- 4 -

Enlarge image

|

DR 0100 (12/13/16)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0013

*DO*NOT*SEND* www.TaxColorado.com

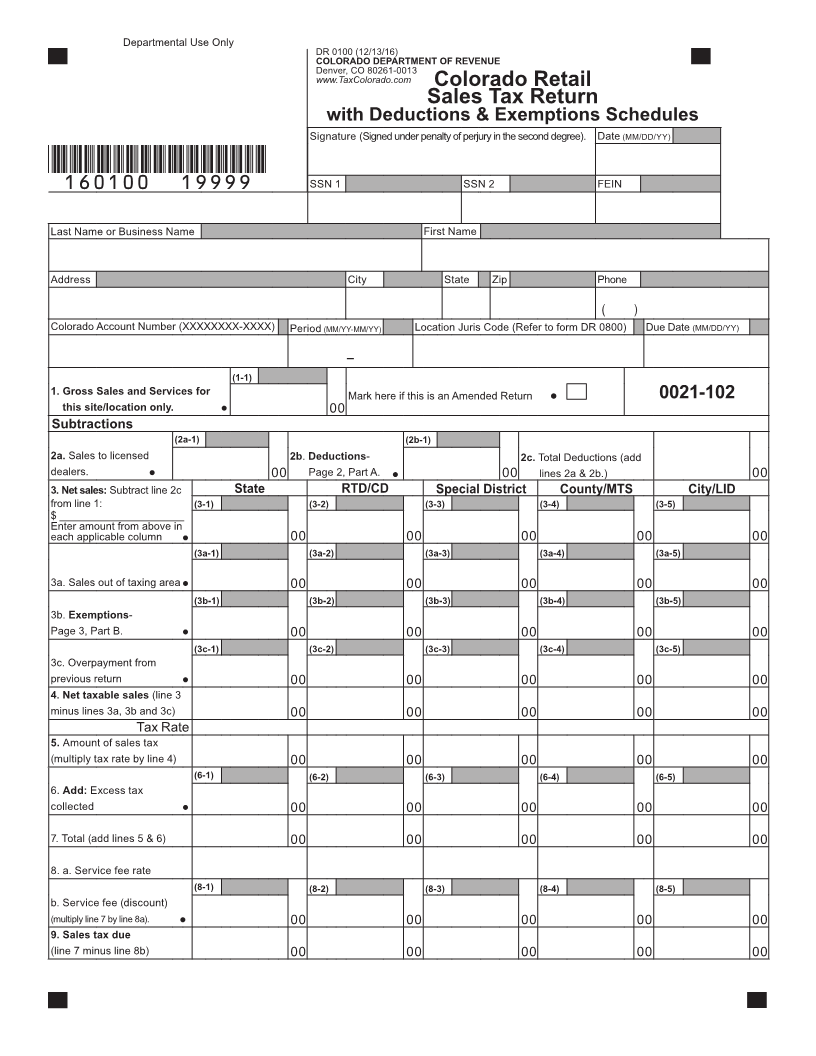

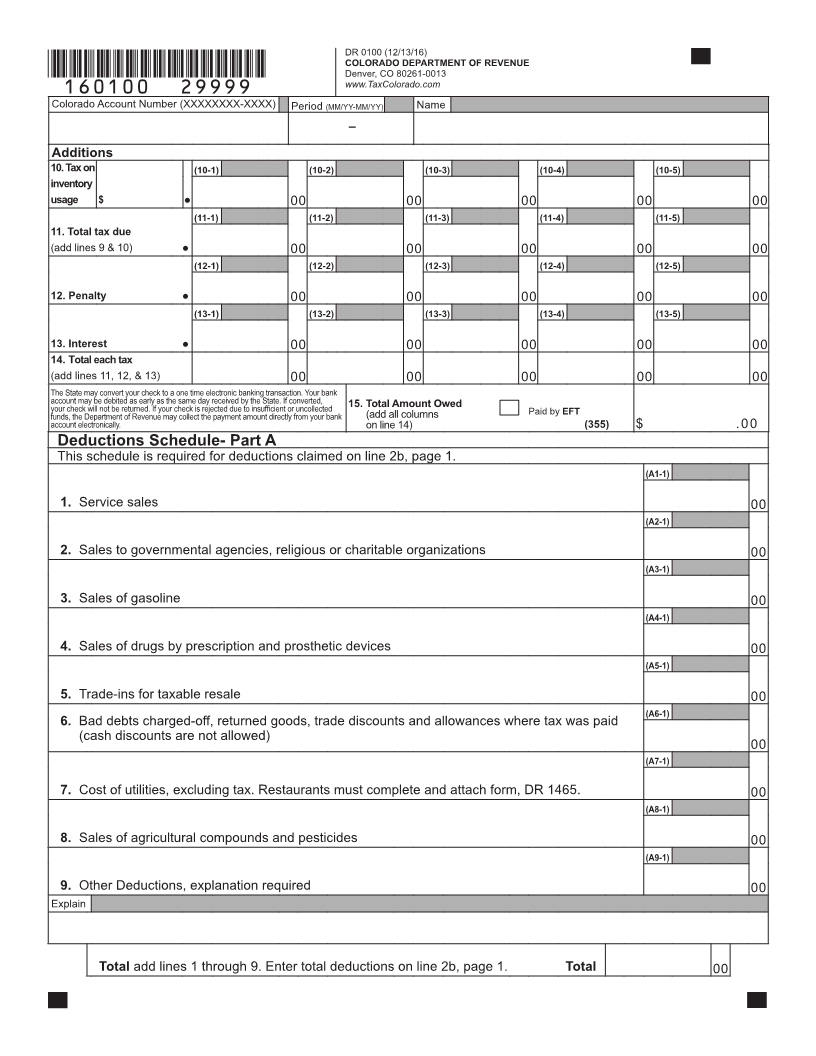

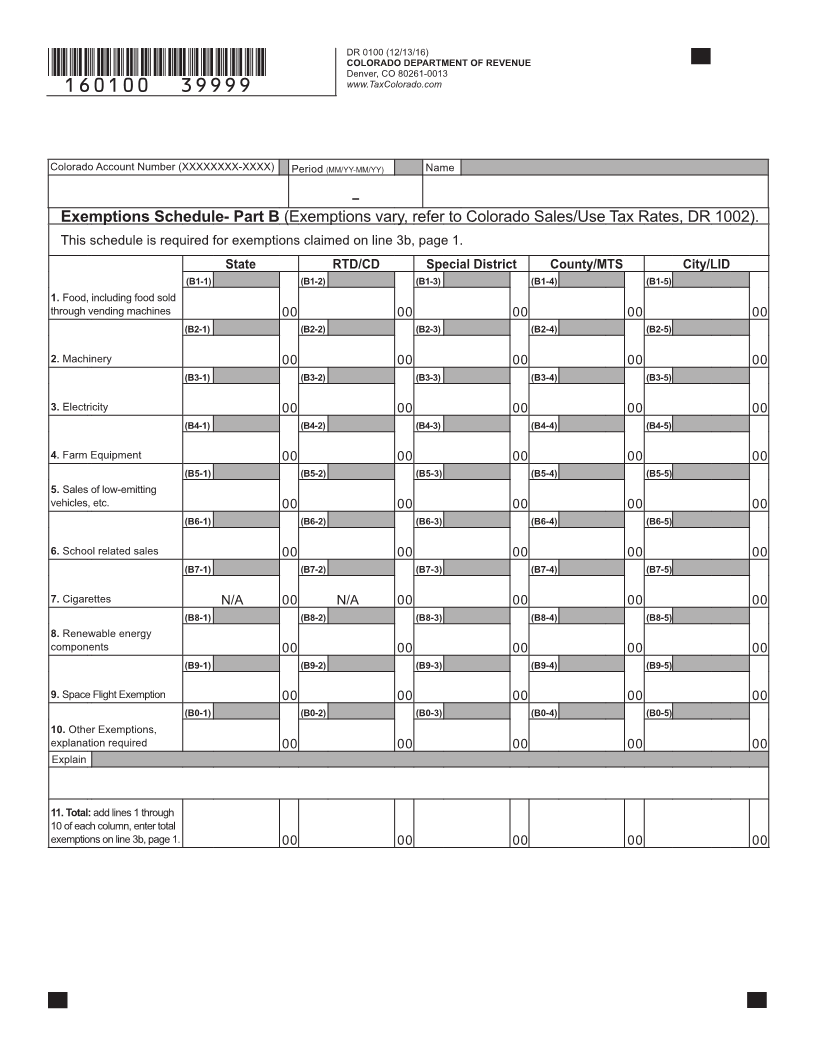

deducted in the city column. Deductions and Exemptions Schedules (Page 2, Part A and

Tax Rate: Tax rates are listed in the Colorado Sales/Use Tax Page 3, Part B)

Rates, DR 1002 and in Revenue Online under "Additional If deductions and exemptions are being claimed on lines 2b and

Services" then "View Sales Rates and Taxes". 3b, the Deductions and Exemptions Schedules are required and

Line 6. Excess tax collected must be attached to the sales tax return. If these schedules

Enter the amount of excess tax collected. For example: The tax are missing, incomplete or incorrect, all deductions and

rate decreased but tax was collected at the old rate on payments exemptions will be disallowed. A separate schedule must

made after the effective date of the new tax rate. Excess tax has be completed and submitted for each site/location. For more

been collected and should be reported on this line. information on allowed deductions and exemptions, refer to DR

Line 8a. Service Fee Rate 1002. Additional information is available at the Taxation website

Service fee rates are published in the Colorado Sales/Use Tax under the Alpha Index letter "S" for Sales Tax.

Rates, DR 1002. PAYMENT INFORMATION

Line 8b. Service Fee (Discount) Online Payments

A "discount" is given to vendors who timely file and pay their sales EFT Payment (No Fee)

taxes. If your return and payment are postmarked and received Pay by electronic fund transfer (EFT) via ACH Debit or Credit.

timely, you can subtract the applicable service fee from your sales EFT registration is required prior to making your payment.

tax due. Note: not all jurisdictions allow a service fee. Refer to the Payments cannot be made until 24-48 hours after you register.

DR 1002 for more information.

Credit Card/E-Check

Line 10: Tax on inventory usage Pay by using a credit card or electronic check. There is an

If your business takes out of its inventory goods that were additional service fee for making a payment using these methods.

purchased tax-free for resale and uses the goods for personal or

business purposes, you must pay sales tax on those items when Paper Check

they are taken out of inventory and used. The cost of the items Online Filing with Payment Coupon

must be entered on line 10 of this form. Tax is due for state, RTD, You can print a payment coupon from Revenue Online after you

CD, special districts, county or state-collected city tax. Do not use have filed your return electronically. Select ‚"Payment Coupon"‚ in

this line to file/pay consumer use. Consumer Use Tax is reported the Payment Option. You can print a coupon for each period.

on the DR 0252 and DR 0251. Paper Filing with Payment

Lines 12 and 13. Penalty and Interest If you are filing and paying by mail, include the account number,

If this return and remittance is postmarked or electronically made filing period and write ‚"sales tax", on your check to ensure

after the due date, a penalty of 10% plus .5% per month (not to proper credit is applied to your account. One check can be

exceed 18%) is due. Interest is due at the prime rate, effective remitted for the total for all returns.

July 1 of the previous year. Penalty and interest rates can be Sign and date the return and mail with your payment to:

found in FYI General 11: Colorado Civil Tax Penalties and Interest. Colorado Department of Revenue

Line 15. Total Amount Owed Denver, CO 80261-0013

Enter the total from all columns. Check for mathematical and Retain copies of all returns for your records.

transposition errors. Both the amount on the return and the If you need further assistance, please call our Customer Service

amount of the payment must match. Center at 303-238-7378.

To avoid processing delays, complete all applicable and

required lines. Lines on the return can be left blank if the value is

zero, except for lines 1, 3, 4, 5, 9, 10, and 11.

Multi-Location Filers: A separate DR 0100 must be filed for

each physical site or for each non-physical site that is collecting

sales tax. All physical sites must file a return even if there were

no sales. Verify your sites/locations in Revenue Online under

"Additional Services". For additional information, refer to FYI

Sales 58: Requirements for Sales Tax Remittance for Multiple

Location Companies.

|