Enlarge image

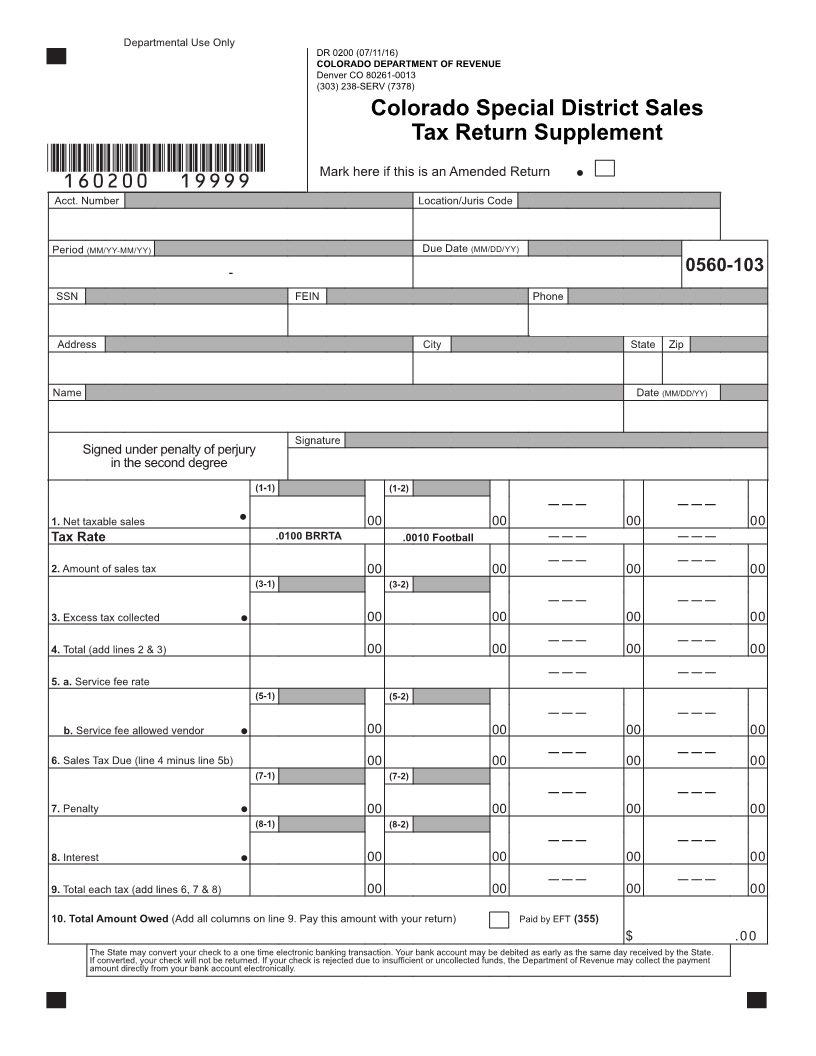

DR 0200 (07/11/16)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

*DO=NOT=SEND* (303) 238-SERV (7378)

Colorado Special District Sales Tax Return Supplement

Instructions

General Instructions Filing an Amended Return?

If you are filing an amended return, a separate amended return

The Baptist Road RTA (BRRTA) sales tax expired but

must be filed for each period and/or each site. The amended return

must continue to be collected on periodic lease or credit

must show all lines as corrected, not merely the difference(s). The

payments still in effect after June 30, 2016. The BRRTA

amended return replaces the original in its entirety.

sales tax rate is 1.0%. If the lease has ended and no tax is

due, do not file a return. Specific Instructions

The Football District (FD) Sales Tax expired but must Line 1 Net Taxable Sales- Enter the net taxable sales

continue to be collected on periodic lease or credit from leases in the applicable column.

payments still in effect after December 31, 2011. The FD Tax Rate- Tax rates can be found in the Colorado Sales/

sales tax rate is 0.1%. If the lease has ended and no tax is Use Tax Rates, DR 1002.

due, do not file a return. Line 2 Amount of Sales Tax- Multiply the amount on line

When to File 1 by the tax rate.

Returns must be postmarked on or before the 20 thday of Line 3 Excess Tax Collected- Enter amount of excess

the month following the reporting period. tax collected.

• Monthly Returns: due the 20 thday of the month Line 4 Total- Add lines 2 and 3.

following the reporting month. Line 5a Service Fee Rate- For rates, refer to DR 1002.

• Quarterly Returns: Line 5b Service Fee Allowed Vendor- Multiply line 4 by line 5a.

Line 6 Sales Tax Due- Line 4 minus line 5b.

January – March due April 20 If this return and remittance are

Line 7 Penalty-

April – June due July 20 postmarked after the due date, a penalty of 10% plus ½%

July – September due October 20 per month (not to exceed 18%) is due. Multiply the tax on

October – December due January 20 line 6 by the applicable percentage to determine penalty.

• Annual Returns: due January 20 Line 8 Interest- If this return and remittance are

postmarked after the due date, interest is due at the prime

Multi-Location Filers

rate, effective July 1 of the previous year. Interest rates can

A separate DR 0200 must be filed for each site that is collecting be found in FYI General 11. Multiply the tax on line 6 by the

the Football District Sales Tax and/or the BRRTA Sales Tax. applicable interest rate to determine interest.

Verify your sites/locations in Revenue Online under “Additional Line 9 Total Each Tax- Add lines 6, 7 and 8.

Services”. www.Colorado.gov/RevenueOnline Line 10 Total Amount Owed- Total the amounts in each

For additional information, refer to FYI Sales 58. applicable column. This is the amount due with your return.

Electronic Filing If you are filing your sales tax returns by paper, the returns

This return can be filed electronically through XML or should be mailed together with this return and payment to:

Excel spreadsheet. For more information, refer to the Colorado Department of Revenue

Spreadsheet Upload Handbook available at Denver, CO 80261-0013

www.TaxColorado.com under the Alpha Index letter “S” for Tax Education

spreadsheet filing.

Free public tax classes are offered in our Taxpayer Service

This return cannot be filed through Revenue Online. If you Center locations. Please visit the Education page of the

are filing your sales tax return (DR 0100) through Revenue Taxation Web site to view current schedules and to register.

Online, the DR 0200 is available as a fillable form if filing a

single location sales return and must be printed and mailed

separate from your sales tax return.