Enlarge image

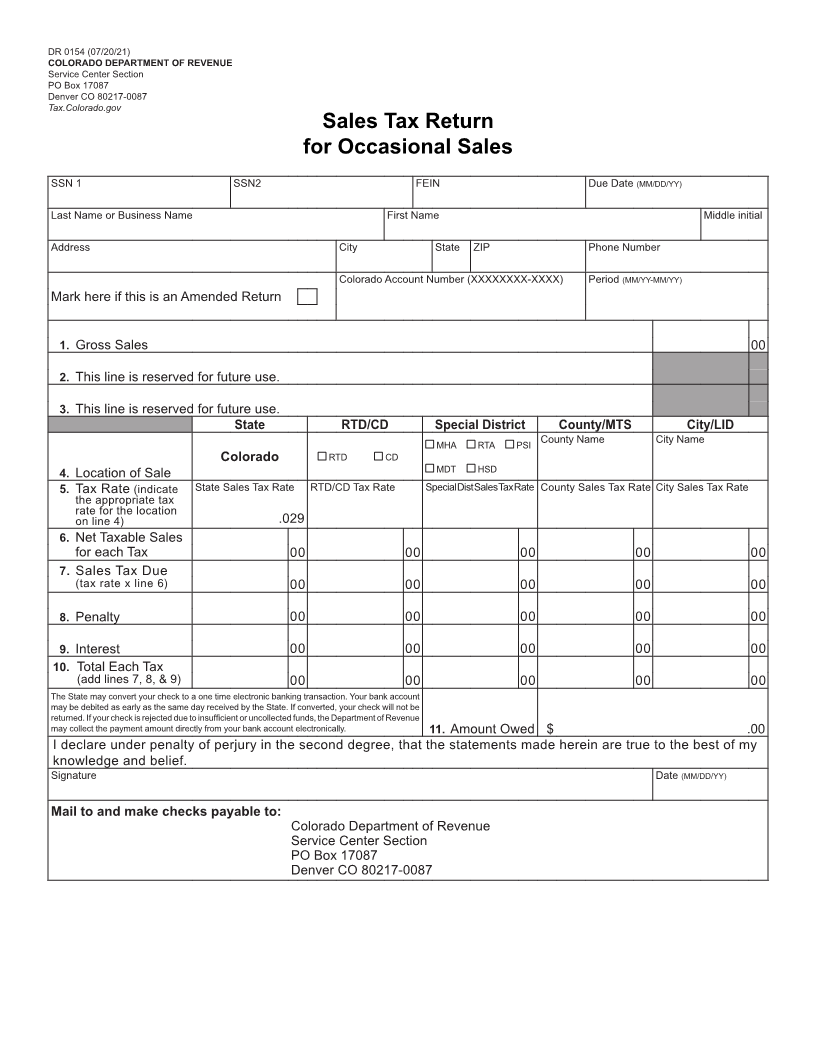

DR 0154 (07/20/21)

COLORADO DEPARTMENT OF REVENUE

Service Center Section

PO Box 17087

Denver CO 80217-0087

Tax.Colorado.gov

Sales Tax Return for Occasional Sales

Instructions

General Instructions Specific Instructions

Form DR 0154 allows individuals who make isolated and Line 1 Gross Sales - Enter the gross sales made during the

occasional sales from their homes to remit the applicable calendar year.

tax on such sales.

Line 2 This line is reserved for future use.

Occasional or Isolated Sales Made From Home Line 3 This line is reserved for future use.

In general, anyone making regular sales of tangible personal

property is required to obtain a sales tax license, collect sales Line 4 Location of Sale - Enter the name of the county

tax, and file periodic returns. However, an individual who and, if applicable, the city in which the private

makes an occasional or isolated sale of tangible personal residence at which the sale was made is

property is not required to obtain a sales tax license and located. Check the boxes of the applicable

instead may file Form DR 0154 to remit tax on the sale(s), special districts (if any). Do not include any

provided all of the following conditions are met: self-collecting home-rule cities or counties (see

publication DR 1002 for a listing). Taxpayers

• the sales are made from the individual’s private can search for the applicable jurisdictions by

residence; address at: https://Colorado.gov/Revenue/GIS/

• the aggregate amount of such sales are no more than Tax rates can be found in Department

Line 5 Tax Rate -

$1,000 per year; and publication Colorado Sales/Use Tax Rates (DR 1002).

• neither the seller nor anyone in the seller’s household is Taxpayers can search for the applicable rates by

engaged in a trade or business selling similar items. address at: https://Colorado.gov/Revenue/GIS/

Individuals who meet the preceding conditions must file Line 6 Net Taxable Sales for each Tax - Enter the amount

Form DR 0154 and remit sales tax on these isolated and from line 1.

occasional sales by April 15 following the calendar year in Multiply the tax rate on line 5 by the

Line 7 Sales Tax Due -

which the sales were made. net taxable sales on line 6 in each column.

Amended Returns Line 8 Penalty - If this return and remittance is postmarked

If an individual is filing a return to amend a previously filed after the due date, a penalty of 10% plus ½%

return, the individual must mark the applicable box to indicate per month (not to exceed 18%) is due. Multiply

that the return is an amended return. If an individual needs the tax on line 7 by the applicable percentage to

to amend previously filed returns for more than one filing determine penalty.

period, a separate amended return must be filed for each If this return and remittance is postmarked

Line 9 Interest -

filing period. The amended return replaces the original in its after the due date, interest is due. Interest rates

entirety and must report the full corrected amounts, rather can be found in FYI General 11. Multiply the tax on

than merely the changes in the amount of sales or tax due. line 7 by the applicable interest rate to determine

If the amended return reflects a decrease in tax from the interest.

amount reported on the original return, the individual must

file a Claim for Refund (DR 0137) along with the amended Line 10 Total Each Tax - Add lines 7, 8 and 9 for each

return to request a refund of the overpayment. applicable column.

Line 11 Amount Owed - Total the amounts in each applicable

column. This is the amount due with your return.

Payment Information

Send a separate check with each return submitted. Include

the Social Security Number (SSN) or Colorado Account

Number (CAN) on your check to ensure proper credit.

Sign and date the return and mail it with your payment to:

Colorado Department of Revenue

Denver, CO 80217-0087

Retain a copy of this return for your records.