer to Sales Tax License for Liability Information)

Industry Type Liability Date Activity Due Date

County City

Signature of Applicant Title Date

The State may convert your check to a one time electronic banking transaction. Your bank account may be deposited Amount Owed

as early as the same day received by the State. If converted, your check will not be returned. If your check is rejected 0140-751 (999)

due to insufficient funds or uncollected funds, the Department Of Revenue may collect the payment amount directly

from your bank account electronically. $ .00