Enlarge image

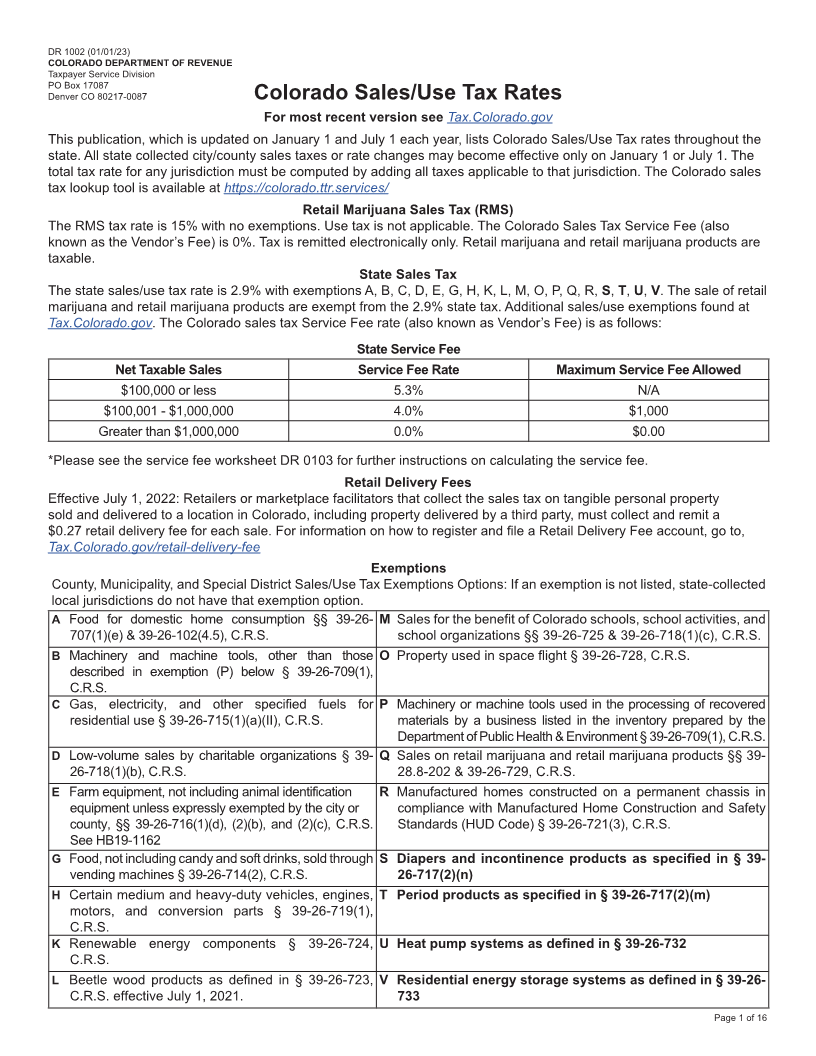

DR 1002 (01/01/23)

COLORADO DEPARTMENT OF REVENUE

Taxpayer Service Division

PO Box 17087

Denver CO 80217-0087 Colorado Sales/Use Tax Rates

For most recent version see Tax.Colorado.gov

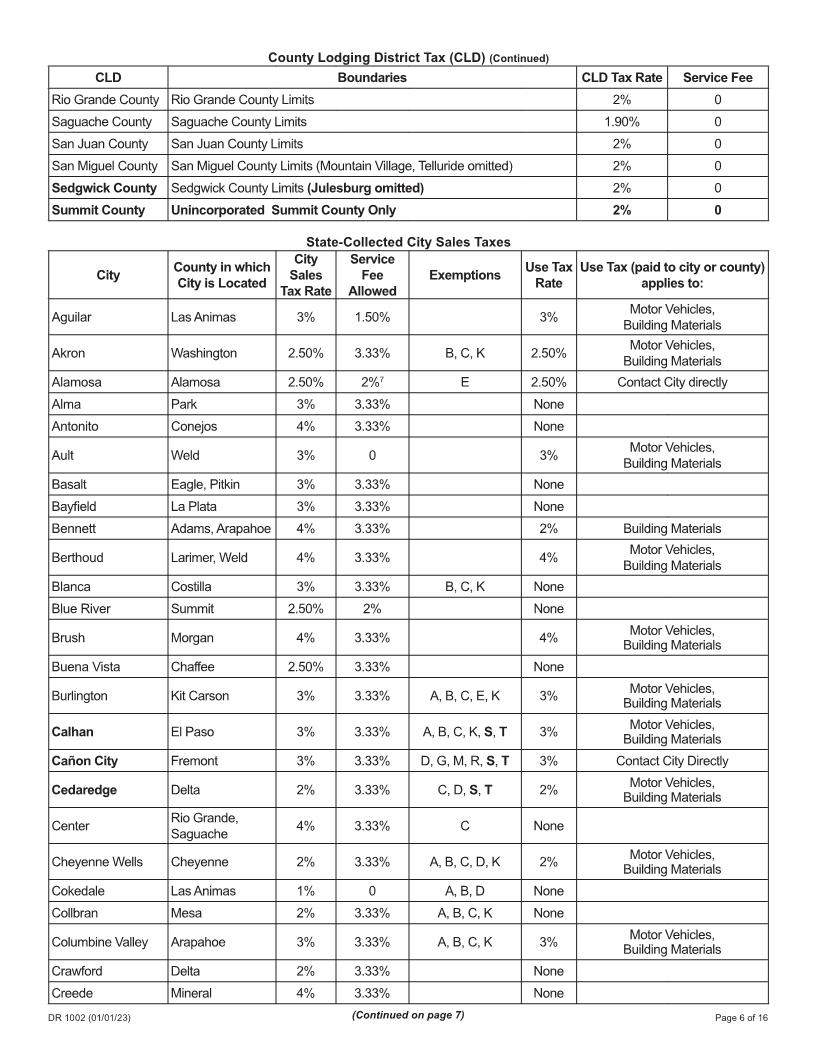

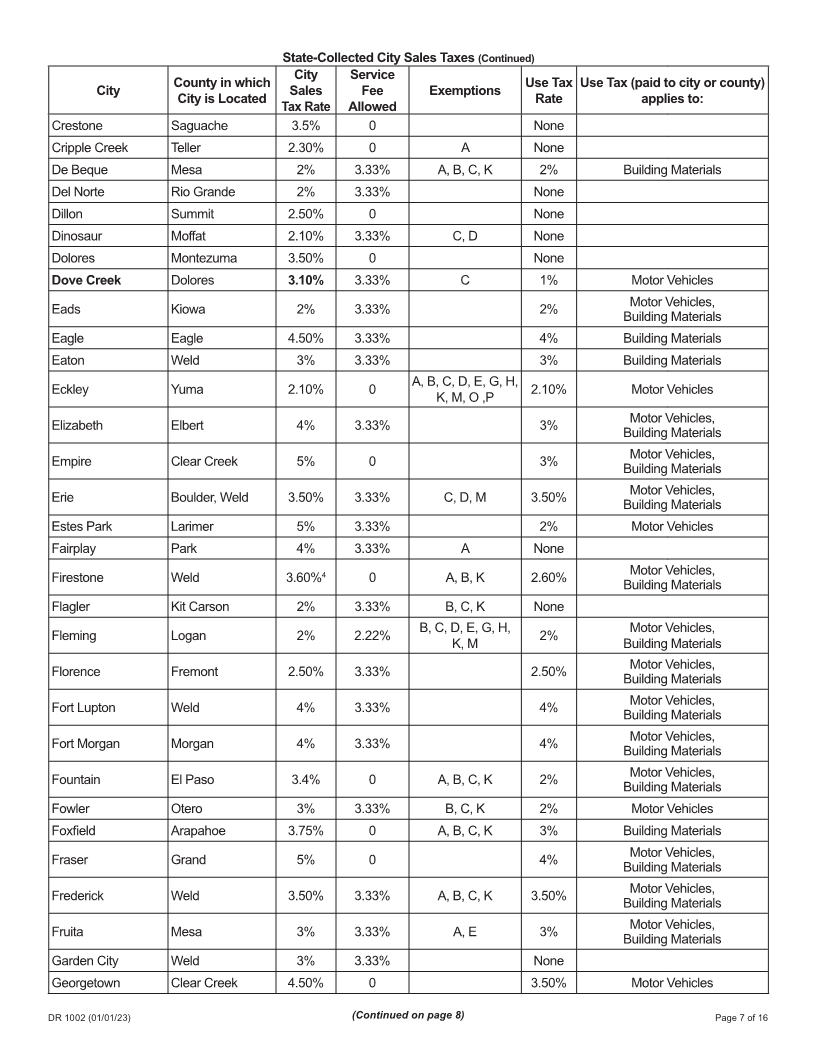

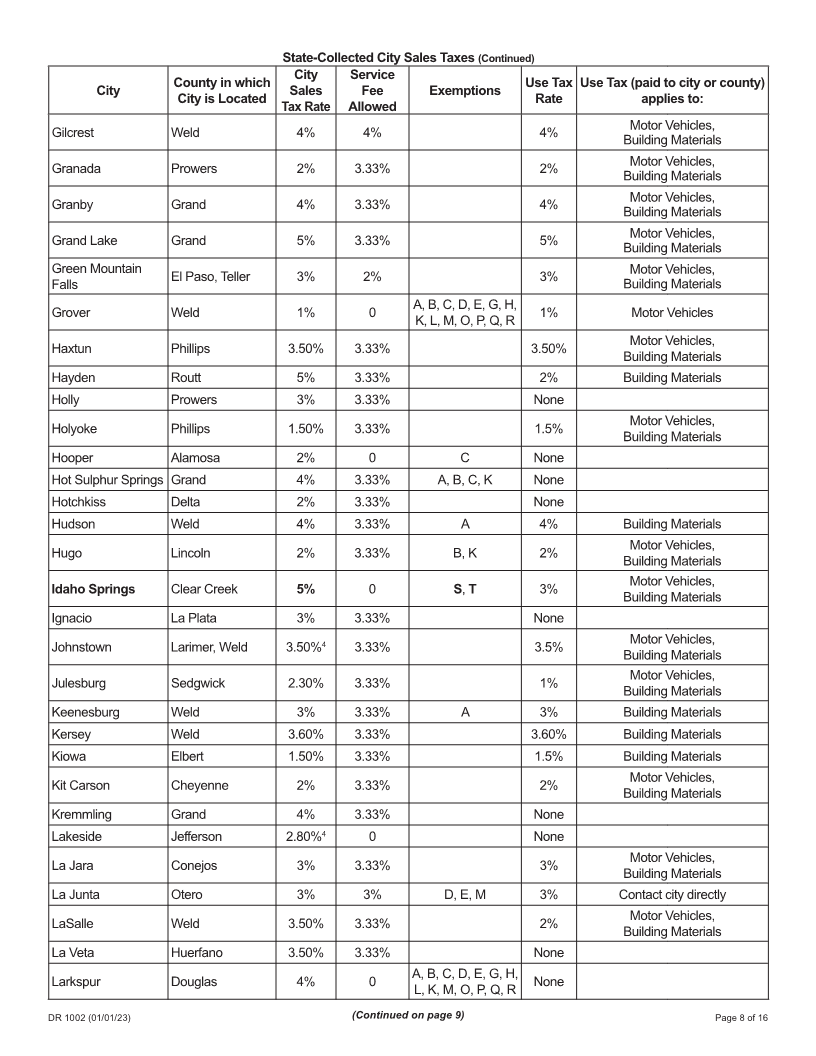

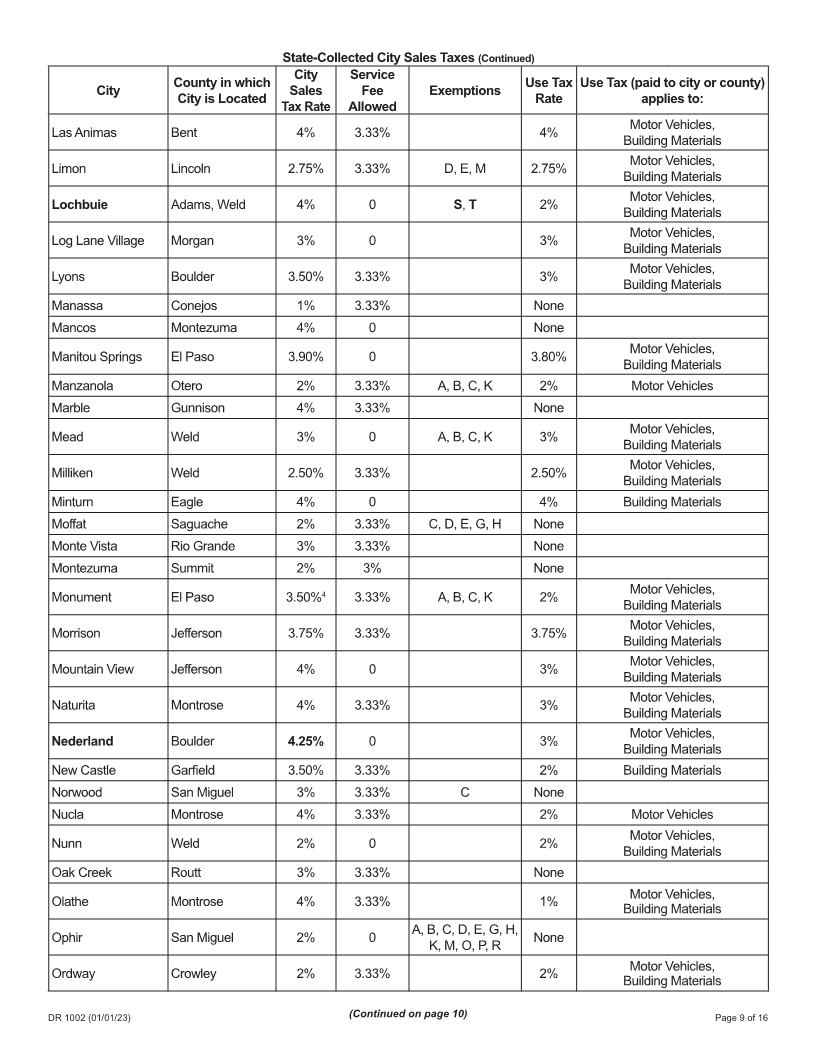

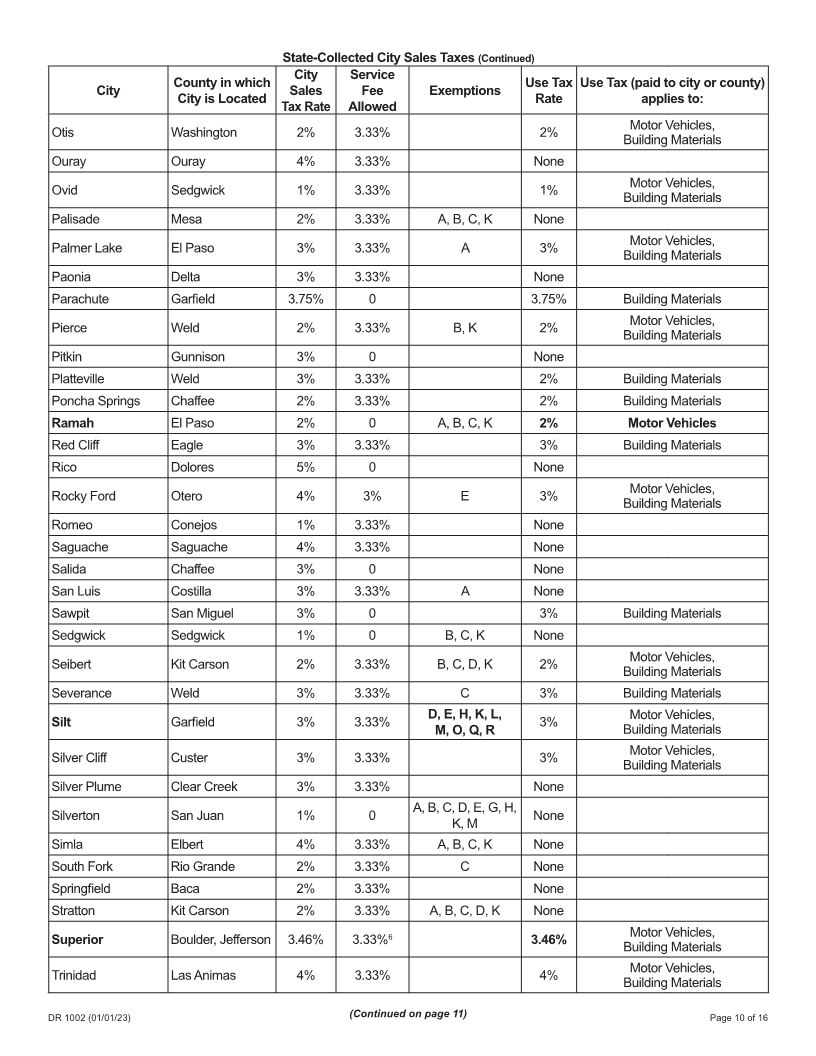

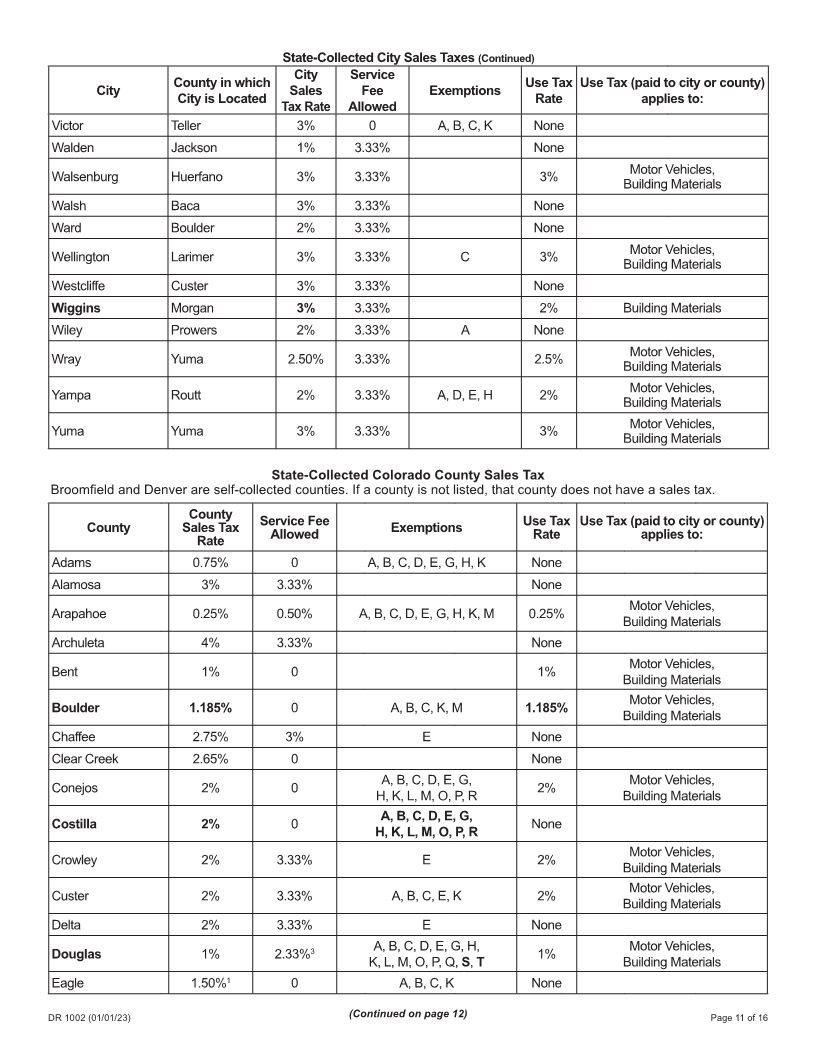

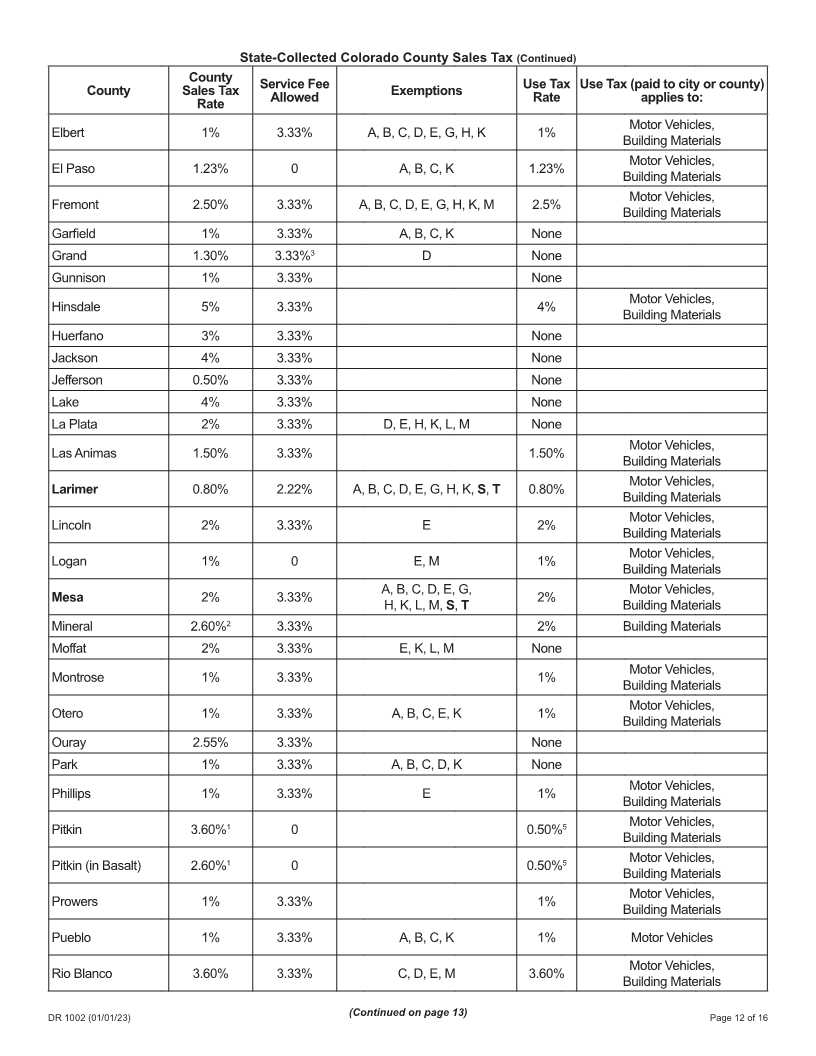

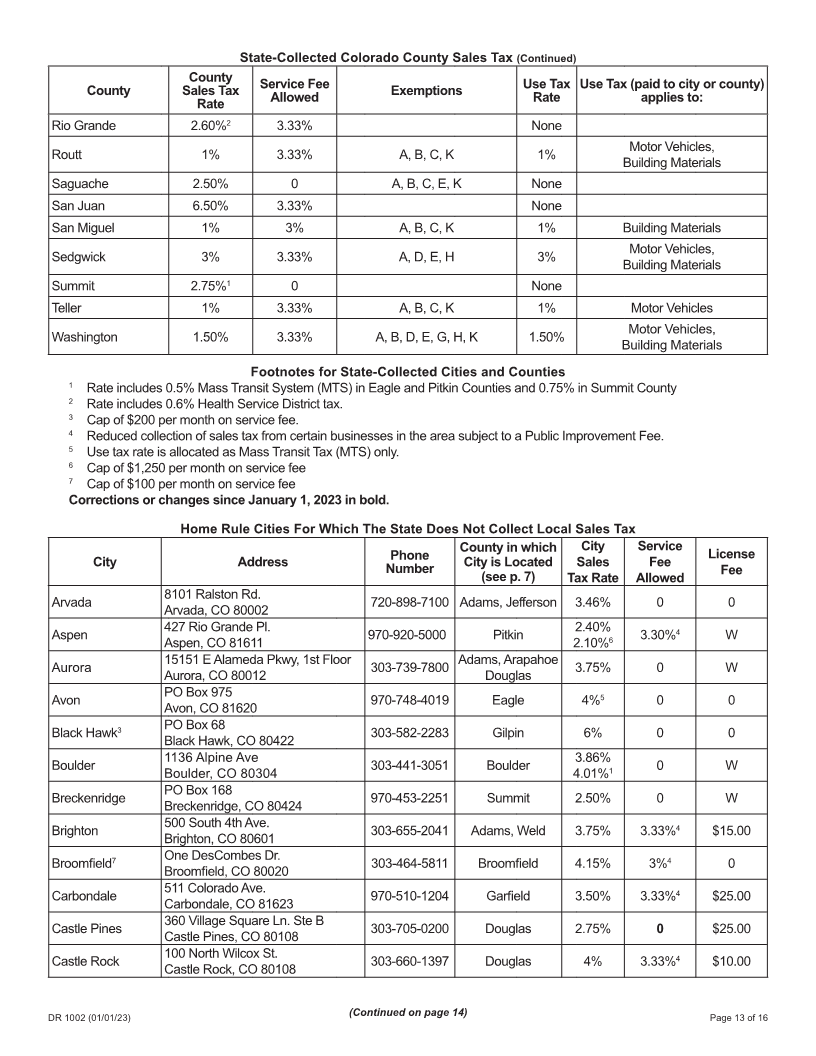

This publication, which is updated on January 1 and July 1 each year, lists Colorado Sales/Use Tax rates throughout the

state. All state collected city/county sales taxes or rate changes may become effective only on January 1 or July 1. The

total tax rate for any jurisdiction must be computed by adding all taxes applicable to that jurisdiction. The Colorado sales

tax lookup tool is available at https://colorado.ttr.services/

Retail Marijuana Sales Tax (RMS)

The RMS tax rate is 15% with no exemptions. Use tax is not applicable. The Colorado Sales Tax Service Fee (also

known as the Vendor’s Fee) is 0%. Tax is remitted electronically only. Retail marijuana and retail marijuana products are

taxable.

State Sales Tax

The state sales/use tax rate is 2.9% with exemptions A, B, C, D, E, G, H, K, L, M, O, P, Q, R, , ,S T U V, . The sale of retail

marijuana and retail marijuana products are exempt from the 2.9% state tax. Additional sales/use exemptions found at

Tax.Colorado.gov. The Colorado sales tax Service Fee rate (also known as Vendor’s Fee) is as follows:

State Service Fee

Net Taxable Sales Service Fee Rate Maximum Service Fee Allowed

$100,000 or less 5.3% N/A

$100,001 - $1,000,000 4.0% $1,000

Greater than $1,000,000 0.0% $0.00

*Please see the service fee worksheet DR 0103 for further instructions on calculating the service fee.

Retail Delivery Fees

Effective July 1, 2022: Retailers or marketplace facilitators that collect the sales tax on tangible personal property

sold and delivered to a location in Colorado, including property delivered by a third party, must collect and remit a

$0.27 retail delivery fee for each sale. For information on how to register and file a Retail Delivery Fee account, go to,

Tax.Colorado.gov/retail-delivery-fee

Exemptions

County, Municipality, and Special District Sales/Use Tax Exemptions Options: If an exemption is not listed, state-collected

local jurisdictions do not have that exemption option.

A Food for domestic home consumption §§ 39-26- M Sales for the benefit of Colorado schools, school activities, and

707(1)(e) & 39-26-102(4.5), C.R.S. school organizations §§ 39-26-725 & 39-26-718(1)(c), C.R.S.

B Machinery and machine tools, other than those PropertyO used in space flight § 39-26-728, C.R.S.

described in exemption (P) below § 39-26-709(1),

C.R.S.

C Gas, electricity, and other specified fuels for MachineryPor machine tools used in the processing of recovered

residential use § 39-26-715(1)(a)(II), C.R.S. materials by a business listed in the inventory prepared by the

Department of Public Health & Environment § 39-26-709(1), C.R.S.

D Low-volume sales by charitable organizations § 39- Q Sales on retail marijuana and retail marijuana products §§ 39-

26-718(1)(b), C.R.S. 28.8-202 & 39-26-729, C.R.S.

E Farm equipment, not including animal identification R Manufactured homes constructed on a permanent chassis in

equipment unless expressly exempted by the city or compliance with Manufactured Home Construction and Safety

county, §§ 39-26-716(1)(d), (2)(b), and (2)(c), C.R.S. Standards (HUD Code) § 39-26-721(3), C.R.S.

See HB19-1162

G Food, not including candy and soft drinks, sold through S Diapers and incontinence products as specified in § 39-

vending machines § 39-26-714(2), C.R.S. 26-717(2)(n)

H Certain medium and heavy-duty vehicles, engines, T Period products as specified in § 39-26-717(2)(m)

motors, and conversion parts § 39-26-719(1),

C.R.S.

K Renewable energy components § 39-26-724, U Heat pump systems as defined in § 39-26-732

C.R.S.

L Beetle wood products as defined in § 39-26-723, V Residential energy storage systems as defined in § 39-26-

C.R.S. effective July 1, 2021. 733

Page 1 of 16