Enlarge image

*DO=NOT=SEND*

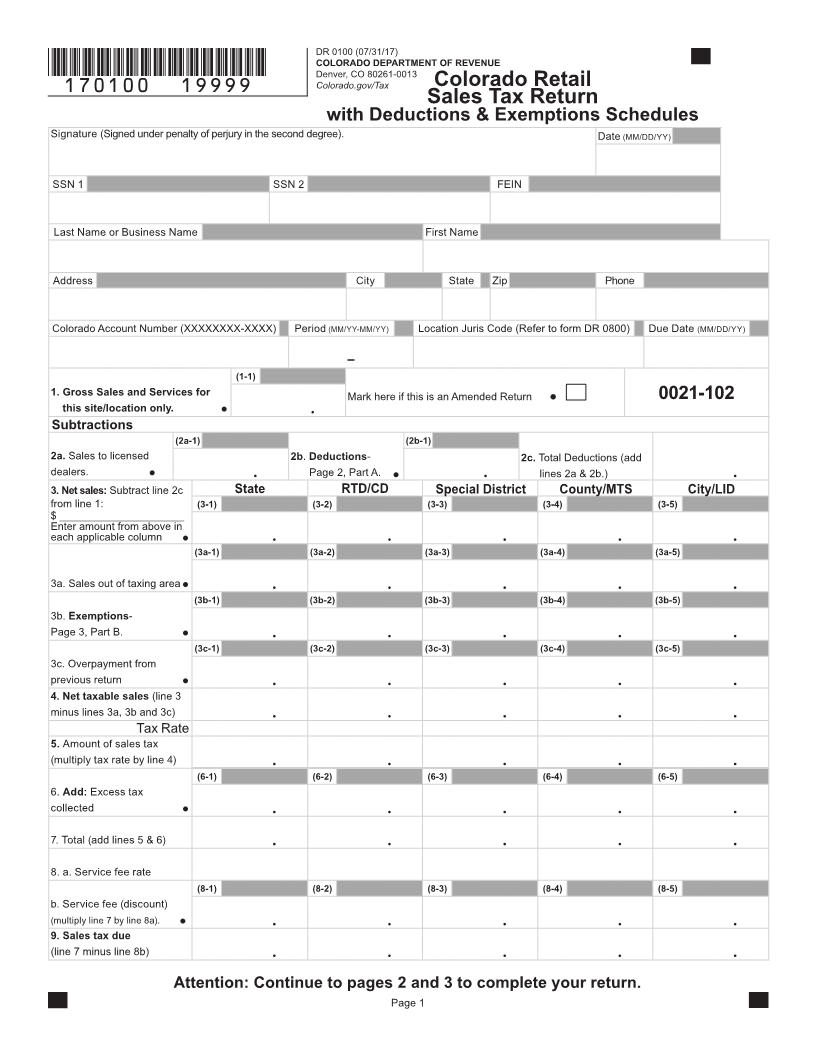

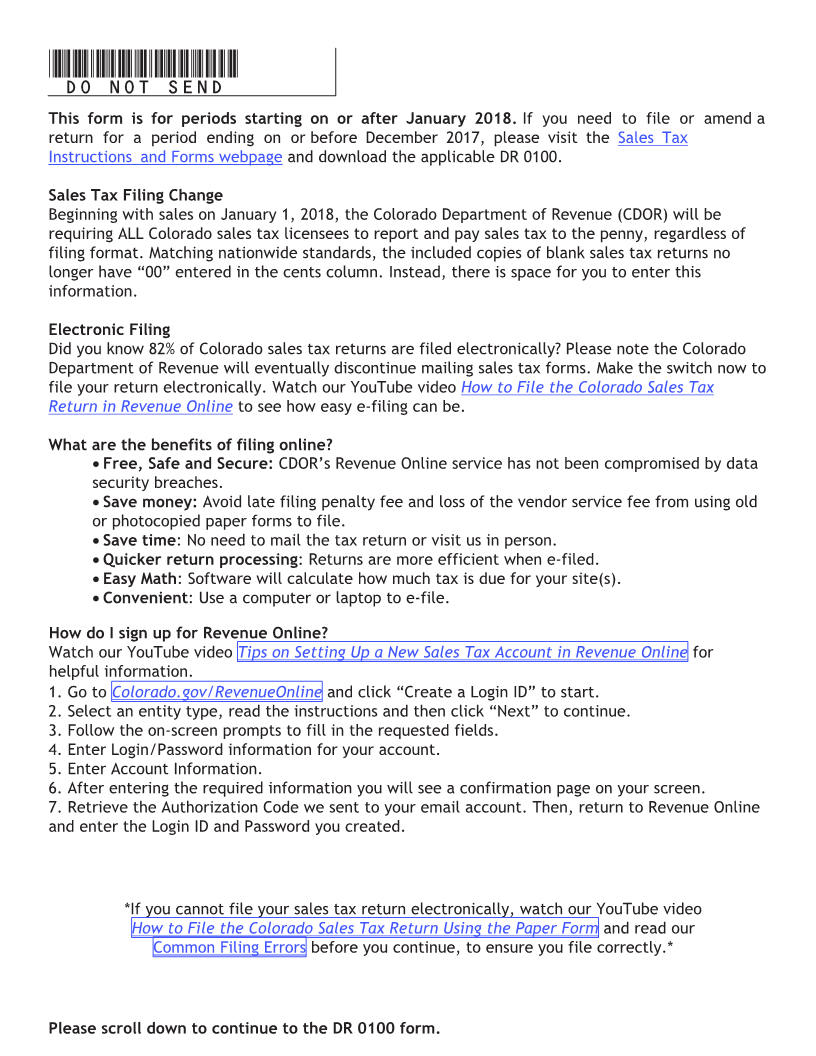

This form is for periods starting on or after January 2018. If you need to file or amend a

return for a period ending on or before December 2017, please visit the Sales Tax

Instructions and Forms webpage and download the applicable DR 0100.

Sales Tax Filing Change

Beginning with sales on January 1, 2018, the Colorado Department of Revenue (CDOR) will be

requiring ALL Colorado sales tax licensees to report and pay sales tax to the penny, regardless of

filing format. Matching nationwide standards, the included copies of blank sales tax returns no

longer have “00” entered in the cents column. Instead, there is space for you to enter this

information.

Electronic Filing

Did you know 82% of Colorado sales tax returns are filed electronically? Please note the Colorado

Department of Revenue will eventually discontinue mailing sales tax forms. Make the switch now to

file your return electronically. Watch our YouTube video How to File the Colorado Sales Tax

Return in Revenue Online to see how easy e-filing can be.

What are the benefits of filing online?

• Free, Safe and Secure: CDOR’s Revenue Online service has not been compromised by data

security breaches.

• Save money: Avoid late filing penalty fee and loss of the vendor service fee from using old

or photocopied paper forms to file.

• Save time: No need to mail the tax return or visit us in person.

• Quicker return processing: Returns are more efficient when e-filed.

• Easy Math: Software will calculate how much tax is due for your site(s).

• Convenient: Use a computer or laptop to e-file.

How do I sign up for Revenue Online?

Watch our YouTube video Tips on Setting Up a New Sales Tax Account in Revenue Online for

helpful information.

1. Go to Colorado.gov/RevenueOnline and click “Create a Login ID” to start.

2. Select an entity type, read the instructions and then click “Next” to continue.

3. Follow the on-screen prompts to fill in the requested fields.

4. Enter Login/Password information for your account.

5. Enter Account Information.

6. After entering the required information you will see a confirmation page on your screen.

7. Retrieve the Authorization Code we sent to your email account. Then, return to Revenue Online

and enter the Login ID and Password you created.

*If you cannot file your sales tax return electronically, watch our YouTube video

How to File the Colorado Sales Tax Return Using the Paper Form and read our

Common Filing Errors before you continue, to ensure you file correctly.*

Please scroll down to continue to the DR 0100 form.