Enlarge image

DR 0200 (05/14/14)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0013

(303) 238-SERV (7378)

Colorado Football District

Sales Tax Return-Instructions

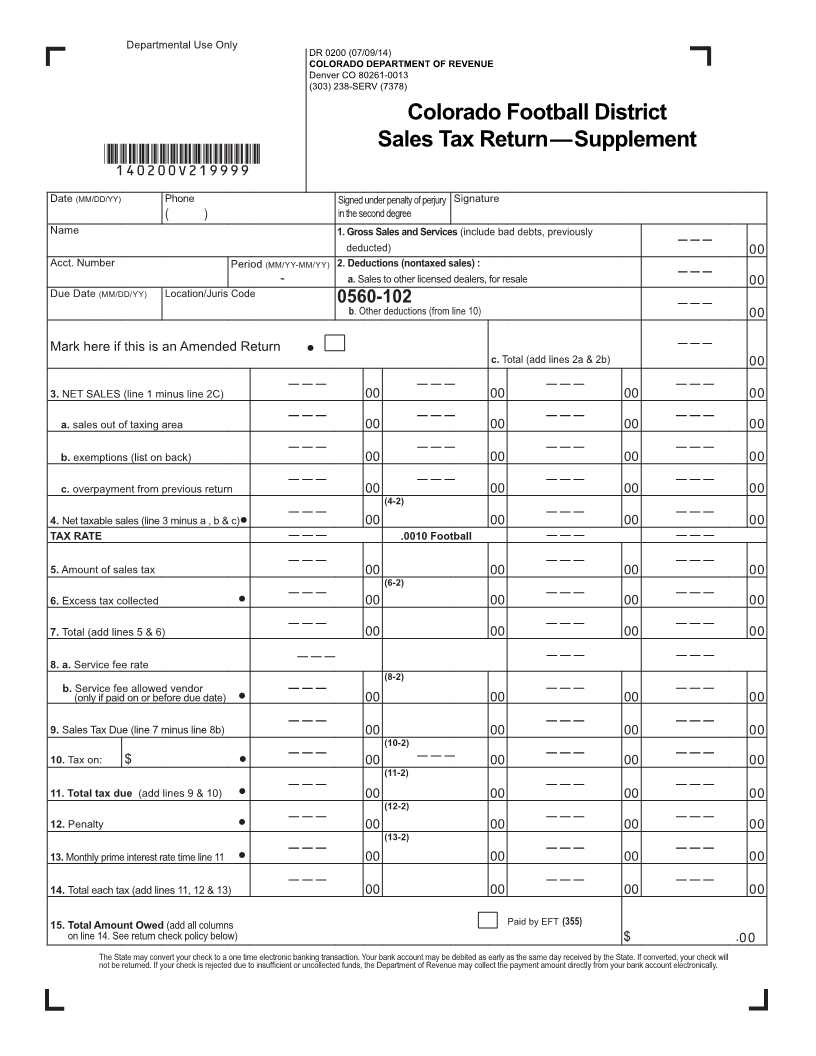

The DR 0200 Football District Sales Tax Return- Supplement Line 8A: Service fee rate. If this rate is not shown, see

should only be used if you are required to collect the football Colorado Sales/Use Tax Rates (DR 1002) to

district tax on periodic payments made or leases entered into determine appropriate rate.

before the sunset of the tax. Enter deduction for service (vendor’s) fee allowed

Line 8B:

The Football District tax sunset date was December 31, 2011 to the seller for each applicable tax. Multiply line

and the DR 0200 should be used to report tax on leases 7 by the applicable service fee rate shown in

entered into before January 1, 2012. If you enter into a new each column. This deduction is only allowed if the

lease or credit sale on or after January 1, 2012, you should complete return is filed and the tax is paid on or

not collect the Football District Tax on that lease. If you do not before due date. Note: For timely filed returns due

require this form, notify the department at (303) 238-SERV on or after July 1, 2014, the FD service rate fee is

(7378). See the form DR 1002 Colorado Sales/Use Tax Rates .0333 (3.33 percent).

at www.TaxColorado.com for more information. Sales tax due. Line 7 minus line 8B.

Line 9:

Change in Ownership: Sales tax statutes require that This line is not applicable to this form.

Line 10:

the Department of Revenue be notified of any changes in

ownership, names, or addresses. Notify by separate letter. Line 11: Total tax due (Bring down the figure from line 9).

Important note: RTD and CD special district taxes must be Line 12: Penalty. Failure to file the return by the due date or

reported on the location return for the DR 0100 as applicable. pay the tax by the due date subjects the vendor to a

See DR 1002 on the department’s Web site penalty of 10% plus 1/2% for each additional month

www.TaxColorado.com for applicable rates. If you do not not to exceed 18% of the tax due.

require this form, please notify the department at Line 13: Interest and penalty interest. Failure to file the

(303) 238-SERV (7378). return and pay the tax on time subjects the vendor

Lines 1., 2A., 2B., C., 3., 3A., 3B. and 3C. are not applicable to interest at the prime rate effective on July 1 of the

to the DR 0200. Only the net taxable sales generated from previous year and to penalty interest at the same

leases entered into before the sunset of the football district tax amount. Monthly interest rate may be prorated for a

that are still in effect through the life of the contract should be part of a month. Current interest rates are available

reported on the DR 0200. on Department of Revenue Web site,

www.TaxColorado.com

Line 4: Enter the net taxable sales from football leases in

column two. Line 14: Total each tax (add lines 11, 12, & 13)

Line 5: Multiply the net taxable sales from leases by the tax Line 15: Add the total of ALL taxes shown in each column

rate and enter in the appropriate column on line 5. of line 14. Amount shown in line 15 must equal

amount remitted. If paying by EFT, be sure to mark

Line 6: Enter the amount of excess tax collected. the box.

Line 7: Add lines 5 and 6.