Enlarge image

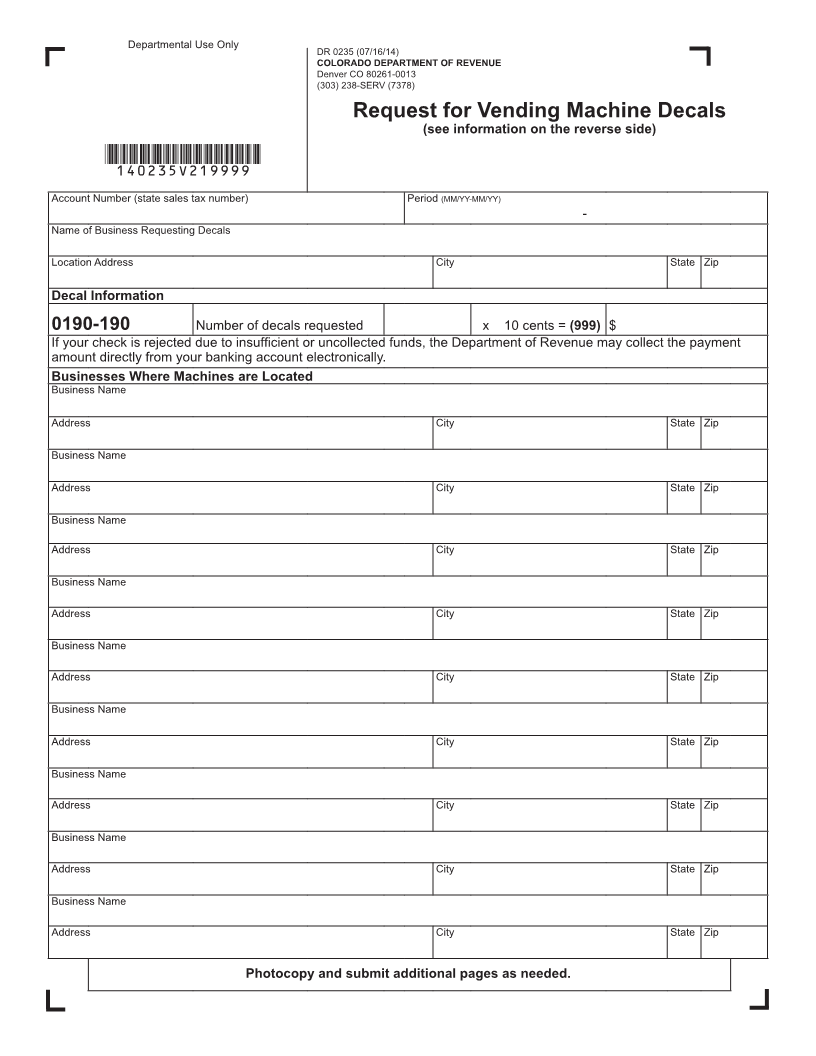

Departmental Use Only DR 0235 (07/16/14)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

(303) 238-SERV (7378)

Request for Vending Machine Decals

(see information on the reverse side)

*140235V219999*

Account Number (state sales tax number) Period (MM/YY-MM/YY)

-

Name of Business Requesting Decals

Location Address City State Zip

Decal Information

0190-190 Number of decals requested x 10 cents = (999) $

If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment

amount directly from your banking account electronically.

Businesses Where Machines are Located

Business Name

Address City State Zip

Business Name

Address City State Zip

Business Name

Address City State Zip

Business Name

Address City State Zip

Business Name

Address City State Zip

Business Name

Address City State Zip

Business Name

Address City State Zip

Business Name

Address City State Zip

Business Name

Address City State Zip

Photocopy and submit additional pages as needed.