Enlarge image

*DO=NOT=SEND* This version of the DR 0100 form (dated 06/18/14) should only be used for filing original and amended sales tax returns for periods prior to December 2016. Please scroll down to continue to the DR 0100 form.

Enlarge image | *DO=NOT=SEND* This version of the DR 0100 form (dated 06/18/14) should only be used for filing original and amended sales tax returns for periods prior to December 2016. Please scroll down to continue to the DR 0100 form. |

Enlarge image |

DR 0100 (06/18/14)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0013

www.TaxColorado.com Colorado Retail Sales Tax Return Instructions

Read all instructions below to ensure accurate filing of your return.

The state sales tax rate is 2.9% amended return box. A separate amended return must be

You can access your tax account information, file your tax filed for each period and show all tax columns as corrected,

return, see your payment history, make payments online not merely the differences. Be sure to use the correct

and more - all on our one-stop, streamlined Web site called service fee rate of the period.

Revenue Online. Sign Up and begin using your Login The state sales tax rate is 2.9% (.029). Special district taxes

immediately. Visit www.Colorado.gov/RevenueOnline to get include RTD 1.0% (.01), Scientific and Cultural District .1%

started today. (.001) and the Rural Transportation Authority (RTA) with

The DR 0100 Colorado Retail Sales Tax Return and the various rates per district.

Deductions and Exemptions Schedule must be completed See form DR 0200 to report Football District (FD) tax

correctly with all figures substantiated and verified before collected on leases.

filing the return. It is the responsibility of the business owner/ Notify the department of changes or closures by completing

operator to know the tax rates and exemptions that apply to form “Address Change or Business Closure Form” (DR

their business. Verify your accounts active sites by going to 1102). For a physical change to a location, your must

www.Colorado.gov/RevenueOnline, Other Services, View send in the DR 1102. New ownership or a change in FEIN

Business Location Rates and search by Colorado account requires a new Colorado Account Number (CAN).

number. The verification system will show all open locations for Copies of completed returns and records of purchases

your account number and the current, applicable tax rates for and sales, including sales invoices and purchase orders

each location. Filing a return late, not filing a return, incomplete must be retained for a period of 3 years. Records must be

returns and non-payment or incomplete payment of the tax due open for inspection by authorized representatives of the

will all result in an assessment of penalties and interest. department. All taxes paid by the purchaser to the seller

Instructions for the Deductions and Exemptions Schedule shall be and remain public money, as property of the taxing

Complete the Deductions and Exemptions Schedule prior jurisdiction. The seller should maintain records of payment.

to completing the DR 0100. A separate schedule must be The law provides severe penalties for any violation of the

completed and submitted for each site. The exemptions for sales tax laws. Methods of enforcement, as defined in

state and RTD/CD will be the same effective January 1, 2014. the regulations, include liens which are satisfied before all

The exemptions for a state-collected local jurisdiction may be other claims on real and personal property of the taxpayer

different. Please refer to publication "Colorado Sales/Use Tax or property used by the seller. Continued delinquency will

Rates" (DR 1002) for exemptions that apply to the state and result in seizure and sale of the property under distraint

RTD/CD and state-collected local jurisdictions. See publication, warrant.

“History of Local Sales/Use Tax Rates” (DR 1250) for tax rates If you remit by Electronic Funds Transfer (EFT), you must

and exemption history. initiate the payment before 4:00 p.m. Mountain Time on the

A return must be filed even if there is no tax due. Enter due date. Remember to mark the EFT box before mailing

the number 0 in any column on line 14 if there is no tax the return.

due. Failure to enter zeros will result in the issuance of an Make your payment online through Revenue Online

automatic estimated tax due notice. or make check payable to the Colorado Department of

Amended returns can be filed through Revenue Online. If Revenue. Note the tax type, period and account number on

you are amending a return by paper, be sure to mark the your check to ensure accurate posting to your account.

|

Enlarge image |

Returns must be filed on or before the 20th day of the month not have the deductions or exemptions indicated on the

following the close of the tax period. Mailed returns must be schedule, those who do must carefully report them on the

postmarked the 20th day of the month or before. Mail returns to paper return. Ignoring these deductions and exemptions

the following address: may result in owing additional tax.

Colorado Department of Revenue Line 5: Enter amount of tax for each type of sales tax collected.

Denver, CO 80261-0013 Multiply the amount of line 4 by the applicable tax rates

FYI publications, forms, and additional information are available which are printed below line 4.

on the Department of Revenue’s Taxation Web site regarding Line 6: Enter the amount of excess tax collected. Do not

filing sales/use tax in the state of Colorado. The Taxation include any amounts already included on line 3c. Report

Web site is www.TaxColorado.com Due to the complexities the amount of any excess sales tax collected on this line.

surrounding the laws on the collection and remittance of sales/ Line 7: Add lines 5 and 6.

use taxes in Colorado, it is advised that you attend a live class or Line 8a: Service fee rate. A service fee is a deduction allowed

take an online tax class offered by the department after opening for timely filed and paid returns. It is not allowed on a

your business and/or obtaining a sales tax license. Visit www. delinquent return. If this rate is not shown, see publication

TaxSeminars.state.co.us for class schedule and registration. Colorado Sales/Use Tax Rates (DR 1002) to determine

Interested in keeping up with state tax news? Colorado Taxation appropriate rate. Please Note: The state service fee rate

Weblog: cotaxinfo.wordpress.com is .0333 (3.33 percent) for timely filed and paid returns

Line Instructions for the DR 0100 Colorado Retail Sales Tax received on or after July 1, 2014.

Return All entries of state and local taxes on this sales tax return Line 8b: Enter deduction for service (vendor's) fee allowed to

must be rounded to the nearest dollar. You will still collect and the seller for each applicable tax. Multiply line 7 by the

keep track of exact amounts of sales tax. Round amounts less applicable service fee rate shown in each column. This

than 50 cents down to 0 (zero) cents. Increase amounts from 50 deduction is only allowed if the complete return is filed

to 99 cents to the next dollar. on department-approved forms and the tax is paid on or

Line 1: Enter the total amount of money received from all before due date.

sales and services from all sales and services attributed Line 9: Sales tax due (line 7 minus line 8b).

to this site/location only, including taxable and nontaxable Line 10: Goods purchased tax-free for resale but taken out of

sales and collections of bad debts previously deducted. inventory for personal or business use must be reported

Do not include the amount of sales tax collected. and tax paid on the items. Enter cost of goods next to the

Line 2a: Enter the amount of sales to other licensed dealers $ sign. Then multiply that amount by the tax rate for each

for this site/location only. Sales to other licensed dealers separate tax that applies (for example, county, city, RTD)

should be reported on line 2a. not on line 2b. Keep and enter that amount in the appropriate column. Other

documentation for verification of these sales. tax-free purchases of any kind which will not be resold

Line 2b: Enter the amount of any other deductions. Upon should be reported and taxed on the Consumer Use

completion of the Deductions and Exemptions Schedule, Tax Return (DR 0252) and/or RTA Use Tax Return (DR

enter the total from Part A -Deductions. Deductions taken 0251), or through Revenue Online (www.Colorado.gov/

on Line 9 Other should include an explanation. Provide RevenueOnline).

the schedule with your return. Line 12: Penalty. Failure to file the return and pay the tax by the

Line 3: The net sales amount must be entered in each column. due date subjects the vendor to a penalty of 10% plus

If this amount is zero, file the return online through 1/2% for each additional month not to exceed 18% of the

Revenue Online, www.Colorado.gov/RevenueOnline tax due.

Line 3a: Enter the amount of sales delivered out of your Line 13: Interest. Failure to file the return and pay the tax on time

taxing area for this site/location only. subjects the vendor to interest at the prime rate effective

Line 3b: Enter the total amount of state exemptions and on July 1 of the previous year. Monthly interest rate may

any applicable local exemptions. Exemptions must be be prorated for a part of a month.

itemized on the Deductions and Exemptions Schedule For additional information see FYI General 11 on the

of the sales tax return. Exemptions taken on Line 10 department's Taxation Web site at www.TaxColorado.

Other should include an explanation. You must complete com

3b Exemptions and include the form with your return. Line 15: Add the total of ALL taxes shown in each column

Please note: Effective January 1, 2014, in addition to of line 14. Amount shown in line 15 must equal amount

state sales tax, cigarettes are also subject to RTD and remitted. If paying by EFT, be sure to mark the box.

CD sales tax. Cigarettes are still exempt from city, county The State may convert your check to a one time electronic

and other special district sales tax. banking transaction. Your bank account may be debited as

Line 3c: If an overpayment for sales tax was made on a early as the same day received by the State. If converted,

previous return, enter the amount of Line 3 Net sales

your check will not be returned. If your check is rejected

on which the tax was based. You can bring Line 4 Net

due to insufficient or uncollected funds, the Department of

taxable sales to zero and will carry forward any remaining

Revenue may collect the payment amount directly from your

overpayment to a future return. Do not use Line 3c if the

bank account electronically.

credit already exists on a period. See FYI Sales 90 for

additional information. For additional information:

Line 4: Enter net taxable sales. Subtract the total lines 3a, 3b, Colorado Department of Revenue

and 3c from line 3 in each column. The net taxable sales Denver CO 80261-0013

amount must be entered in each column. If a column (303) 238-SERV (7378)

does not apply, write N/A in the TAX RATE line. All www.TaxColorado.com

information reported on lines 1 through 4 will be reviewed

to ensure an accurate return. While some taxpayers do

|

Enlarge image |

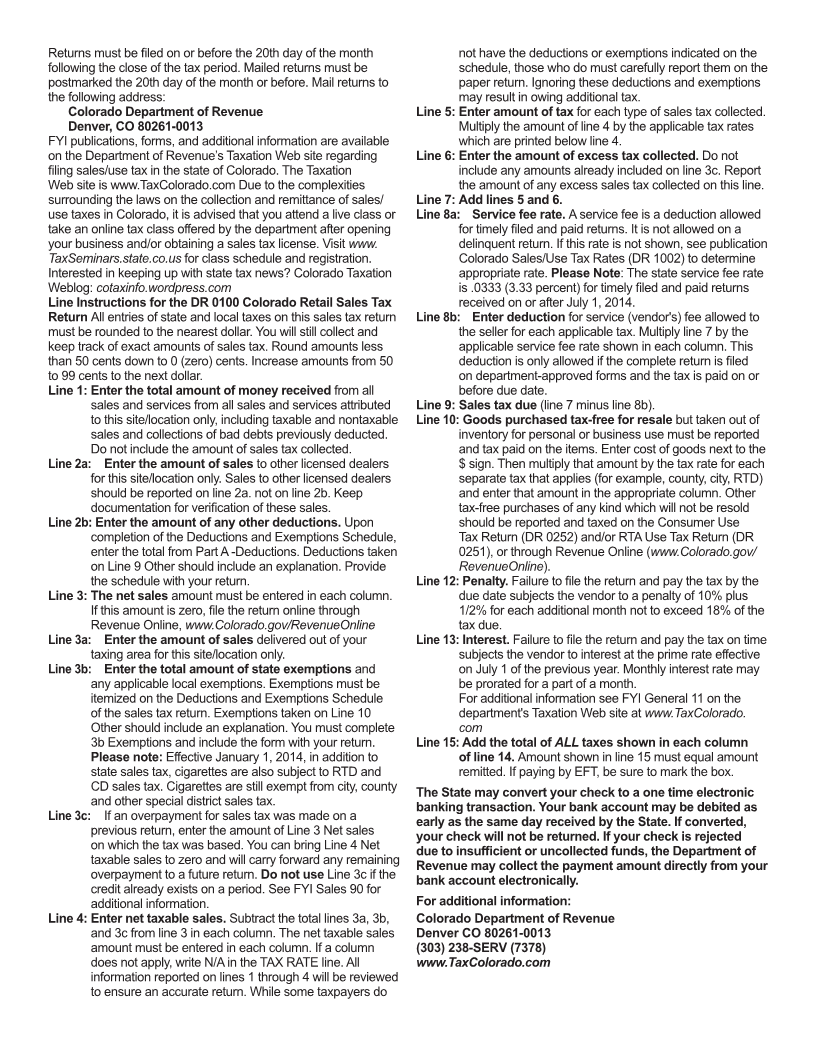

Departmental Use Only

DR 0100 (06/18/14)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0013

www.TaxColorado.com Colorado Retail

Sales Tax Return

Signed under penalty of perjury in the second degree.

Signature Date (MM/DD/YY)

*140100V219999* SSN 1 SSN 2 FEIN

Last Name or Business Name First Name Middle Initial

Address City State Zip

0021-101

Phone 1. Gross Sales and Services for this site/location only (1-4)

( ) (include bad debts previously deducted) 00

Colorado Account Number Period (MM/YY-MM/YY) 2. Deductions (nontaxed sales): (2a-4)

– a. Sales to other licensed dealers, for resale 00

Due Date (MM/DD/YY) Location/Juris Code (2b-4)

b. Other deductions (from page 2) 00

Mark here if this is an

Amended Return c. Total (add lines 2a & 2b) 00

County/MTS City/LID Special District State

(3-1) (3-2) (3-3) (3-4)

3. Net sales: (line 1 minus line 2c) 00 00 00 00

(3a-1) (3a-2) (3a-3) (3a-4)

a. Sales out of taxing area 00 00 00 00

(3b-1) (3b-2) (3b-3) (3b-4)

b. Exemptions (list on page 2). 00 00 00 00

c. Overpayment from previous (3c-1) (3c-2) (3c-3) (3c-4)

return 00 00 00 00

4. Net taxable sales

(line 3 minus a,b,& c) 00 00 00 00

Tax Rate

5. Amount of sales tax 00 00 00 00

(6-1) (6-2) (6-3) (6-4)

6. Excess tax collected 00 00 00 00

7. Total (add lines 5 & 6) 00 00 00 00

8. a. Service fee rate

b. Service fee allowed vendor (8-1) (8-2) (8-3) (8-4)

(only if paid on or before due date) 00 00 00 00

9. Sales tax due

(line 7 minus line 8b) 00 00 00 00

(10-1) (10-2) (10-3) (10-4)

10. Tax on $ 00 00 00 00

(11-1) (11-2) (11-3) (11-4)

11. Total tax due (add lines 9 & 10) 00 00 00 00

(12-1) (12-2) (12-3) (12-4)

12. Penalty: 00 00 00 00

13. Monthly interest rate times (13-1) (13-2) (13-3) (13-4)

line 11 .0025 00 00 00 00

14. Total each tax

(add lines 11, 12, & 13) 00 00 00 00

The State may convert your check to a one time electronic banking transaction. Your

converted, your check will not be returned. If your check is rejected due to insufficient

bank account may be debited as early as the same day received by the State. If 15. Total Amount Owed Paid by EFT

or uncollected funds, the Department of Revenue may collect the payment amount (add all columns

directly from your bank account electronically. on line 14) (355) $ .00

|

Enlarge image |

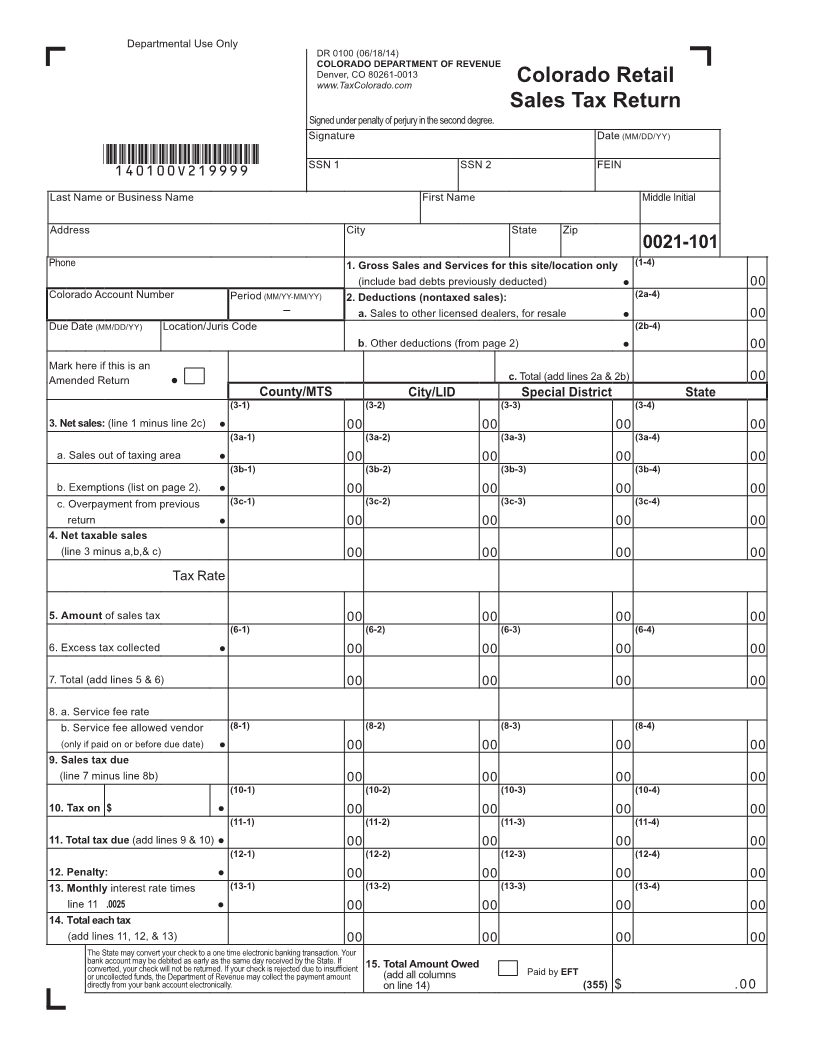

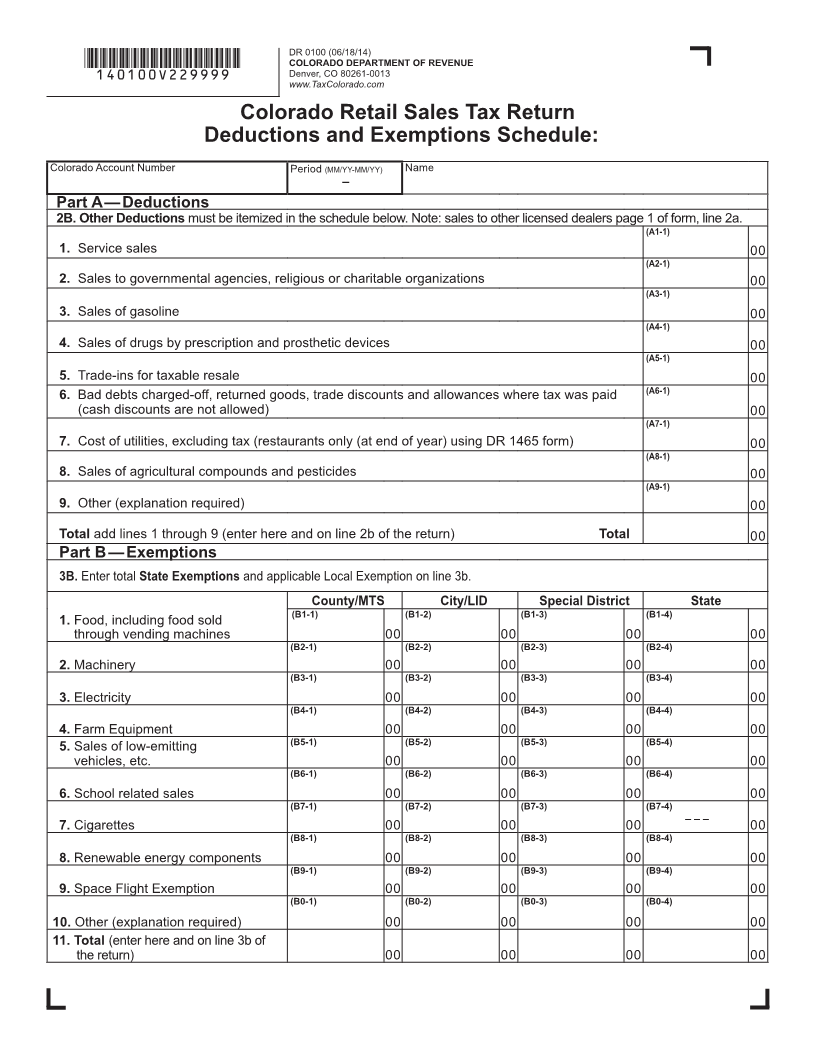

DR 0100 (06/18/14)

COLORADO DEPARTMENT OF REVENUE

*140100V229999* Denver, CO 80261-0013

www.TaxColorado.com

Colorado Retail Sales Tax Return

Deductions and Exemptions Schedule:

Colorado Account Number Period (MM/YY-MM/YY) Name

–

Part A — Deductions

2B. Other Deductions must be itemized in the schedule below. Note: sales to other licensed dealers page 1 of form, line 2a.

(A1-1)

1. Service sales 00

(A2-1)

2. Sales to governmental agencies, religious or charitable organizations 00

(A3-1)

3. Sales of gasoline 00

(A4-1)

4. Sales of drugs by prescription and prosthetic devices 00

(A5-1)

5. Trade-ins for taxable resale 00

6. Bad debts charged-off, returned goods, trade discounts and allowances where tax was paid (A6-1)

(cash discounts are not allowed) 00

(A7-1)

7. Cost of utilities, excluding tax (restaurants only (at end of year) using DR 1465 form) 00

(A8-1)

8. Sales of agricultural compounds and pesticides 00

(A9-1)

9. Other (explanation required) 00

Total add lines 1 through 9 (enter here and on line 2b of the return) Total 00

Part B — Exemptions

3B. Enter total State Exemptions and applicable Local Exemption on line 3b.

County/MTS City/LID Special District State

(B1-1) (B1-2) (B1-3) (B1-4)

1. Food, including food sold

through vending machines 00 00 00 00

(B2-1) (B2-2) (B2-3) (B2-4)

2. Machinery 00 00 00 00

(B3-1) (B3-2) (B3-3) (B3-4)

3. Electricity 00 00 00 00

(B4-1) (B4-2) (B4-3) (B4-4)

4. Farm Equipment 00 00 00 00

5. Sales of low-emitting (B5-1) (B5-2) (B5-3) (B5-4)

vehicles, etc. 00 00 00 00

(B6-1) (B6-2) (B6-3) (B6-4)

6. School related sales 00 00 00 00

(B7-1) (B7-2) (B7-3) (B7-4)

– – –

7. Cigarettes 00 00 00 00

(B8-1) (B8-2) (B8-3) (B8-4)

8. Renewable energy components 00 00 00 00

(B9-1) (B9-2) (B9-3) (B9-4)

9. Space Flight Exemption 00 00 00 00

(B0-1) (B0-2) (B0-3) (B0-4)

10. Other (explanation required) 00 00 00 00

11. Total (enter here and on line 3b of

the return) 00 00 00 00

|