Enlarge image

DR 0103 (11/19/21)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

*DO=NOT=SEND* Tax.Colorado.gov

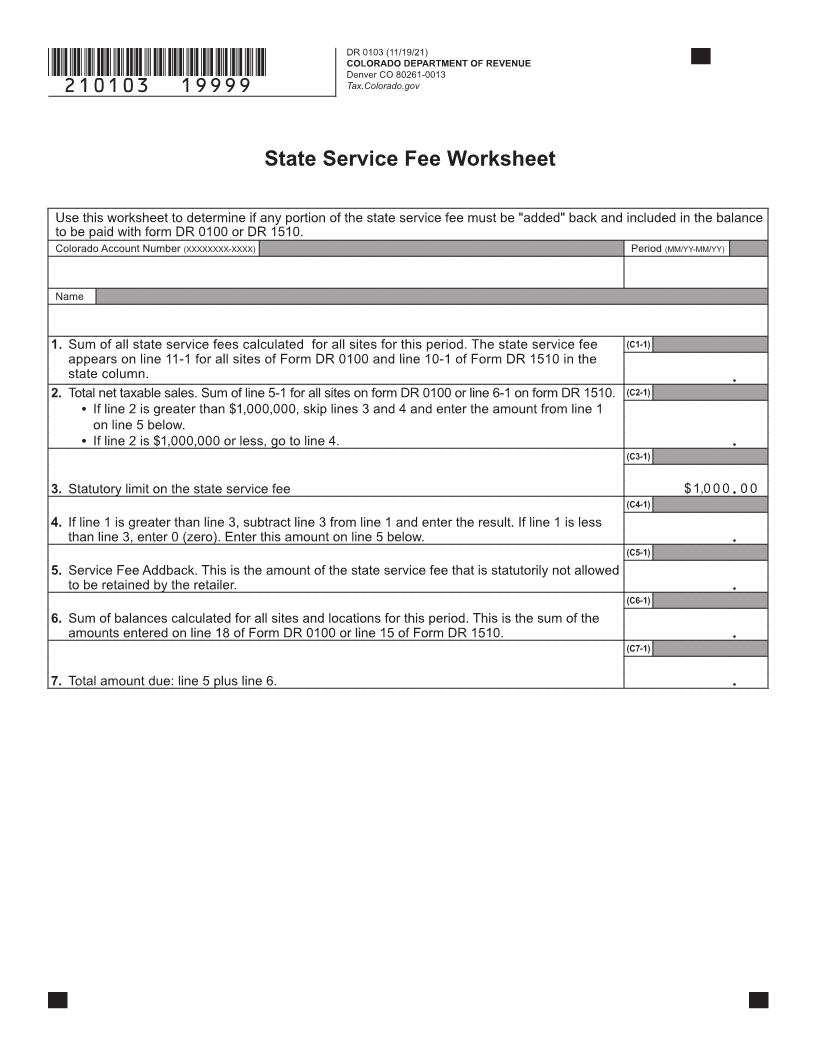

State Service Fee Worksheet

General Information

Beginning January 1, 2022, a retailer with total state net taxable sales (Column 1, Line 5 of the DR 0100 or Column 1,

Line 6 on form DR 1510) greater than $1,000,000 is not eligible to retain the state service fee.

For any filing period beginning January 1, 2020 or later, the Colorado state service fee a retailer is allowed to retain is

limited to $1,000. The State Service Fee Worksheet (DR 0103) is used to determine the total balance a retailer owes if the

total combined state service fee otherwise calculated on the retailer's sales tax returns exceeds $1,000. Retailers should

first complete their Colorado Retail Sales Returns (DR 0100) or Aviation Fuel Sales Tax Returns (DR 1510), calculating

their state service fees without limitation, and then complete the State Service Fee Worksheet (DR 0103) to determine

their total balance due.

Electronic Filing

Retailer's can avoid completing the paper DR 0103 by filing electronically through Revenue Online. Revenue Online can be

accessed at Colorado.gov/RevenueOnline.

Form Instructions

Retailer's must enter their eight digit Colorado account number, their name, and the filing period.

Line 1.

Enter the sum of all state service fees calculated on all sites/returns filed for this period. The state service fee appears on

line 11 of Form DR 0100 and line 10 of Form DR 1510 in the state column. Do not include any service fees calculated and

claimed for any state-administered local jurisdictions.

Line 2.

Enter the sum of all state net taxable sales on all returns filed for this period. The state net taxable sales appears on line 5

of Form DR 0100 and line 6 on form DR 1510 in the state column.

● If line 2 is greater than $1,000,000, skip lines 3 and 4 and enter the amount from line 1 on line 6 below.

● If line 2 is $1,000,000 or less, go to line 4.

Line 4.

If line 1 is greater than line 3, subtract line 3 from line 1 and enter the result. If line 1 is less than line 3, enter 0 (zero). Enter

this amount on line 6.

Line 5.

If the net taxable sales from line 2 are greater than $1,000,000, the service fee amount on line 1 will be entered here,

otherwise, enter the amount from line 4 here. This is the amount of the state service fee that is statutorily not allowed to be

retained by the retailer and must be added back to the balance due for this filing period.

Line 6.

Enter the sum of the balances calculated for all sites and locations for this period. This is the sum of the amounts calculated

on line 18 of Form DR 0100 or line 15 of Form DR 1510 for all returns prepared for all sites and locations for this period.

The amount entered on this line should include all state and state-administered local sales taxes due for this filing period.

Line 7.

Enter the sum of lines 5 and 6 of the worksheet. This amount should be the total balance due for the tax period, including

all state and state-administered local sales taxes calculated on all DR 0100 or DR 1510 returns, along with the service fee

addback calculated on line 6 of the DR 0103.