Enlarge image

DR 1465 (11/24/20)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

*141465==19999* Tax.Colorado.gov

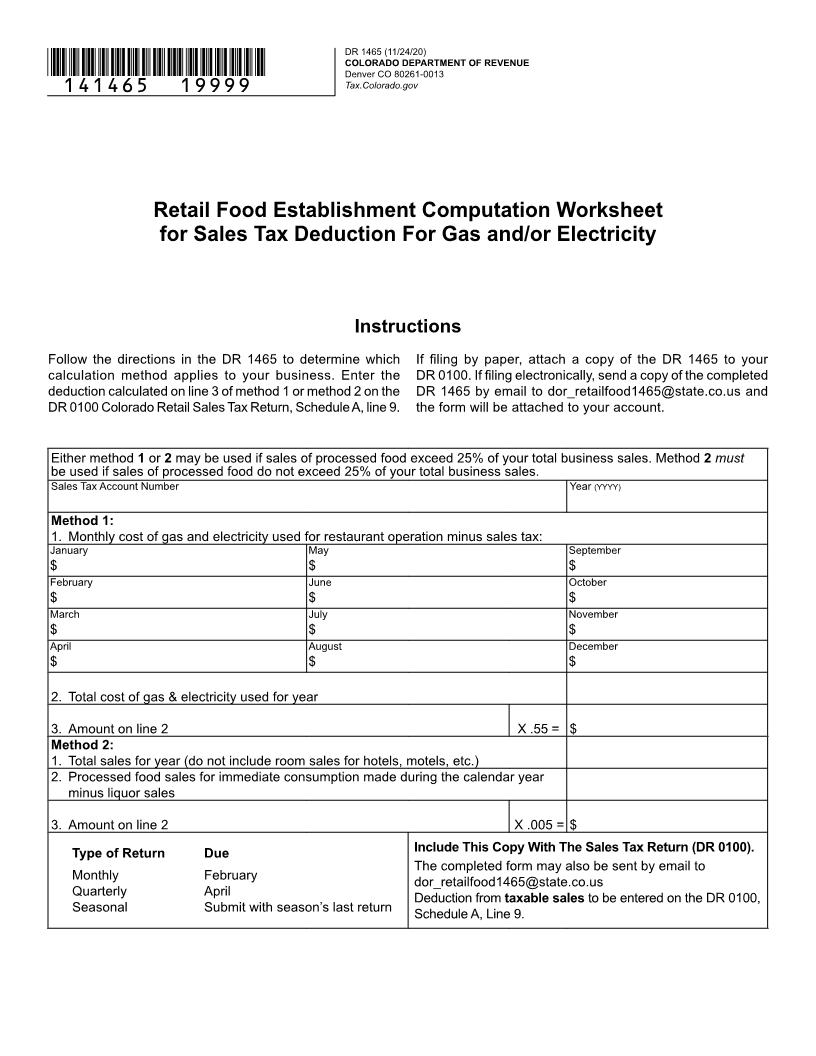

Retail Food Establishment Computation Worksheet

for Sales Tax Deduction For Gas and/or Electricity

Instructions

Follow the directions in the DR 1465 to determine which If filing by paper, attach a copy of the DR 1465 to your

calculation method applies to your business. Enter the DR 0100. If filing electronically, send a copy of the completed

deduction calculated on line 3 of method 1 or method 2 on the DR 1465 by email to dor_retailfood1465@state.co.us and

DR 0100 Colorado Retail Sales Tax Return, Schedule A, line 9. the form will be attached to your account.

Either method 1or may2 be used if sales of processed food exceed 25% of your total business sales. Method 2 must

be used if sales of processed food do not exceed 25% of your total business sales.

Sales Tax Account Number Year (YYYY)

Method 1:

1. Monthly cost of gas and electricity used for restaurant operation minus sales tax:

January May September

$ $ $

February June October

$ $ $

March July November

$ $ $

April August December

$ $ $

2. Total cost of gas & electricity used for year

3. Amount on line 2 X .55 = $

Method 2:

1. Total sales for year (do not include room sales for hotels, motels, etc.)

2. Processed food sales for immediate consumption made during the calendar year

minus liquor sales

3. Amount on line 2 X .005 = $

Type of Return Due Include This Copy With The Sales Tax Return (DR 0100).

The completed form may also be sent by email to

Monthly February

dor_retailfood1465@state.co.us

Quarterly April

Deduction from taxable sales to be entered on the DR 0100,

Seasonal Submit with season’s last return

Schedule A, Line 9.